Inc42

4w

408

Image Credit: Inc42

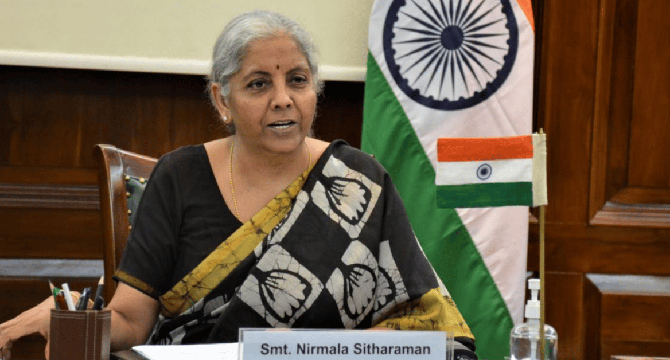

Conversational Payments Via AI Being Developed To Bolster India’s Digital Ecosystem: FM

- Conversational payments through AI and offline functionality are being developed to enhance India's digital financial ecosystem.

- India leads in real-time digital payments globally with 48.5% share and over 35 Cr users on the UPI system.

- Conversational payments enable users to interact with AI for transactions via natural language communication.

- Offline functionality allows digital transactions in areas with limited connectivity.

- Finance minister urges fintech startups to explore opportunities in rural India for expansion.

- Fintech firms encouraged to offer services in regional languages and voice-based options for wider adoption.

- India's fintech revolution is influencing the global market, with UPI now accepted in seven other countries.

- India's fintech market set to exceed $400 Bn by 2028-29, achieving 80% financial inclusion rate in just six years.

- NPCI introduced new mandates to expedite UPI payment processing response time to 10 seconds for specific transactions.

- In April, UPI transactions hit a record high of 18.68 Bn, showcasing continued growth in the digital payment landscape.

Read Full Article

24 Likes

For uninterrupted reading, download the app