Cryptography News

Coindoo

174

Image Credit: Coindoo

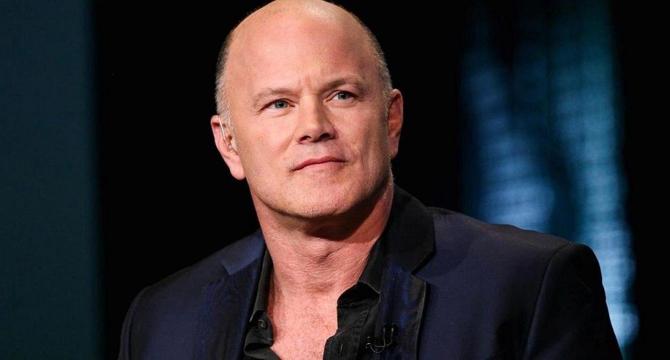

Bitcoin Could 10X to $1 Million, Says Galaxy Digital CEO Mike Novogratz

- Galaxy Digital CEO Mike Novogratz predicts Bitcoin could increase 10 times to reach $1 million, comparing its potential to that of gold.

- Novogratz sees a generational shift favoring Bitcoin over gold as young people show more interest in the digital currency.

- He highlighted that Bitcoin's market cap is currently much lower than gold's, suggesting significant room for growth.

- The increasing adoption of Bitcoin by retail investors, institutions, public companies, and sovereign wealth funds is seen as a key driver for its valuation.

- Novogratz emphasized that Bitcoin's expansion in the macro asset space is akin to a 'ball rolling downhill' with momentum.

- Despite acknowledging that Bitcoin's journey to $1 million may be gradual and volatile, Novogratz remains optimistic about its long-term investment potential.

- Factors like institutional infrastructure development, regulatory clarity, and global inflation concerns are strengthening Bitcoin's position as a store of value.

- Novogratz believes that the narrative of Bitcoin as digital gold will gain more traction as more financial entities and younger demographics allocate funds to the cryptocurrency.

Read Full Article

10 Likes

Coindoo

103

Image Credit: Coindoo

With $298M Raised, Can BlockDAG Surpass Toncoin (TON) Market Outlook & Bittensor (TAO) Gains?

- BlockDAG, Toncoin (TON), and Bittensor (TAO) are showcasing promising developments in the crypto space in 2025.

- BlockDAG secures a strong position with a $298 million presale and a strategic partnership with Inter Milan, leveraging cultural influence and high performance to stand out.

- Toncoin's market outlook strengthens through integration with Telegram, aiming to onboard 30% of Telegram's user base in the coming years, boosting its utility and exposure.

- Bittensor shows potential for a 46% rally as technical indicators signal positive momentum, with oversold conditions and early trend reversal signs.

- BlockDAG's approach of connecting with popular culture through sports sets it apart, drawing attention, credibility, and loyalty, leading to substantial funds raised and participant engagement.

- BlockDAG's presale has raised $298 million with over 22.4 billion coins sold, showcasing a significant return for participants.

- Toncoin ranks 18th in market capitalization at $7.8 billion, benefiting from a strong user base through Telegram integration and continuous support from major investors.

- Bittensor's price target indicates a potential rally of 46%, with technical signals pointing towards a rebound and trend reversal, making it an attractive choice for short-term gains.

- BlockDAG's balanced approach of credibility, growth, and storytelling positions it as a top contender for successful crypto opportunities in 2025.

Read Full Article

6 Likes

Coindoo

336

Image Credit: Coindoo

Ripple and SEC File Motion to Officially Settle Case, Propose $125M Penalty Resolution

- Ripple and the SEC have filed a motion to settle their case, proposing a $125 million penalty resolution.

- The motion asks Judge Analisa Torres to approve an injunction and release the civil penalty held in escrow.

- If approved, Ripple would pay $50 million to the SEC and receive $75 million back from escrow.

- The settlement aims to resolve the case without further litigation or appeals and has been filed under Case No. 1:20-cv-10832-AT-SN.

- This resolution could provide clarity for XRP and set a precedent for future crypto-related regulatory actions.

- The outcome of this settlement could influence how digital assets are treated under U.S. securities law.

- Ripple and the SEC's readiness to settle may lead to renewed momentum for XRP in regulatory and market contexts.

Read Full Article

20 Likes

Changelly

165

Image Credit: Changelly

Fully Diluted Valuation (FDV) in Crypto Explained: What It Is and Why It Matters

- Fully Diluted Valuation (FDV) in crypto investing reveals the total potential value by considering all tokens in circulation.

- Understanding FDV aids in foreseeing market changes as more tokens become available, affecting the project's value.

- FDV vs. Market Capitalization distinguishes the current value from the future by incorporating total token supply.

- FDV computed as Current Token Price × Total Token Supply estimates potential project value.

- High FDV relative to market cap indicates locked tokens, posing risks of dilution when released.

- FDV's limitations include overlooking market dynamics, early-stage project context, and treating all tokens equally.

- Token unlocks, burns, emissions, and inflationary models influence FDV's accuracy and utility.

- Tracking tools like CoinGecko, Tokenomist.ai offer insights into FDV, tokenomics, and supply dynamics.

- High FDV may suggest future potential but could signal dilution risks if demand fails to match increased supply.

- FDV is essential for long-term assessment, but combining it with other metrics is crucial for balanced investment decisions.

Read Full Article

9 Likes

Coindoo

228

Image Credit: Coindoo

Top Altcoins to Watch This Market Cycle: Don’t Miss Out On Cardano, BlockDAG, VeChain & Chainlink!

- Getting in early on the right crypto projects is crucial in 2025, with several top altcoins showing promise.

- Leading the pack is BlockDAG with a unique presale model and hybrid framework boosting transaction speed.

- Cardano stands out for its research-driven development and scalability features, focusing on real-world applications.

- VeChain's enterprise integration and partnerships with major companies make it an attractive option for supply chain transparency.

- Chainlink continues to be essential for Web3 data infrastructure and decentralized oracle network.

- BlockDAG's time-sensitive pricing and upcoming GO LIVE event position it as a strong contender in the current market cycle.

- Cardano's stability through research and upgrades, VeChain's practical solutions in global supply chain regulations, and Chainlink's data accuracy maintenance contribute to their positions as top altcoins to watch.

- BlockDAG has raised over $298 million in its presale, highlighting strong market interest.

- Each of these altcoins presents unique advantages for investors seeking growth opportunities.

Read Full Article

13 Likes

Bitcoinmagazine

295

Bitcoin Will Replace Gold And Go To $1,000,000, Says Galaxy Digital CEO Mike Novogratz

- Galaxy Digital CEO Mike Novogratz predicts that Bitcoin will replace gold and could reach $1,000,000 in value.

- Novogratz states that Bitcoin has become a mainstream macro asset and is no longer considered a fringe investment.

- The CEO highlights that Bitcoin's volatility is now viewed as normal compared to traditional assets.

- He mentions a global shift away from the dollar towards assets like Bitcoin, citing a weaker dollar stance by the US administration.

- Novogratz indicates that macro funds are performing well, being short on the dollar and long on alternative currencies and assets like Bitcoin, gold, and silver.

- Bitcoin's fixed supply of 21 million coins is seen as a significant factor contributing to its increasing value.

- He notes that more Bitcoins have been lost than will be mined in the future, emphasizing scarcity.

- The CEO believes that institutional involvement, including firms like BlackRock, is solidifying Bitcoin's role as a savings asset.

- Novogratz sees a scenario where Bitcoin gradually replaces gold as a store of value, with Bitcoin having significant growth potential to reach parity with gold.

- He suggests that Bitcoin could potentially reach $1,000,000 per coin to match gold's market cap.

- The interview with Novogratz was featured on CNBC and shared by Bitcoin Magazine through Twitter.

- The original article was written by Oscar Zarraga Perez for Bitcoin Magazine.

Read Full Article

17 Likes

Coindoo

152

Image Credit: Coindoo

Crypto Market Hit by $711M Liquidation Wave as Bitcoin, Ethereum Plunge

- The crypto market experienced a significant downturn with over $711 million in liquidations as leveraged positions were forcefully closed.

- Leading cryptocurrencies recorded notable 24-hour declines: Bitcoin (BTC) fell 2.73%, Ethereum (ETH) dropped 6.35%, Solana (SOL) declined 6.20%, XRP shed 4.89%, and BNB fell 2.18%.

- Ethereum and Solana saw the steepest losses, indicating higher volatility among altcoins and increased speculative activity.

- Over 147,000 traders were liquidated in the past day, totaling $711.48 million in forced position closures, with a heavy skew towards long positions.

- A single $201.31 million BTCUSDT order on Binance marked a severe liquidation event, emphasizing the scale of leverage exposure during fast price reversals.

- In the final hour of the drop, over $334.94 million was wiped out, with the majority coming from long positions, highlighting the abrupt market reversal.

- Despite the correction, Bitcoin remains above the key $106,000 support, with analysts suggesting that the broader uptrend is maintained as long as this level holds.

- Further downside movement could escalate volatility and extend liquidations across the altcoin sector.

Read Full Article

8 Likes

Financemagnates

318

Following Successful Public Listing, Circle’s Stablecoin Launches on XRP Ledger

- Circle's USDC stablecoin has launched on the XRP Ledger to broaden its utility in DeFi and cross-border payments.

- The move signifies Ripple's strategy to bridge traditional finance and crypto seamlessly.

- USDC integration on XRPL facilitates direct access for users, institutions, and developers to the second-largest dollar-pegged stablecoin.

- Stablecoin transfers on decentralized exchanges using XRP as a bridge currency are enabled through auto-bridging.

- The integration follows Circle's recent IPO success and increasing interest in stablecoins as financial tools.

- USDC aims to strengthen the dollar's role in the global financial system amidst dollar's credibility challenges.

- Gold-backed stablecoins are seen as potential rivals to dollar-pegged tokens for inflation resistance by critics.

- Circle Mint and Circle APIs now support USDC on XRPL, enhancing access to DeFi, cross-border payments, and fiat on/off-ramps.

- Ripple benefits from the integration as it pursues broader stablecoin adoption to support its global payment ambitions.

- The stablecoin market surpasses $237 billion, attracting attention from regulators, institutions, and technologists.

- The expanded cross-chain functionality by issuers like Circle intensifies competition in anchoring the digital dollar.

- USDC's XRPL integration emphasizes speed, compliance, and accessibility for Ripple and Circle in shaping future digital finance infrastructure.

Read Full Article

19 Likes

NullTX

188

Image Credit: NullTX

HYPERLIQUID PRICE ANALYSIS & PREDICTION (June 12) – Hype Faces Rejection After Tapping New All-Time High, Can it Sustain Momentum?

- Hype's price surged 4x in two months, hitting a new all-time high before facing a slight rejection.

- The rally began in April from a low of $9, gaining momentum in May to peak at $40 before a pullback.

- In June, after consolidating around $30, Hype broke out to reach $44, experiencing rejection but showing signs of recovery.

- The bulls are currently controlling the market, with potential for further highs if the new ATH of $44 is surpassed.

- Key resistance levels to watch include $44, $50, and $55, with support levels at $40, $32.6, and $28.4.

- The current spot price for Hype is $43.3, with a bullish trend and high volatility.

Read Full Article

11 Likes

NullTX

363

Image Credit: NullTX

VIRTUALS PROTOCOL PRICE ANALYSIS & PREDICTION (June 12) – Virtual Fails to Reclaim Previous High After a Week Bounce, What Next?

- Virtual's price failed to reclaim previous highs after a week of recovery, facing rejection and showing a minor loss since yesterday.

- The general outlook for Virtual remains bullish on the daily chart, despite a past rejection at $2.6 leading to a slight pullback and recovery from the $1.65 support level.

- Although the price turned bullish again over the past week, it failed to maintain momentum above the previous high of $2.3, indicating a loss on the daily chart.

- A potential drop below the support level could trigger a major sell-off, forming a new double-top on the daily chart and risking a significant long-term crash.

- Key support levels to monitor for a rebound include $1.65, with potential dips to $1.23 and $0.846 if the support breaks, while breaking $2.59 resistance could signal a climb to $3.16 and $4.13.

- Current spot price sits at $2 with a bullish trend and high volatility in the market.

Read Full Article

21 Likes

Bitcoinmagazine

156

Coinbase Announces Bitcoin Rewards Credit Card, Offering up to 4% BTC Back on Everything

- Coinbase is launching its first-ever branded credit card in partnership with American Express, called the Coinbase One Card, offering 2% to 4% back in Bitcoin on everyday purchases.

- The card will be exclusively available to U.S. members of Coinbase One, the platform's monthly subscription service.

- Previously, Coinbase only offered a prepaid debit card in 2020 with Visa.

- The launch was announced during the Coinbase State of Crypto Summit in New York by American Express global network services head, Will Stredwick.

- Coinbase is expanding its subscription-based services, with Coinbase One costing $29.99/month and offering benefits like zero trading fees and higher staking rewards.

- A more affordable subscription tier called Coinbase Basic is available for $4.99/month or $49.99/year.

- Coinbase's subscription business generated $698.1 million in Q1 2025 and now has over a million members since its launch in 2023.

- The company is focused on building its ecosystem around Bitcoin, supporting Bitcoin custody services, ETFs, and actively advocating for Bitcoin-friendly regulation.

- Coinbase positions Bitcoin as the core of its long-term vision, integrating Bitcoin rewards into its products and providing support for Bitcoin development.

Read Full Article

9 Likes

Coindoo

170

Image Credit: Coindoo

Is BlockDAG the Fastest-Growing Crypto of 2025? NEAR, ETH, & AGIX Get Outpaced

- BlockDAG is gaining traction as the fastest-growing crypto of 2025 with a massive presale, booming user base, and unique tools appealing to various users.

- The project offers full EVM compatibility, a mining app with over 1.5 million users, and a confirmed launch price of $0.05, promising a substantial ROI.

- In contrast, Ethereum remains dominant in smart contracts but is considered less likely to offer significant growth compared to newer platforms like BlockDAG.

- NEAR Protocol is quietly making strides with a developer-first approach and efforts to integrate blockchain with AI.

- SingularityNET (AGIX) focuses on AI and privacy but is yet to gain significant market attention.

- BlockDAG's momentum, user base, and accessibility set it apart as the fastest-growing crypto, offering a game-changing mobile mining experience and unmatched presale figures.

- Partnerships, cultural buzz, and real developer tools make BlockDAG a standout project in the crypto space.

- Interested investors have until June 13 to enter BlockDAG at a price of $0.0018, presenting a compelling opportunity.

- Readers are advised to conduct their research before engaging in any cryptocurrency-related actions.

- Coindoo, the source of the article, does not endorse or assume responsibility for the content provided.

- Article sponsors make readers accountable for researching and using content mentioned.

- Maintain caution when dealing with cryptocurrency matters.

Read Full Article

10 Likes

Zycrypto

264

Image Credit: Zycrypto

What a Total US-China Trade Freeze Could Mean for Crypto

- Escalating tensions between the US and China are raising the possibility of a complete trade freeze.

- A trade freeze could lead to a flight to alternative assets like Bitcoin as investors seek safe-haven options.

- Bitcoin, seen as a digital alternative to gold, could benefit from the collapse of US-China trade as investors look for non-state assets.

- The falling dominance of the US dollar due to eroding trust may lead to increased interest in Bitcoin for cross-border transactions and currency hedging.

- Cryptocurrencies like XRP could also gain traction in regions facing currency volatility and disruptions in global trade.

- In emerging markets, a trade freeze could accelerate crypto adoption to preserve value and facilitate international transactions amid economic turmoil.

- However, governments may respond to increased crypto usage with tighter scrutiny and regulations to maintain monetary control.

- A full-scale trade war might lead to crackdowns on crypto if it is perceived as a threat to economic sovereignty.

- Bitcoin could face short-term volatility in the event of a US-China trade freeze as panic selling and subsequent speculative surges are likely.

Read Full Article

15 Likes

Coindoo

264

Image Credit: Coindoo

Here’s the Exact Date Altcoin Season Could Start, According to History

- Historical data indicates that major altcoin seasons have typically followed a consolidation phase before experiencing significant surges in market cap.

- Chart analysis by traders suggests similarities between the current market setup and previous bull runs, hinting at a potential full-scale altcoin breakout.

- Past altseasons have yielded gains of 7,000% and 12,000%, showing identifiable bottoming patterns before substantial surges.

- A projected 25,000% move is being predicted, signaling a potential influx of capital into altcoins as the broader crypto market gains momentum.

- Traders are anticipating the start of the next altseason, with signs pointing towards its potential initiation or already being in progress.

- The market is closely monitored to confirm if the altcoin season is beginning or has already commenced.

- Bitcoin is aiming for $120,000, while altcoins demonstrate potential for a historic breakout.

- Traders and analysts are observing patterns from historical data to assess the likelihood of an upcoming altcoin season.

- The conditions for a significant altcoin surge seem to be aligning, indicating a positive outlook for altcoin investors.

- The post on Coindoo discusses the potential initiation of the altcoin season based on historical analysis.

- Traders are analyzing the market closely to determine if the current situation reflects the onset of a major altcoin surge.

- Market participants are vigilant for indicators that the market is entering a new altcoin season.

- Technical formations and investor sentiment are creating a favorable environment for a substantial increase in altcoin market activity.

- Crypto enthusiasts are anticipating a potential altseason following patterns observed in previous market cycles.

- Investors and traders are optimistic about the prospect of a notable altcoin breakout in the near future.

- The ongoing market trends suggest a positive outlook for altcoin investments, potentially leading to a significant surge.

- Analysts are closely monitoring market dynamics to gauge the timing and extent of the anticipated altcoin season.

Read Full Article

15 Likes

Zycrypto

98

Image Credit: Zycrypto

If Ripple Buys Circle, What Happens to XRP’s Price?

- Ripple is rumored to be considering acquiring Circle, the company behind USDC, sparking curiosity among XRP holders about the potential impact on XRP's price.

- Ripple has been active in acquisitions, recently buying Hidden Road for $1.25 billion and now reportedly eyeing Circle with bids between $6 and $11 billion.

- If Ripple acquires Circle, it would have control over USDC and RLUSD, potentially strengthening its position in the stablecoin market and crypto payments infrastructure.

- Market analysts suggest that in a moderate scenario of Ripple integrating USDC post-acquisition, XRP could reach $3.50 to $4.50 due to increased liquidity and demand.

- The integration of stablecoins into Ripple Payments may boost XRP's utility for cross-border settlements, indirectly affecting its price.

- In a bullish scenario of successful global scaling of Ripple Payments post-acquisition, analysts see XRP potentially rising to $6-$10 under favorable market conditions.

- The price impact of the speculated Ripple-Circle deal on XRP remains uncertain but could be significant given Ripple's aggressive acquisition strategy.

- Ripple's possible acquisition of Circle would mark a strategic move that could reshape the stablecoin landscape and Ripple's competitive position.

- XRP holders are closely monitoring developments regarding the rumored Ripple-Circle acquisition to gauge potential implications on XRP's value.

- The speculated deal between Ripple and Circle underscores the ongoing consolidation and evolution within the cryptocurrency and stablecoin sectors.

- Investors and analysts are awaiting further updates to ascertain the likelihood and details of the proposed acquisition deal.

- XRP's price dynamics post any Ripple-Circle acquisition could be influenced by market sentiment, adoption of USDC, and the overall crypto market conditions.

- Potential synergies between Ripple, USDC, and Circle could have broader implications for the cryptocurrency industry and the adoption of blockchain-based payment solutions.

- Ripple's aggressive M&A approach reflects its ambition to expand its ecosystem and offerings in the rapidly evolving crypto and blockchain space.

- The rumored Ripple-Circle deal highlights the growing importance of stablecoins and their integration with established crypto players like Ripple.

- XRP's valuation post any Ripple-Circle acquisition would likely hinge on the successful integration and execution of joint strategies by both entities.

- While XRP's price speculation remains speculative, a Ripple-Circle deal could bring heightened attention to Ripple's influence on the wider crypto market.

Read Full Article

5 Likes

For uninterrupted reading, download the app