Cryptography News

Cryptonewsz

228

Image Credit: Cryptonewsz

Binance Now Available in Syria After Suspension of US Sanctions

- Global crypto exchange Binance is now available in Syria following the lifting of U.S. sanctions.

- Syrian residents can now access Binance's services to trade over 300 cryptocurrencies, including Bitcoin and XRP.

- Features like spot and futures trading, staking, stablecoins, and Binance Pay are accessible in Syria for the first time.

- Educational content in Arabic and localized support have been introduced to aid Syrian users in using the platform.

- Binance aims to promote financial inclusion and provide secure tools for Syrian users to navigate the digital economy.

- The move is significant as Syria has faced economic instability, high inflation, and limited financial options due to restrictions on global platforms.

- Syria ranked among the top 10 countries for crypto-related online searches in 2021, indicating strong interest in cryptocurrencies.

- Binance plans to conduct educational campaigns and offer guides to assist Syrian users in understanding digital assets and minimizing risks.

- In its year-end report, Binance disclosed exceeding 250 million registered users by 2024, signaling substantial growth.

- The exchange operates in numerous countries globally and is focused on expanding further to reach a billion users.

Read Full Article

13 Likes

Coindoo

85

Image Credit: Coindoo

Treasury Secretary Bessent: USD Stablecoin Market Could Surpass $2 Trillion by 2028

- Treasury Secretary Bessent predicts the USD stablecoin market could reach over $2 trillion by 2028.

- Bessent supported estimates linked to the GENIUS Act, aimed at regulating and expanding the U.S. stablecoin ecosystem.

- He stated that government-backed stablecoin legislation could enhance the global use of the U.S. dollar through stablecoins.

- Bessent believes $2 trillion is a feasible milestone for the stablecoin market, anticipating potential surpassing of this mark.

- Stablecoins are viewed as a strategic financial tool to strengthen the international presence of the U.S. dollar.

- The Treasury Secretary highlighted historical instances where new mechanisms preserved the U.S. dollar's reserve currency status.

- He emphasized the Trump administration's support for U.S.-backed stablecoins to secure and expand the dollar's global significance.

- With increasing digital currency demand worldwide, regulated stablecoins could advance the dollar's influence.

- Bessent sees stablecoins as a modern evolution in maintaining the U.S. dollar's dominance as a reserve currency.

- Bitcoin aims for $120,000 amidst potential historic breakout signals in altcoins.

- Stablecoins backed by U.S. treasuries are perceived as a means to protect and extend the dollar's status in the global market.

Read Full Article

5 Likes

Zycrypto

381

Image Credit: Zycrypto

Ripple’s XRP ETF Momentum Points to XRP Explosion As $5 Price Target Builds

- As XRP ETF filings surge, the third-largest cryptocurrency, XRP, shows signs of potential growth.

- A hidden bullish divergence signals a possible surge in XRP's value.

- Market analyst Javon Marks indicates a continuation move higher based on the bullish divergence.

- Bullish divergence suggests weakening selling momentum even as prices drop.

- XRP may be on track to reach $5 prompted by an ascending triangle pattern.

- Analyst Ali Martinez predicts an 86% price increase for XRP.

- XRP saw a 3.3% increase in the past week, reaching $2.25.

- Expectations for an explosive breakout are fueled by positive XRP ETF filings.

- The SEC has received spot XRP ETF filings from Canary Capital, Wisdom Tree, and Bitwise.

Read Full Article

22 Likes

Zycrypto

408

Image Credit: Zycrypto

Anthony Scaramucci says Solana will Seamlessly Substitute Banks for IPOs

- Anthony Scaramucci predicts that Solana could allow non-traditional users to buy IPOs through wallets by tokenizing public offerings.

- He is authoring a book titled “Solana Rising”, highlighting Solana's appeal to institutional investors and its potential for tokenizing real-world assets.

- Scaramucci believes Solana could become a principal rail system for assets, positioning it as an operating layer for stocks, bonds, and tokenization.

- He anticipates skeptics like Jamie Dimon of JP Morgan Chase will eventually embrace crypto, attributing Dimon's caution to regulatory pressures.

- Scaramucci and Michael Saylor are interested in assets transitioning into yield-bearing assets, with Solana offering staking opportunities and potential for lending.

- Anthony Scaramucci sees Solana as a key player in the future financial ecosystem.

- He envisions a tokenization process enabling broader access to IPOs through Solana.

- Scaramucci's book, “Solana Rising”, showcases the network's scalability and efficiency for institutional investors.

- Solana is poised to facilitate the tokenization of various assets such as real estate and securities.

- Scaramucci highlights Solana's potential to serve as a foundational layer for the trading and transfer of tangible assets.

- He expresses confidence that traditional finance figures, like Jamie Dimon, will eventually warm up to crypto innovations like Solana.

- Scaramucci emphasizes the versatility of Solana's ecosystem in enabling lending and staking opportunities for users.

- He foresees Solana evolving into a reputable platform for financial services akin to established institutions like Goldman Sachs.

- Anthony Scaramucci discusses the evolving landscape where assets can generate yields through platforms like Solana.

- He believes Solana's lending capabilities will enhance its attractiveness as a yield-generating asset beyond basic staking rewards.

- Based on Scaramucci's insights, Solana appears to offer a comprehensive financial ecosystem with diverse benefits for users.

Read Full Article

24 Likes

Coindoo

345

Image Credit: Coindoo

Short-Term Holder Realized Price Nears $100K, Marking New Era for Bitcoin Entry Levels

- The short-term holder realized price for Bitcoin is nearing $100,000, indicating a new era for entry levels in the market.

- This milestone signifies a significant shift where new buyers are purchasing Bitcoin at five-digit prices by default.

- The short-term holder realized price reflects the average purchase price of BTC for addresses holding coins for 155 days or less, serving as a gauge of market conviction and capital inflows.

- The metric has been steadily increasing along with the spot price, with a notable uptick during Q2 2025.

- The trend suggests that most new buyers are entering the market at historically high levels, showcasing growing long-term confidence and broader adoption.

- This indicates a transition for Bitcoin from an early speculative asset to a maturing global financial instrument.

- The rise in the short-term holder realized price raises concerns about affordability for latecomers but also highlights increased capital commitment from newer investors.

- The $100,000 range is now seen as a potential base rather than a speculative peak.

- This development comes after a period of price consolidation and heightened institutional interest in Bitcoin, potentially setting the stage for a significant upward movement.

- Bitcoin's current range is viewed as a possible starting point for the next major price increase.

Read Full Article

20 Likes

Coindoo

58

Image Credit: Coindoo

Is Altcoin Season 2025 Around the Corner? Key Indicators Signal a Potential Breakout

- The Altcoin Season Index tracks altcoins outperforming Bitcoin, signaling market dynamics.

- Two scenarios historically trigger altcoin breakouts: post-Bitcoin rally weakness and Bitcoin bear phases.

- Altcoin accumulation opportunities arise when the index is in the green 'Bitcoin Season' zone.

- Historically, June marks the start of Altcoin Seasons since 2022.

- Currently, 23% of altcoins are outperforming Bitcoin, hinting at increasing strength.

- Key metrics beyond price for Altcoin Seasons include on-chain flows, pair strength, sector momentum, etc.

- Web3 startup funding saw highs in Q1 2025 but dropped significantly in Q2.

- The data suggests a potential breakout moment for altcoins, with signals aligning in June 2025.

- Investors remain cautious due to lack of all-time highs, but data points to upcoming momentum.

Read Full Article

3 Likes

Cryptopotato

251

Image Credit: Cryptopotato

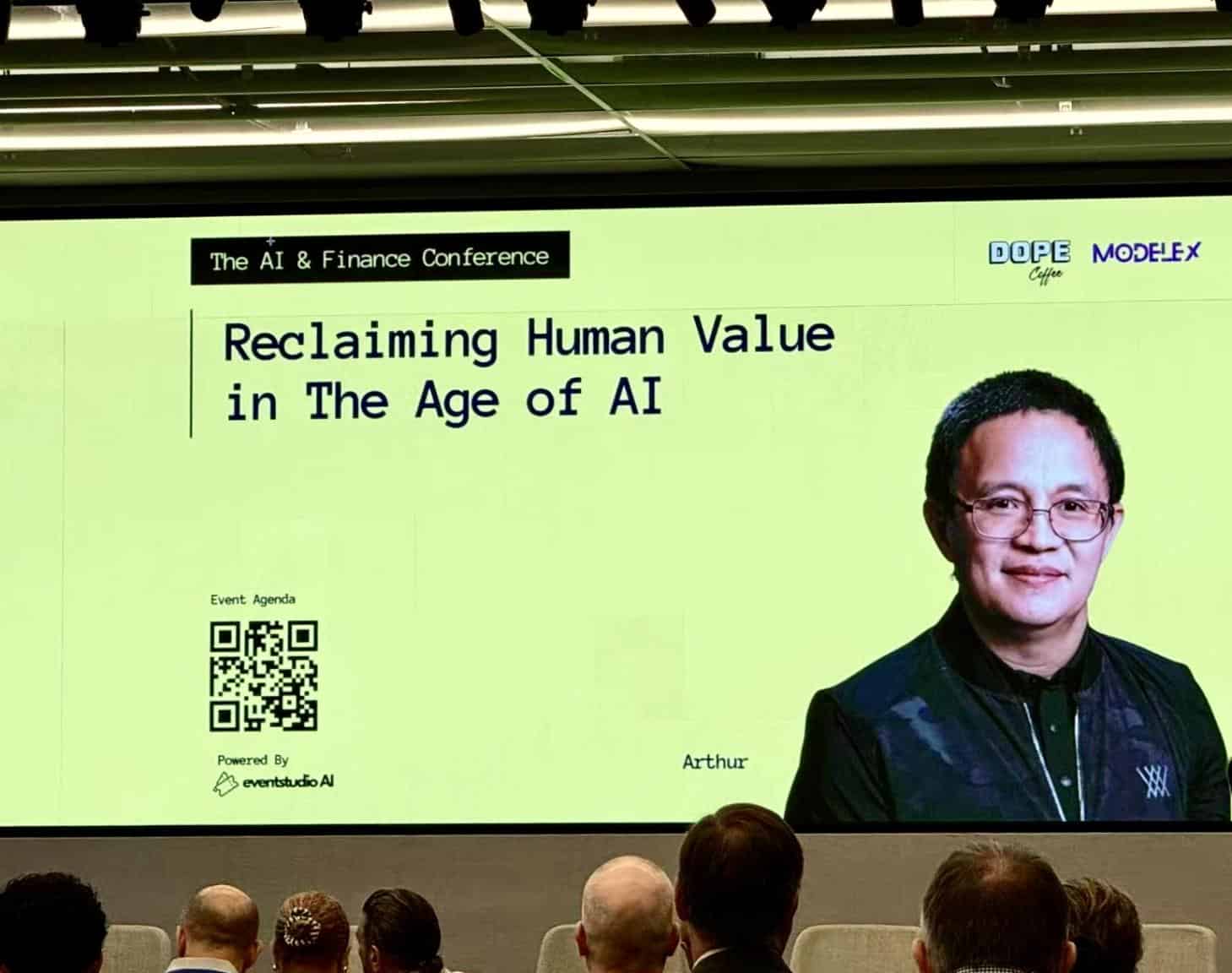

BioMatrix to Present Vision for Human-Centric AI Economy at a16z Tech Week’s AI & Finance Conference 2025

- BioMatrix presented its vision for a human-centric AI economy at a16z Tech Week’s AI & Finance Conference 2025.

- The project focuses on redefining digital identity and universal basic income through biometric verification.

- The AI & Finance Conference had over 1,500 attendees, including top builders, investors, and researchers in AI, fintech, blockchain, and quantitative modeling.

- BioMatrix emphasized building people-centric systems in a technology-driven era.

- Founder Arthur Qin highlighted the importance of applying AI responsibly and ensuring technology enhances human value.

- BioMatrix uses a biometric system named Proof of You (PoY) to verify identity and assign value.

- Within a year, BioMatrix scaled to over 4.5 million verified users with its token reaching a $1 billion market cap.

- The project aims to onboard 1 billion BioMatrix Citizens by 2028 and become an infrastructure layer for a fair, AI-enhanced economy.

- BioMatrix offers various AI and blockchain-based services across different sectors.

- For more information, users can visit biomatrix.ai or follow @BioMatrixAI on X.

- BioMatrix's objective is to ensure fairness, security, and inclusion for all through its Proof of You AI Token utility.

- The presentation emphasized the idea of verifying identity with dignity and ensuring technology complements human value.

- BioMatrix positions itself as a long-term solution for a more equitable digital economy.

- The company advocates that in the economy, being human should suffice without the need to prove one's worth.

- The focus lies on creating a decentralized system where human existence is valued in the economy.

Read Full Article

15 Likes

NullTX

174

Image Credit: NullTX

DEX-to-CEX Volume Ratio Spikes Amid Binance Alpha Campaign and Wash Trading Concerns

- The DEX-to-CEX volume ratio surged in May and early June 2025, exceeding 140% briefly, driven by a spike in DEX trading on the BNB Chain.

- Binance's Alpha DEX Campaign incentivized trading on decentralized protocols, leading to a significant increase in DEX volume.

- Wash trading became prevalent during the campaign, with Polyhedra and KOGE generating billions in daily volume artificially.

- CEX volumes have been declining as DEX gained temporary prominence, with regulatory oversight impacting centralized exchanges.

- While DEXs attract users with incentives, true growth may be driven by meaningful demand rather than just rewards.

- The DEX-to-CEX volume ratio hitting 140% raises questions on the future of organic growth in decentralized trading.

- Despite some volume manipulation, DEX platforms show improved capacity to handle large transaction volumes.

- Quality vs. quantity will be key in distinguishing growth, with long-term sustainability relying on real user adoption and improved infrastructure.

- The recent spike in DEX-to-CEX ratio highlights the challenges in establishing decentralized finance against centralized platforms.

- This article emphasizes the importance of research in cryptocurrency investments and advises caution amidst market dynamics.

Read Full Article

10 Likes

NullTX

80

Image Credit: NullTX

Is Avalanche (AVAX) Waking Up? Network Activity Surges in June

- Avalanche (AVAX) network activity surged in June, with daily transactions exceeding 1 million on key days.

- The spike followed the launch of MapleStory Universe, a Web3 game on AVAX, attracting over 50,000 daily active users.

- The game features blockchain integration, allowing players to earn and exchange assets with real-world value.

- Avalanche's daily transactions increased by over 275% since early May, now averaging 759k transactions per day.

- Weekly transaction volume peaked at 5.8 million, signaling a revitalized network compared to earlier in 2024.

- The use of subnets in Avalanche's architecture has proven beneficial for high-volume use cases like gaming.

- While the surge in activity appears tied to MapleStory Universe, sustained growth will depend on new applications and community engagement.

- Avalanche ecosystem expansion includes new subnet projects, gaming collaborations, and growth in DeFi platforms.

- MapleStory Universe's success may influence other game developers to explore Web3 and blockchain, potentially shifting user bases to blockchain gaming.

- Historically, intensified network performance precedes market movements, hinting at potential price responses to AVAX's network activity.

Read Full Article

4 Likes

NullTX

773

Image Credit: NullTX

Kamino Finance v2 Sees Explosive Growth as Solana’s Leading Lending Venue

- Kamino Finance's v2 money markets on Solana are experiencing rapid growth in the decentralized finance (DeFi) sector.

- It has become the top choice for users seeking to borrow against their principal tokens (PTs) with substantial liquidity.

- Since launch, Kamino has seen $150 million in total liquidity supplied and $60 million borrowed across its lending markets.

- The platform's PT lending space surged, surpassing competitors with $28 million in PT deposits leading the market.

- The Exponent Finance PT market has attracted $17 million in deposits allowing users to take out loans pegged to the price of SOL against restaked tokens.

- High annual percentage yields (APY) up to 15% for Solana (SOL) suppliers are attracting new capital into the ecosystem.

- Kamino's association with Maple Finance led to significant growth, with deposits topping $25 million in the SyrupUSDC market.

- The platform's infrastructure supports isolated lending markets, offering users the ability to engage in DeFi activities without external risks.

- Kamino Finance's v2 launch sets a new standard for DeFi lending on Solana, drawing liquidity to various markets and innovative concepts.

- If Kamino's growth trajectory continues, it could become a key player in Solana's financial ecosystem, setting new benchmarks for capital efficiency in DeFi.

Read Full Article

9 Likes

NullTX

102

Image Credit: NullTX

Crypto Investment Funds Reach Record $167B AUM as Capital Rotates Out of Traditional Markets

- Crypto investment funds have hit a record $167 billion in assets under management (AUM) in May, with over $7 billion in net new inflows.

- This surge in crypto investments contrasts with outflows from traditional assets such as equity and gold funds.

- The divergence between traditional markets and the crypto world indicates a shift in investor sentiment.

- The increase in crypto fund AUM signifies renewed interest in the sector and the maturity of the industry's infrastructure.

- Ethereum has surpassed Bitcoin in total contract trading volume and liquidations, reflecting growing interest in DeFi and other applications.

- Institutional demand for cryptocurrencies is rising, with capital being rotated out of traditional markets into digital assets.

- The market sentiment in the crypto space is turning bullish, with expectations of increased trading activity and network transactions.

- The influx of capital into cryptocurrencies suggests a potential new bull phase for digital assets amidst regulatory crackdowns.

- Investors should conduct thorough research before buying cryptocurrencies or investing in related services.

- Stay updated with the latest news on Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse by following @nulltxnews on Twitter.

Read Full Article

Like

NullTX

114

Image Credit: NullTX

Arbitrum Protocols Generate $5.5M in Revenue Despite Slight Monthly Decline

- Despite a slight monthly revenue decline, Arbitrum protocols generated $5.5 million in revenue in May, showcasing a vibrant community actively using the network.

- Revenue breakdown in Arbitrum's ecosystem reveals diversification, particularly in derivatives and yield protocols.

- GMX leads the derivatives sector with $1.83 million in revenue, while Penpie stands out in yield protocols with $497,000.

- Uniswap remains the top DEX in Arbitrum, with other platforms like Mayan Finance and Camelot DEX making progress.

- Arbitrum's DeFi landscape is evolving with new entrants and sector fragmentation shaping revenue dynamics.

- The ecosystem presents a laboratory for DeFi capital experimentation and growth, driving user interest and innovation across sectors.

Read Full Article

6 Likes

NullTX

117

Image Credit: NullTX

Bitcoin Liquid Staking Market Nears $4B TVL as Lombard Finance Dominates

- The Bitcoin Liquid Staking Tokens sector is growing rapidly, approaching a total value locked (TVL) of nearly $4 billion.

- Lombard Finance leads in the liquid staking BTC space with 18,338.96 LBTC, significantly ahead of its competitors.

- Capital efficiency is a key theme in DeFi, with Bitcoin staking offering yield opportunities for investors.

- Lombard Finance is popular and gaining traction in lending markets, with 42.7% supply used in top DeFi platforms.

- LBTC's adoption in lending protocols has reached new highs, with Aave and Spark Protocol being notable adopters.

- The integration of LBTC into lending markets showcases Bitcoin's evolving role in DeFi, transforming it into a productive asset.

- The LST market is maturing, with Bitcoin staking becoming popular among individuals and institutions seeking yield-bearing opportunities.

- Platforms like Lombard are driving the transformation by offering integrated products within the DeFi ecosystem.

- The liquid BTC tokens market is valued around $4 billion, offering new investment vehicles but also raising concerns about risks.

- Investment disclaimer: This does not constitute trading or investment advice. Always conduct thorough research before investing in cryptocurrencies.

Read Full Article

7 Likes

NullTX

309

Image Credit: NullTX

Ethereum Breaks Out: Bullish Momentum Builds as Cost Basis Support Strengthens

- Ethereum has broken out of a prolonged sideways price action, surpassing key accumulation levels and aiming for the next price hurdle.

- Cost basis clusters indicate a solid foundation of support zones between $2,700 and $2,760 for Ethereum.

- On-chain data shows around 2.1 million ETH accumulated in the $2,700 to $2,760 range, suggesting strong support if the price retraces.

- Resistance levels are relatively balanced above the current spot price until $3,400–$3,420, with minimal hindrances observed.

- Short-term volatility has surged post-breakout, with options market reflecting increased demand for hedges and leverage as Ethereum's implied volatility rises.

- Technical analysis suggests Ethereum's momentum holds with resistance thin until $3.4K, dependent on sellers' behavior and broader market sentiment.

- ETH's recent gains of almost 50% this quarter indicate strong momentum, requiring observance of how it navigates the next price range for a sustainable rally.

- Market indicators like spot price performance, cost basis levels, and options market sentiment will play a pivotal role in Ethereum's price trajectory in the near future.

Read Full Article

18 Likes

NullTX

255

Image Credit: NullTX

Bitcoin Faces Calm Before the Storm as Market Eyes $120K Milestone

- Bitcoin remains in a bullish structure, but a temporary cooling-off phase is suggested by recent market activity.

- Short-term holders show restraint despite recent price movements, leading to a strategic pause rather than a sentiment shift.

- Indicators signal a possible short-term pullback from the recent $110K peak towards a healthy pause before potentially reaching $120K.

- Short-term holders have sold an average of 21K BTC on centralized exchanges, indicating a relative calm and normal market phase.

- Traders view $120K as a psychological milestone that could trigger renewed market volatility and profit-taking.

- Derivatives market shows caution with a $1 billion drop in open interest, suggesting unwinding leveraged positions during market reset.

- If Bitcoin approaches $120K with patient short-term holders and low leverage, breaking this threshold might occur more smoothly.

- Bitcoin's market structure remains bullish, but the next phase depends on a delicate balance of investor behavior and market dynamics.

- Consolidation with a cautionary undertone is observed, indicating a potential push to the upside if short-term holders maintain composure.

- Leverage stepping back and market dynamics favoring Bitcoin holders could lead to another upward push in price.

Read Full Article

15 Likes

For uninterrupted reading, download the app