Hackernoon

3w

166

Image Credit: Hackernoon

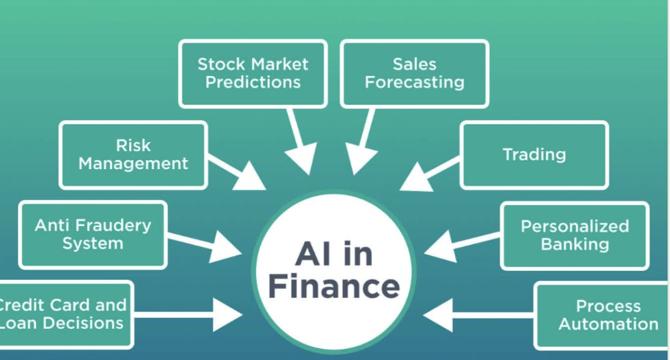

AI’s Invisible Hand: The Emerging Intelligence Gap in Financial Services

- AI is reshaping financial services by creating an Intelligence Gap where institutions leveraging AI outpace others in knowledge and capability.

- This intelligence shift creates a new systemic risk based on knowledge disparities rather than financial imbalances.

- Financial power is now influenced by intelligence capital, the ability to process data faster and act before others perceive market changes.

- Investing in AI allows firms to compound knowledge and create cognitive advantages that shape the future of financial services.

- The next frontier in AI is not operational efficiency but epistemology, changing how institutions perceive risks and opportunities.

- As firms embrace AI-native cognition, a gap between AI-mature and AI-immature entities widens, leading to cognitive fractures in the market.

- Concentration of AI in a few dominant players poses a risk of systemic blind spots and potential catastrophic failures due to over-reliance on similar systems.

- Regulatory frameworks need to evolve to oversee the dynamic nature of AI, shifting from static validation to continuous oversight for transparent cognition.

- In an AI-dominated world, human judgment becomes crucial in asking the right questions, ensuring explainability, and navigating ethical dilemmas.

- The key differentiator in AI adoption is cycle time—the speed at which institutions can deploy intelligence at scale, separating leaders from laggards.

- The future of financial services lies in translating intelligence into action responsibly and at scale, defining the next era of the industry.

Read Full Article

9 Likes

For uninterrupted reading, download the app