Startup News

Inc42

57

Image Credit: Inc42

Karnataka Plans To Unveil Its Own AI Mission: Report

- Karnataka government plans to launch a dedicated AI Mission to regulate AI use.

- The state aims to include the AI framework policy in the upcoming Karnataka IT policy 2025-30.

- The AI framework discussions coincide with the state's AI Workforce Impact Study.

- Karnataka's mature startup ecosystem received significant funding for AI startups, and Bengaluru emerged as a well-funded hub.

Read Full Article

3 Likes

Inc42

1.1k

Image Credit: Inc42

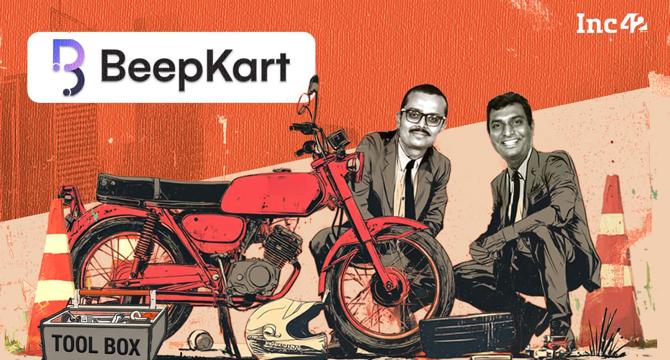

Exclusive: Battling For Survival, Stellaris-Backed BeepKart Shuts Chennai Ops

- Two-wheeler marketplace BeepKart shuts down operations in Chennai amid financial challenges.

- Layoffs, closures of stores, high-profile exits, and fiscal losses contribute to the downfall.

- BeepKart's expansion plans, high refurbishment costs, and tough competition led to shutting down.

Read Full Article

7 Likes

Medium

239

Image Credit: Medium

How First-Time Founders Can Reach Out to Global VCs.

- Warm introductions through mutual contacts are the most effective way to reach VCs.

- Cold outreach via personalized emails can also be successful if done correctly.

- Leveraging accelerators like Y Combinator and engaging in communities can provide credibility and connections.

- Building a public presence on social media and demonstrating early traction are key to gaining VCs' attention.

Read Full Article

9 Likes

Inc42

128

Image Credit: Inc42

Zepto Cafe Scaling Down Operations Amid Supply Chain Issues: Report

- Zepto Cafe is scaling down its 10-minute food delivery service due to supply chain issues and a shortage of trained staff.

- The startup is also slowing down its expansion efforts to manage cash burn, according to sources.

- Zepto has delayed the launch of its dark stores.

- The quick food delivery arm of Zepto temporarily closed operations in 44 cafes, affecting over 400 employees, mainly in northern India.

Read Full Article

7 Likes

Inc42

533

Image Credit: Inc42

Healthtech Startup Truemeds Bags $20 Mn From Peak XV

- Mumbai-based healthtech startup Truemeds secures $20 Mn from Peak XV Partners in Series C funding round.

- Truemeds raises the amount through issuing Series C2 compulsory convertible preference shares, planning to use it for business advancement and growth, with a post money valuation over $400 Mn.

- The recent funding is in addition to the $44 Mn raised from Accel India VII (Mauritius) Ltd in March, bringing the total Series C funding to $64 Mn.

- Founded by Akshat Nayyar and Kunal Wani, Truemeds focuses on providing alternative medicine brands and affordable options, extending to personal care products, vitamins, supplements, and healthcare devices.

Read Full Article

17 Likes

Startup Pedia

84

Image Credit: Startup Pedia

Deepinder Goyal Dismisses Reports That Aviation Startup Backed By Him Has Brought A Private Jet

- Zomato CEO Deepinder Goyal dismissed reports of a startup backed by him purchasing a private jet.

- Deepinder Goyal clarified that the startup, LAT Aerospace, is not involved in buying planes but focuses on developing them for regional aviation.

- LAT Aerospace, co-founded by Surobhi Das and Deepinder Goyal, aims to revolutionize regional travel with 24-seater STOL aircraft.

- The reports claiming the purchase of a Bombardier Global Jet were deemed 'clickbaity' by Deepinder Goyal, who expressed a desire to own a private jet in the future.

Read Full Article

Like

ISN

147

Image Credit: ISN

ChrysCapital to acquire 90 % stake in Indian bakery chain Theobroma for Rs 2,410 crore: Report

- ChrysCapital is set to acquire a 90% stake in Theobroma Foods, a popular bakery chain in India, for Rs 2,410 crore.

- ICICI Venture, the current investor in Theobroma, is exiting the company entirely as part of the deal.

- The founders of Theobroma will retain about 10% equity after the acquisition by ChrysCapital.

- Theobroma, known for its brownies and cakes, has scaled to over 200 stores across 30 Indian cities and is expected to report a revenue of Rs 525-550 crore in FY25.

Read Full Article

7 Likes

ISN

102

Image Credit: ISN

Fashion quick commerce platform Zulu Club raises $250K to expand presence in Delhi NCR

- Gurugram-based fashion quick commerce platform Zulu Club has raised $250,000 in a pre-seed funding round led by TDV Partners.

- Zulu Club offers a unique shopping experience allowing customers to order from trusted malls and outlets and receive pre-curated Try-at-Home kits within 100 minutes.

- The platform aims to address fashion e-commerce challenges like high return rates by enabling cross-selling and upselling through a more personalized shopping experience.

- Zulu Club plans to expand its presence in Delhi NCR by leveraging the funding to enhance its services, improve personalization features, and deepen partnerships with outlet stores and mall retailers.

Read Full Article

6 Likes

Gritdaily

305

Image Credit: Gritdaily

How Lauren Petrullo Uses AI to Scale Marketing and Grow Brands Fast

- Lauren Petrullo, the founder of Mongoose Media, embraces burning $5,000 on marketing as essential for gathering data, not immediate results.

- Petrullo leverages AI tools like Chatbot Builder and Jasper to scale marketing efforts and increase conversions through more personalized interactions.

- She emphasizes the importance of building trust with consumers through personalized, culturally relevant messaging and advocates for investing money wisely in business growth.

- Petrullo encourages brands to focus on 'edutaining' content, embrace radical inconsistency, and prioritize hobbies as a strategy to prevent burnout in entrepreneurship.

Read Full Article

18 Likes

Startup Pedia

530

Image Credit: Startup Pedia

Google brings 1 year of free Gemini AI Pro subscription worth ₹19,500 for Indian students

- Google is offering Indian students a 1-year free subscription to its Gemini AI Pro plan, previously available only to U.S. students, worth Rs 19,500.

- Eligible students must be 18 years or older, reside in India, have a personal Google Account, and subscribe to Google AI Pro through the Google Play Store.

- The offer includes benefits such as expanded storage, AI-powered text-to-video tools, Gemini integration, and more.

- After the complimentary year, standard Google One subscription charges will apply, with registration deadline set as September 15, 2025.

Read Full Article

5 Likes

Inc42

229

Image Credit: Inc42

Sarvam To Open Source Its Models Under IndiaAI Mission

- Bengaluru-based GenAI startup Sarvam AI will be open sourcing its models trained under the IndiaAI Mission.

- LLMs sponsored by the central government will be made open source according to IndiaAI Mission chief executive Abhishek Singh.

- Sarvam has received the highest subsidy under the IndiaAI Mission, amounting to INR 98.68 Cr against a bill of INR 246.71 Cr for access to 4,096 Nvidia H100 GPUs for six months.

- Sarvam's model will focus on reasoning, support voice-based tasks, work across Indian languages, and is being designed for secure, population-scale use with a plan for full development, deployment, and optimization within India.

Read Full Article

11 Likes

Moneyweb

188

Nvidia boss expects to get first H20 China export licenses soon

- Nvidia's CEO, Jensen Huang, expects to receive the first batch of US licenses to export H20 AI chips to China soon, allowing the company to resume sales of the sought-after component in the semiconductor market.

- While awaiting export permissions from Washington, Nvidia has reassured that orders are in place to fill once the licenses are granted.

- The US government plans to green-light export licenses for Nvidia's H20 AI chips, potentially boosting the company's revenue and enabling it to fulfill previously restricted orders.

- Nvidia's CEO praised China's contributions to artificial intelligence and highlighted Nvidia's role in powering global AI applications, emphasizing the importance of collaboration in advancing technologies.

Read Full Article

10 Likes

Inc42

429

Image Credit: Inc42

Kettleborough VC Launches Second Fund With INR 80 Cr Target Corpus

- Nisarg Shah-led Kettleborough VC launches its second fund with a target corpus of INR 80 Cr.

- The Fund II has already secured INR 35 Cr in its first close, backed by undisclosed investors and family offices in India and the US.

- Kettleborough VC plans to invest in startups across sectors like fintech, full stack commerce solutions, vertical SaaS, and agentic AI-led platforms, with an initial investment ranging from $300K-500K.

- Several other VCs in India are also launching early-stage funds to support startups, as the ecosystem shows promise with significant fundings in seed-stage startups.

Read Full Article

25 Likes

Medium

221

Image Credit: Medium

Why Global VCs Should Pay Attention to Bangladeshi Startups — Right Now

- With over 125 million people having internet access through mobile phones and a median age of 27, Bangladesh presents a rapidly growing market for digital services.

- The country's massive consumer base is largely underserved, creating opportunities for innovation and tech-driven solutions in various sectors like finance, education, healthcare, and logistics.

- Bangladeshi startups, like ShopUp and Chaldal, are gaining traction by addressing real-world problems with scalable solutions, attracting funding from both regional and global venture capitalists.

- While global investor competition in Bangladesh is currently low, the country offers attractive entry points, long-term upside, and the opportunity for VCs to support impactful startups that address critical issues while building sustainable business models.

Read Full Article

13 Likes

Startup Pedia

84

Image Credit: Startup Pedia

Raised In Humble Family, Noida Founder Built a ₹35 Cr Logistics Business, Now Eyes ₹400 Cr in 3 years with His Bakery Venture- Bakeats

- From humble beginnings, Pankaj Mishra, a Noida-based entrepreneur, shares his journey to success.

- Starting with a logistics business, he now ventures into the FMCG industry with Bakeats.

- Bakeats aims to offer premium bakery products at affordable prices and focuses on quality.

- With innovative flavors, unique packaging, and a Made-in-India approach, Bakeats sets itself apart.

- Investments, expansion plans, and a people-centric approach drive Bakeats' vision for growth.

Read Full Article

2 Likes

For uninterrupted reading, download the app