AR News

VentureBeat

234

Image Credit: VentureBeat

The great AI agent acceleration: Why enterprise adoption is happening faster than anyone predicted

- Enterprise leaders focus on AI practical applications and measurable results, not AGI hype.

- Companies like Intuit, Capital One, and LinkedIn are deploying AI agents with tangible returns.

- Industry shift towards multi-model, multi-cloud strategy for AI deployments is accelerating.

- Tech leaders emphasize practical AI solutions for immediate business challenges, not superintelligence.

Read Full Article

13 Likes

Pymnts

433

Image Credit: Pymnts

This Week in AI: Nvidia Hits $4 Trillion Market Cap; Reddit Post Reignites AI in Healthcare Debate

- Nvidia became the first company to achieve a $4 trillion market capitalization, driven by its dominance in AI chipmaking.

- Americans are increasingly seeking medical advice from AI chatbots, with 1 in 6 adults using them monthly, although they may lack the nuanced insights of human professionals.

- Restaurants are adopting robots for various tasks, expecting the smart restaurant robot industry to surpass $10 billion by 2030, with companies like Uber Eats, LG, and Miso Robotics deploying robots.

- Microsoft claims to have saved over $500 million using AI in call centers, despite laying off thousands of employees, sparking concerns about AI replacing human jobs.

Read Full Article

20 Likes

Insider

270

Image Credit: Insider

How Nvidia's rise is minting so many millionaires among its relatively small workforce

- Nvidia's rapid valuation surge to $4 trillion is enriching its relatively small workforce.

- An analysis of a mid-career Nvidia engineer's 2022 stock grant suggests that more senior Nvidia staffers are likely multi-millionaires.

- The AI chip company, with about 36,000 employees, has seen its shares soar, resulting in substantial wealth for its workforce.

- Levels.fyi analysis reveals how even regular individual contributors at Nvidia have likely become millionaires, with more senior staff experiencing greater wealth.

Read Full Article

16 Likes

Insider

299

Image Credit: Insider

Six companies, one coast, $17 trillion

- Nvidia became the first $4 trillion company, almost reaching the GDP of Japan and trailing behind Germany.

- Nvidia's value is driven by the demand for AI models requiring their GPUs, mainly purchased by cloud providers like Amazon, Microsoft, Google, Meta, and others.

- When combining the market value of Nvidia, Apple, and major tech players, the total surpasses $17 trillion, approaching China's GDP.

- These companies collectively generated almost $500 billion in net income in 2024, with significant investments in AI data centers and projects like Project Stargate.

Read Full Article

17 Likes

Macdailynews

263

Image Credit: Macdailynews

World’s most valuable company Nvidia closes above $4 trillion market value

- Nvidia's market value exceeded $4 trillion for the first time, solidifying its position as the most valuable company globally and a significant player in Generative AI technology.

- Nvidia ended Thursday with a market value of $4.004 trillion, surpassing Apple and Microsoft, fueled by a rise in demand for AI technologies.

- Nvidia became the most valuable public company ever, surpassing Apple's previous peak, and briefly reached over $4 trillion in market value before settling around $3.97 trillion.

- Microsoft is the second most valuable U.S. company at $3.73 trillion, while Apple's market value stands at $3.17 trillion with concerns over its slow adoption of AI in products.

Read Full Article

15 Likes

Digit

160

Image Credit: Digit

Best gaming PC build under ₹1,05,000 in July 2025

- A balanced gaming PC build under ₹1.05L featuring AMD Ryzen 5 9600X and NVIDIA RTX 4070.

- Designed for 1440p ultra gaming, 4K workloads, 3D rendering, video editing, and streaming.

- Includes fast DDR5 memory, reliable cooling, and power setup in an airflow-focused chassis.

Read Full Article

9 Likes

VC Cafe

326

Image Credit: VC Cafe

Weekly Firgun Newsletter – July 11 2025

- The newsletter highlights the concept of Firgun, celebrating others' accomplishments and good fortune.

- Tech news from Israel and globally includes investment rounds, exits, appointments, and new funds.

- Notable mentions: NVIDIA's Israel campus plan, AI advancements, and global funding insights.

Read Full Article

19 Likes

Fourweekmba

957

Image Credit: Fourweekmba

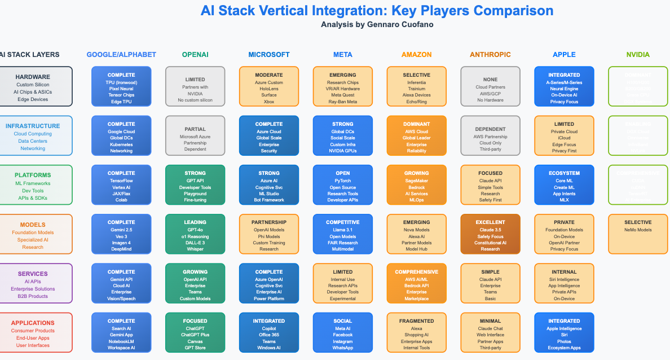

The Strategic Map of AI

- Eight major players have adopted fundamentally different approaches to achieving AI dominance within the AI Value Chain.

- Companies have positioned themselves across the AI value chain as Full-Stack Integrators, Specialized Dominators, and Strategic Enablers.

- Contrary to the winner-take-all AI race belief, companies with unique positions enjoy sustainable competitive advantages.

- Analysis reveals which companies are competing for the same territory and which have identified defensible white spaces in the AI ecosystem.

Read Full Article

Like

Siliconangle

358

Image Credit: Siliconangle

12 signs AI infrastructure is reshaping the IPO market: theCUBE’s RAISE Summit insights

- AI infrastructure reshaping IPO market, critical for scaling, competing, going public.

- Companies now focus on embedding AI in business models for sustainability, profitability.

- Investors prioritize durability, growth, changing playbook for IPO readiness in 2025.

- Insights on AI infrastructure from industry leaders at RAISE Summit, Paris.

Read Full Article

14 Likes

Crypto-News-Flash

213

Image Credit: Crypto-News-Flash

Nvidia Hits Historic $4T Milestone Thanks to AI—Is Crypto’s AI Sector Ready to Rally?

- Nvidia's stock price hits a record high of $164.32, solidifying its position in AI infrastructure.

- Despite earlier challenges, Nvidia reports $44 billion in revenue and $19 billion in Q1 earnings.

- Nvidia becomes the first publicly traded company to surpass a market value of $4 trillion.

- The surge in Nvidia's value is attributed to its dominance in AI technology, impacting the stock and potentially reviving the crypto AI sector.

Read Full Article

12 Likes

Pcgamesn

162

Image Credit: Pcgamesn

Win this Nvidia GeForce RTX 5090 Superman graphics card, hand-painted by Jim Lee

- Nvidia is giving away a custom, hand-painted RTX 5090 Founders Edition graphics card to celebrate the new Superman movie.

- The RTX 5090 is recognized as the fastest gaming GPU currently available, making it a desirable prize for gamers and comics fans.

- The custom paint job on the RTX 5090 Founders Edition card enhances its appearance, transforming it into a unique collector's item.

- The giveaway not only offers a chance to win a high-end graphics card but also saves the winner approximately $2,000 or more.

Read Full Article

9 Likes

Pcgamesn

124

Image Credit: Pcgamesn

This Nvidia GeForce RTX graphics card just melted into a chocolatey mess

- A gamer experienced a Nvidia graphics card, specifically the Nvidia GeForce RTX 4060 Ti, melting due to a PC blowout.

- The incident highlights the importance of using quality parts when building or repairing a gaming PC.

- Nvidia, despite being a dominant player in the GPU market, has faced issues like melting RTX power cables in the past.

- The damaged graphics card serves as a cautionary tale for gamers to avoid cutting corners when it comes to PC components.

Read Full Article

7 Likes

Medium

90

Image Credit: Medium

Nvidia Becomes the World’s First $4 Trillion Company

- Nvidia becomes the first company in the world to reach a market valuation of $4 trillion, driven by demand for AI technology.

- The company's stock surged by 2.4% to $164, marking a rapid climb from breaking the $1 trillion barrier in June 2023.

- Nvidia's dominance in the chip market has been instrumental in fueling the AI revolution, with Wedbush analyst Dan Ives describing it as a historic moment.

- Despite geopolitical challenges, Nvidia's stock has rebounded strongly, with CEO Jensen Huang gaining celebrity-like status in the tech world.

Read Full Article

Like

Fourweekmba

181

Image Credit: Fourweekmba

The Interconnected Web: How Today’s Stories Reveal Tech’s New World Order

- Today's technology news unveils interconnectivity shaping digital economy architecture and tech trends.

- Nvidia's $4 trillion valuation, AI browser wars, AR/VR race intertwined defining industry landscape.

- Key players like Nvidia, Meta, IBM, and Microsoft impacting infrastructure, hardware, and enterprise transformations.

- Investment thesis focuses on infrastructure, vertical integration, enterprise AI, regulatory responses.

Read Full Article

6 Likes

Livebitcoinnews

254

Image Credit: Livebitcoinnews

Nvidia Hits $4 Trillion Valuation as AI Demand Surges

- Nvidia achieved a market capitalization milestone of $4 trillion driven by high demand for AI technologies and chips.

- Investor focus is shifting towards advanced tech infrastructure with Nvidia's rapid growth highlighting the trend.

- Nvidia's quarterly results showcase a significant increase in demand for AI-driven hardware solutions.

- The company's success marks it as the most valuable business in the semiconductor industry, surpassing market caps of Microsoft and Apple.

Read Full Article

13 Likes

For uninterrupted reading, download the app