Macdailynews

1M

372

Image Credit: Macdailynews

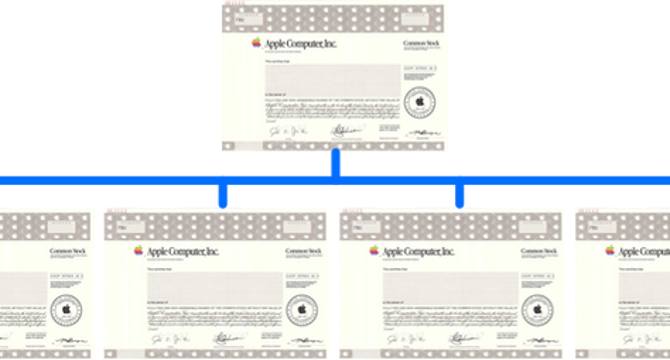

Apple might consider a stock split in 2025 to signal confidence and attract investors

- Apple, once the world’s most valuable company, contemplates a stock split in 2025 to restore investor confidence amidst a year of challenges.

- The possible stock split, a tactic Apple has used multiple times in history, could make shares more accessible to retail investors and attract new investments.

- A stock split reduces the share price by increasing shares outstanding, without affecting market capitalization or total holdings value.

- Lower share prices from a split can broaden Apple's shareholder base and enhance liquidity.

- Apple's struggles in 2025, especially in generative AI compared to competitors, have led to investor skepticism and stock price decline.

- A stock split could project optimism about Apple's future growth, coinciding with anticipated unveilings like iOS 26 and macOS 26 at WWDC 2025.

- Historically, Apple's stock splits have corresponded with periods of growth or recovery, reassuring investors and driving demand.

- Critics may see stock splits as cosmetic, but they have a psychological impact on investors, making the stock appear more affordable and driving demand.

- With its strong financial position, Apple could use a split to project confidence, attract new investors, and stabilize its stock price.

- A stock split before WWDC 2025 could help Apple regain momentum among tech stocks and set the stage for a stronger performance.

Read Full Article

22 Likes

For uninterrupted reading, download the app