Cryptoticker

4w

250

Image Credit: Cryptoticker

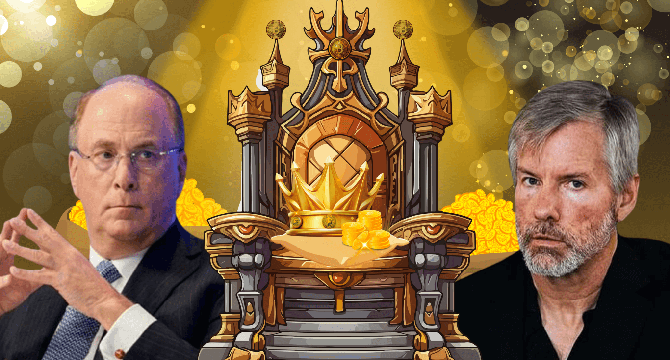

BlackRock Goes All In: From Anti-Crypto to Competing for Bitcoin Supremacy

- BlackRock and Strategy Inc. are in a race to become the world's largest corporate holder of Bitcoin.

- BlackRock, previously a skeptic, is now competing with Strategy Inc. for dominance in the crypto space.

- Both companies hold over half a million BTC each, raising the question of who will claim the crypto crown first.

- BlackRock's CEO, Larry Fink, made a significant pivot from dismissing Bitcoin to managing the iShares Bitcoin Trust (IBIT).

- Key milestones in BlackRock's crypto journey include filing for a spot Bitcoin ETF, approval of IBIT, and surpassing $70 billion in AUM with around 667,000 BTC holdings.

- BlackRock aims to become the top crypto asset manager worldwide by 2030.

- Strategy Inc., led by Michael Saylor, remains a strong player with approximately 582,000 BTC held on its balance sheet.

- Strategy Inc. was the first corporate buyer of BTC, converted its treasury into Bitcoin, and rebranded from MicroStrategy to Strategy Inc.

- In June 2025, Strategy launched a BTC-backed preferred stock offering to raise nearly $1 billion for further Bitcoin purchases.

- The competition and approaches differ between BlackRock through regulated ETFs and Strategy Inc. with a maximalist balance sheet strategy.

- The race between BlackRock and Strategy Inc. is crucial for the mainstream legitimacy of crypto and the perception of Bitcoin as a strategic asset rather than speculation.

- BlackRock contributes regulatory credibility and institutional capital, while Strategy Inc. brings conviction and a bold balance sheet approach to Bitcoin.

- The outcome of this competition could influence how corporations, ETFs, and nations adopt Bitcoin as a strategic reserve asset.

- This race signifies the institutionalization of Bitcoin, reshaping the future of digital finance and benefiting the entire ecosystem.

- The crypto market is evolving significantly, with a focus on strategic Bitcoin holdings and mainstream acceptance.

Read Full Article

15 Likes

For uninterrupted reading, download the app