Siliconangle

1M

117

Image Credit: Siliconangle

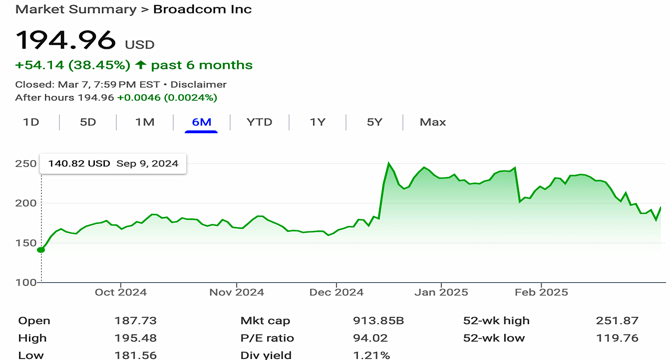

Broadcom momentum sparks renewed investor enthusiasm

- Broadcom's momentum in the market has sparked renewed investor enthusiasm following impressive fiscal first-quarter results and a positive response from shareholders.

- Broadcom is navigating market transitions effectively, with a focus on high-growth sectors like AI and strategic partnerships with hyperscalers and VMware.

- The company's approach to VMware acquisition has shown focus on core products, elevated pricing strategies, and increased customer value, though some customers have faced subscription model transitions.

- Broadcom's CEO, Hock Tan, is recognized for executing strategic moves in alignment with company plans, driving financial stakeholder confidence.

- Broadcom's strategy in AI and software growth, combined with a focus on connectivity technologies for AI workloads, positions the company for continued success.

- Financially, Broadcom has shown significant growth in software revenue, improving margins, and increasing operating efficiency.

- The company's strategic positioning in AI-driven workloads and custom silicon design wins from hyperscalers indicates a strong outlook for future growth.

- Despite regulatory risks and uncertainties, Broadcom's diversified approach and profitable enterprise make it an appealing investment opportunity for investors.

- Broadcom's focus on infrastructure for AI, networking solutions, and advancements in custom silicon design are key factors driving its competitive edge in the market.

- Overall, Broadcom's market positioning, financial performance, and strategic partnerships indicate a bullish outlook with considerations for regulatory challenges.

- Investors are encouraged to evaluate Broadcom's software strategy, on-prem infrastructure partnerships, and risk tolerance amidst regulatory uncertainties to make informed investment decisions.

Read Full Article

7 Likes

For uninterrupted reading, download the app