Insider

1d

149

Image Credit: Insider

BYD is piling on the pain for Tesla. These 5 charts break down how the rivals square up.

- Chinese EV maker BYD has reported soaring sales and revenue, while Tesla faces challenges with plunging sales in China, a diving stock price, and public backlash against CEO Elon Musk's work for DOGE.

- BYD sold 4,272,000 vehicles in 2024, dwarfing Tesla's 1,789,200 vehicle sales. However, BYD fell just short of Tesla's electric vehicle sales crown with 1,764,992 battery-electric vehicle sales.

- BYD's annual revenue for 2024 came in at $107 billion, surpassing Tesla's $97.7 billion. Tesla, on the other hand, reported a higher net profit of $7.1 billion compared to BYD's $5.55 billion in 2024.

- Both Tesla and BYD have diversified business portfolios beyond cars. Tesla generated around 21% of its revenue from energy generation and services, as well as selling regulatory credits, while BYD derived about a fifth of its revenue from assembling smartphone components.

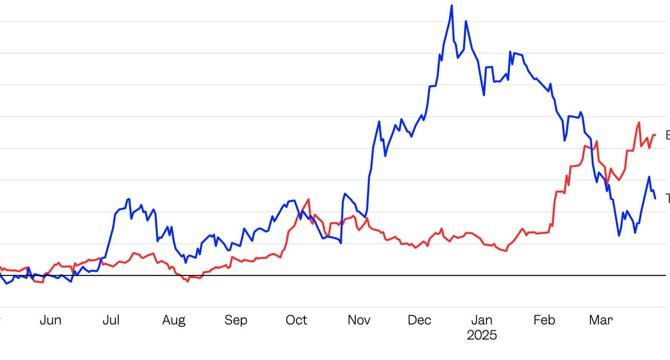

- While Tesla's stock has slumped 30% in 2025 due to concerns over Elon Musk's work at DOGE and disappointing sales figures, BYD's stock has surged in 2025, fueled by the announcement of new fast-chargers and hit a record high.

Read Full Article

9 Likes

For uninterrupted reading, download the app