Medium

1M

239

Image Credit: Medium

Capital Connections: The Growing Role of Asian and Middle Eastern Investors in Africa’s VC…

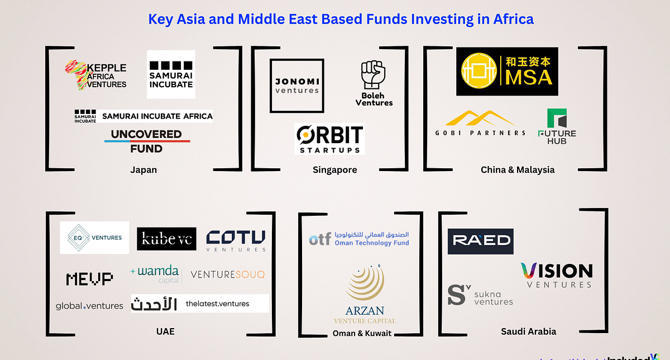

- Asian and Middle Eastern investors are playing an increasingly significant role in Africa's venture capital landscape, contributing 15% of VC funding and driving growth in sectors like fintech and logistics.

- Notable players from the UAE, Japan, and Singapore are making substantial investments across Africa, showcasing a shift in the global investment landscape.

- Africa's unique scalability at lower valuations attracts investors seeking diversification and substantial returns, despite challenges like regulatory hurdles and limited exit opportunities.

- Deeper regional collaboration, ethical partnerships, and market expansion opportunities to Asia and the Middle East are seen as the future of Africa's startup ecosystem.

- Understanding these trends can unlock new opportunities for African founders and provide investors with insights into tapping into a rapidly growing startup ecosystem.

- Asian and Middle Eastern investors bring more than just capital to Africa; they bring expertise, technology, and global networks that elevate African startups to compete globally.

- Partnerships are addressing critical gaps in sectors like fintech, agritech, and renewable energy, driving sustainable growth and impactful innovation.

- Africa offers untapped sectors for Asian and Middle Eastern investors aiming for portfolio diversification, with collaborations focused on technology and scalability.

- Challenges such as regulatory complexities, currency volatility, limited exit opportunities, talent gaps, and infrastructure deficits require strategic solutions and tailored approaches by investors.

- Asian and Middle Eastern funds partnering with African investors bring together local expertise and international capital to drive growth and innovation across sectors like fintech, health tech, and logistics.

Read Full Article

14 Likes

For uninterrupted reading, download the app