Medium

1w

352

Image Credit: Medium

Decoding AI

- AI companies now represent 34% of S&P market cap due to their contribution in providing efficient solutions in different sectors. However, it is uncertain whether the AI mentions in the Q2 earnings reports have played a role in the industry's success.

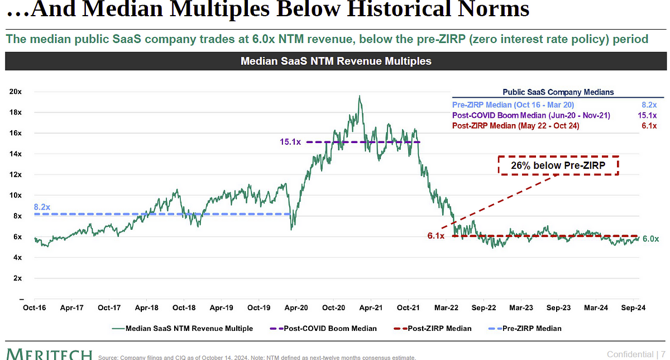

- Despite the moderate valuations in SaaS companies, perceived market leaders are of high value. With AI gaining materialization, software leaders could experience a significant spike in their revenue, leading to vertical take-off.

- The spending spree in the AI scene, currently worth USD 1.2tn, outweighs the significant top-line gains in the industry, resulting in an ROI drag.

- In contrast, growth remains crucial for valuation optimization in this area - efficient growth, in particular. Growth delta around 20% can reshape the revenue multiples of Rule-of-40 companies.

- AI technology is all set to redefine the software landscape by expanding the addressable market of many sectors. It is expected to birth many unicorns in due course.

- Raises concerns in the market with regards to dry exits, marking IPOs at near 15-year lows, and M&A activity staying subdued amidst regulatory headwinds.

- Although Brexit and trade war continues to bring to the uncertainty in markets, VC waits for vertical data to continue yielding profits.

- Chelsea Stoner of Battery Ventures states that companies who control vertical data will reap maximum benefits in the AI landscape.

- Growth remains crucial for valuation optimization in this area- efficient growth, that is. Growth delta around 20% can reshape the revenue multiples of Rule-of-40 companies.

- Although the market may have missed the memo on this, Rule-of-40 companies under-utilize growth levers, leaving USD 500bn of untapped value on the table.

Read Full Article

21 Likes

For uninterrupted reading, download the app