Inc42

2w

323

Image Credit: Inc42

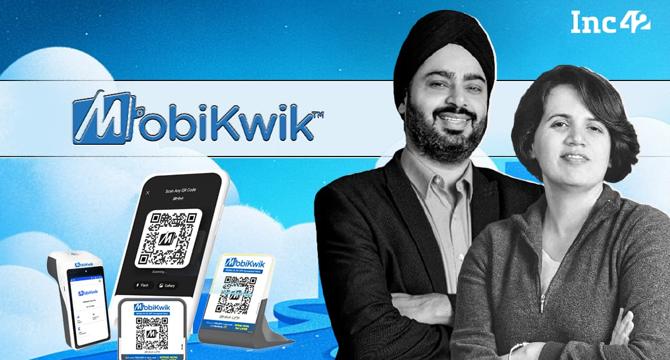

Decoding MobiKwik’s Plans To Get Back Into The Profitability Lane

- Fintech company MobiKwik saw investor attraction for its IPO due to being one of few fintech firms to report a profit for one entire fiscal year. The company’s Q3 results for FY25 showed a net loss of INR55.28 Cr, taking the loss count to INR62.85 Cr. Reasons cited include a decline in its financial services revenue, higher lending-related costs from a transition to new Default Loss Guarantee (DLG) contracts, and lower contribution margins.

- However, MobiKwik reported growth in various areas. Its revenue from operations climbed almost 18% to INR269.47 Cr in Q3 FY25. In the same quarter, MobiKwik added 5 Mn new users and has a userbase crossing the 172 Mn mark. Revenue from the payments business also grew 166% YoY to INR196.5 Cr in Q3 FY25.

- Co-Founder and CFO Upasana Taku and CEO Bipin Preet Singh shared MobiKwik’s plans to resume profitability during an hour-long earnings call. The main takeaways include a focus on expanding MobiKwik’s digital credit products, balancing its lending portfolio with the addition of secure lending products, and offering customised credit cards to capitalise on users’ spends.

- Taku and Singh also revealed that MobiKwik will expand into new fintech sectors, including insurance distribution. The firm has gained the necessary licence for the Insurance Regulatory and Development Authority of India (IRDAI). The team plans to focus on savings and insurance sectors to boost profits in 2025

- MobiKwik is also working to expand its prepaid payment instruments (PPI) offering, Pocket UPI. The company is focusing on developing Pocket UPI to capture a potential merchant discount rate that may open up a profitable revenue stream.

- The telecon mentioned that discussions have finalised around implementing a 1.1% interchange fee on UPI transactions through PPI. This will apply to transactions more than INR 2,000.

- Though MobiKwik experienced losses in the recent quarter, it remains focused on profits while maintaining high governance standards.

- Despite the profitable FY24, the current year's losses stem from a decline in financial services revenue, higher lending-related costs and lower contribution margins. MobiKwik is now focusing on digital credit products and secure lending portfolios, expanding into savings and insurance sectors, and scaling up prepaid payment instruments Pocket UPI.

- MobiKwik’s previous profitability highlights its potential for a profitable future as it moves into new fintech areas.

- Shares of MobiKwik closed at INR403.10 on the BSE after trading.

Read Full Article

19 Likes

For uninterrupted reading, download the app