ADPList’s Newsletter

1M

198

Image Credit: ADPList’s Newsletter

Equity vs. Salary in 2025: What Should You Bet On?

- In 2025, the job market is seeing a shift where people are choosing between stable salaries and the long-term promise of equity.

- Startups are offering lower base salaries but lucrative equity packages post the VC winter of 2022-2023.

- Big corporations like Google and Amazon are keeping salaries competitive while tying performance to Restricted Stock Units (RSUs).

- According to a 2024 report by AngelList, 63% of employees under 30 are willing to consider lower salaries for higher equity stakes.

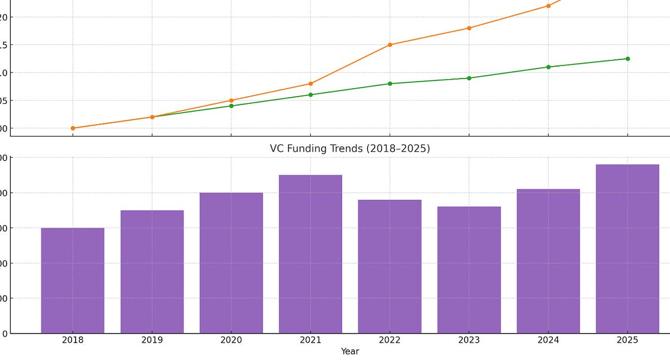

- Equity compensation has shown a 6% growth in 2025, emphasizing stock-based incentives, but there is a shift towards cash pay as well.

- Global venture funding reached $113 billion in Q1 2025, with AI startups driving growth and accounting for a significant portion of the deal value.

- Equity types include stock options, RSUs, and ESOPs, each with its own risk, reward, and liquidity profile.

- Equity can be deceptive as dilution, vesting schedules, and taxes significantly impact the actual value employees receive.

- Before accepting equity compensation, individuals should consider factors like dilution, vesting, and tax implications using frameworks like the Equity Worth Estimator.

- Understanding one's risk appetite, career stage, and long-term goals are crucial in deciding the ideal mix of salary and equity compensation.

Read Full Article

9 Likes

For uninterrupted reading, download the app