Fintechnews

1M

166

Image Credit: Fintechnews

Europe’s Startup Ecosystem Surges With Over 600 Unicorns Emerging to Date

- Europe's startup landscape is flourishing, with 606 unicorn companies emerging in Europe since 2020.

- The UK leads in unicorn creation with 185 companies, followed by Germany, France, Sweden, and the Netherlands.

- London is Europe's top unicorn-producing city, fueled by a strong VC environment and fintech sector.

- The fintech sector dominates unicorn creation, with 65 out of 198 European tech unicorns in Q1 2025.

- London hosts six of the top ten most valuable fintech startups in Europe.

- Challenges in European fundraising include a growth-stage funding gap and reliance on US capital.

- Talent shortage, particularly in green tech and digital innovation, poses a challenge for European startups.

- Regulatory fragmentation in Europe's single market complicates cross-border growth for startups.

- Top valuable fintech startups in Europe include Revolut, Klarna, and Checkout.com.

- Late-stage investments in Q1 2025 amounted to US$3.6 billion for European startups.

- Geographic distribution shows strong unicorn hubs in cities like London, Berlin, Paris, and Stockholm.

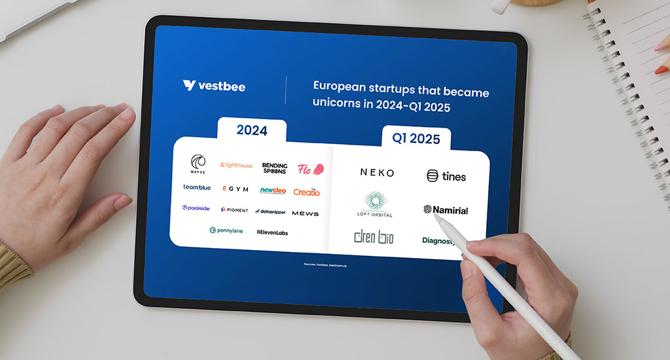

- Significant rebound in unicorn creation in early 2025, with six new unicorns established in Q1.

- Fintech unicorns such as Revolut and Klarna hold banking licenses to enhance profitability.

- Europe faces challenges in retaining top talent and navigating regulatory differences among 27 national systems.

- Berlin benefits from a rich talent pool in software-driven industries, while Stockholm thrives due to digital infrastructure.

- Despite progress, Europe struggles with funding gaps and talent shortage, hindering tech innovation.

Read Full Article

10 Likes

For uninterrupted reading, download the app