Hackernoon

1M

419

Image Credit: Hackernoon

How Ethereum and Bitcoin Handle Transaction Delays and Fees

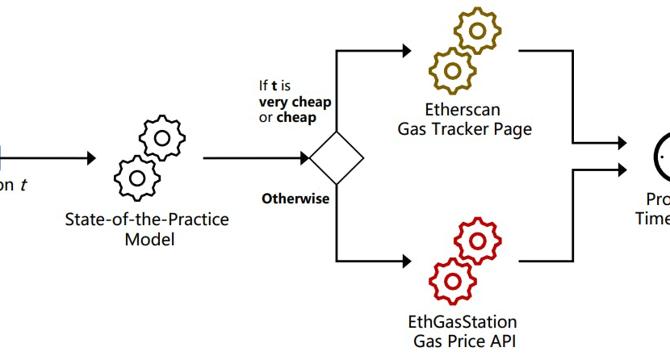

- The article examines how Ethereum and Bitcoin handle transaction delays and fees, focusing on factors impacting transaction processing times.

- Hu et al. study private blockchains for banking processes, correlating transaction times with block generation times.

- Kasahara and Kawahara analyze Bitcoin fees' effect on transaction processing times, noting longer processing for low-fee transactions.

- Rouhani and Deters compare transaction processing times in Ethereum clients Geth and Parity, observing a significant increase with Parity.

- Pierro and Rocha investigate factors influencing transaction fees in Ethereum, finding the total number of miners and pending transactions impact fees.

- Chen et al. outline security vulnerabilities due to extremely low gas prices in Ethereum, proposing dynamic cost adjustments to prevent disruptions.

- Studies highlight gas price choices' influence on Ethereum economics and behavior, emphasizing the importance of understanding factors driving gas price decisions.

- Kim et al. delve into Ethereum's peer-to-peer network characteristics, analyzing node distribution, client usage, and network size.

- Silva et al. study geo-distribution and mining pools' impact on Ethereum's efficiency and security, highlighting selfish mining behaviors.

- Oliva et al. analyze Ethereum's transactional activity, revealing the concentration of transactions on a small percentage of smart contracts and its impact on gas prices.

- Various studies explore gas usage estimation methods in smart contracts, including worst-case and exact estimations to optimize gas consumption.

Read Full Article

25 Likes

For uninterrupted reading, download the app