Siliconangle

3w

351

Image Credit: Siliconangle

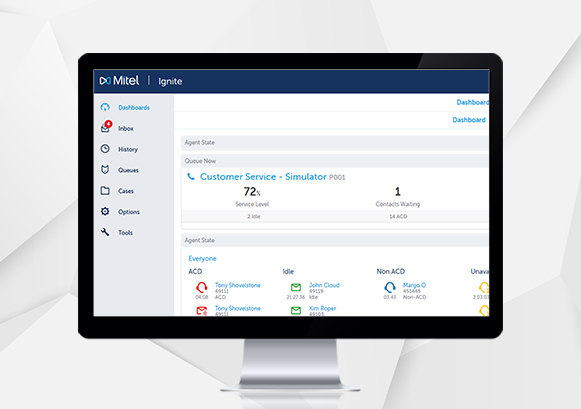

Mitel restructures under Chapter 11 bankruptcy to pursue hybrid opportunity

- Mitel Networks Corp. has filed for Chapter 11 bankruptcy to optimize its capital structure and recapitalize its debt, ending Searchlight Capital Partners' ownership.

- Mitel will use a prepackaged plan under Chapter 11 to restructure its debt, with no anticipated impact on customers, partners, or employees.

- The company aims to reduce its debt significantly, receiving commitments for new financing to support operations during the process.

- Similar to Avaya and C1's experiences, the restructuring could strengthen Mitel post-process.

- Mitel expects to deleverage by about $1.15 billion, reduce annual interest payments by $135 million, and focus on its strong hybrid cloud strategy.

- The company plans to attract customers with innovative solutions, leveraging AI, security, and compliance in the hybrid communications market.

- Mitel CEO, Tarun Loomba, emphasizes the proactive step to invest in the business for long-term success and support evolving customer needs.

- This decision positions Mitel to compete with Avaya in the midmarket segment, catering to demand for on-premises/hybrid cloud solutions.

- The restructuring allows Mitel to invest in AI capabilities, security, and compliance, ensuring the latest features for its customers.

- Ultimately, the Chapter 11 move signifies Mitel's commitment to controlling its future, adapting to industry changes, and emerging stronger.

Read Full Article

21 Likes

For uninterrupted reading, download the app