Medium

1M

36

Image Credit: Medium

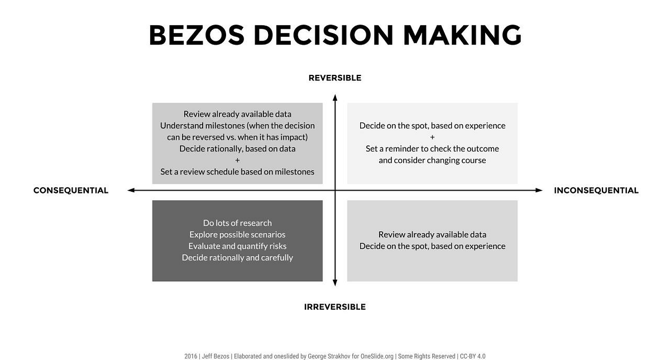

No Exit or Easy Escape: How One-Way And Two-Way Doors Shape Startup Success

- Amazon's founder, Jeff Bezos, introduced the concept of one-way and two-way doors to guide decision-making, with over 85% of Amazon's big bets originating as reversible decisions.

- Differentiating between one-way and two-way door decisions is crucial for founders and investors to move decisively yet flexibly in the business landscape.

- One-way door decisions, like Amazon transitioning to 'The Everything Store' or Instagram pivoting to a photo-sharing platform, are defining, irreversible choices.

- In contrast, two-way door decisions, exemplified by Amazon Prime's introduction, allow for testing, adjustment, and pivoting with minimal consequences.

- Overanalyzing reversible decisions can impede execution and innovation, illustrated by Blackberry's reluctance to embrace touchscreen smartphones.

- Investors who viewed opportunities like Facebook as two-way doors with potential for exponential returns fared better than those who saw them as one-way doors.

- Some decisions may seem reversible but lead to disaster when assumed to be flexible, as seen in eBay's mismanagement of the Skype acquisition.

- Accelerators like Y Combinator understand that while most startups may fail, the successful ones like Airbnb and Dropbox bring significant returns.

- Late-stage investments and major pivots are akin to one-way doors, requiring careful consideration to avoid costly missteps, as seen with SoftBank's investment in WeWork.

- Speed is crucial for reversible decisions like marketing strategies, as demonstrated by Slack's pivot from gaming to workplace communication, resulting in a successful acquisition.

Read Full Article

2 Likes

For uninterrupted reading, download the app