Siliconangle

1M

389

Image Credit: Siliconangle

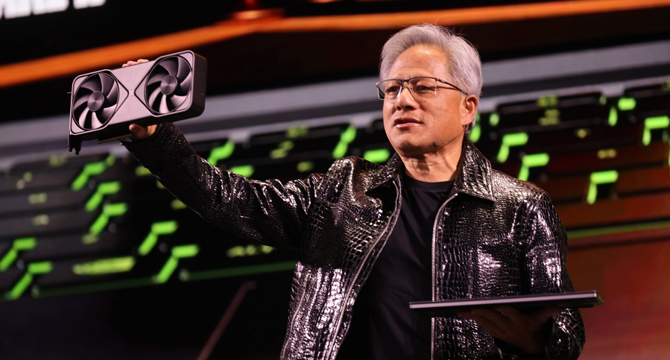

Nvidia delivers another earnings and revenue beat on rampant data center growth

- Nvidia's shares rose 5% after reporting better-than-expected earnings and revenue, with a 73% growth in data center business.

- The company beat analyst forecasts with earnings of 96 cents per share and revenue of $44.06 billion.

- Despite falling short on guidance, Nvidia attributed it to the impact of U.S. export restrictions on advanced chips selling to China.

- The export restrictions led Nvidia to write off $4.5 billion in inventory and forfeit $15 billion in planned sales.

- Nvidia's gross margin was affected, but the company is still aggressively growing in the AI infrastructure space globally.

- Despite challenges in China, Nvidia's data center division showed a 73% increase, accounting for 88% of total revenue.

- Sales of Nvidia's gaming division increased by 42%, while its automotive and robotics chip sales grew by 72%.

- Nvidia's stock, fueled by its data center and gaming divisions, remains stable in the market, near its record high.

- The company's continued growth outlook remains strong, with a focus on AI, gaming, automotive, and robotics applications.

- Despite geopolitical challenges, Nvidia's performance and revenue forecast demonstrate resilience and growth potential.

Read Full Article

23 Likes

For uninterrupted reading, download the app