Siliconangle

1M

152

Image Credit: Siliconangle

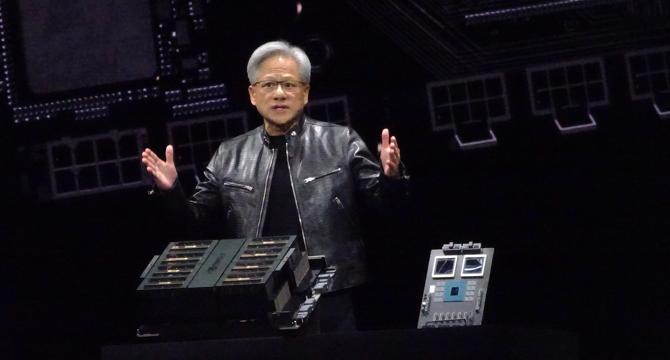

Nvidia posts another strong earnings beat as customers race to deploy next-gen Blackwell GPUs

- Nvidia delivered better-than-expected Q3 earnings with earnings before certain costs at 81 cents per share, beating the Wall Street’s projection of 75 cents.

- Revenue rose 94% YoY to $35.08bn, ahead of the $33.16 billion analyst target.

- Net income rose to $19.3 bn in Q3, up from just $9.24 bn in the year-ago quarter.

- In Q4, Nvidia said it’s expecting to see revenue of around $37.5bn at the midpoint of its guidance range, just above the analysts’ consensus estimate of $37.08bn, implying YoY growth of 70%.

- The growth stems from Nvidia’s data center business, attributed $30.8 billion of its sales, up 112%, while sales of GPUs for gaming delivered $3.28 billion.

- Most of the growth is driven by incredible demand from cloud infrastructure providers and other enterprises for its iconic graphics processing units, which power the vast majority of AI workloads today.

- Nvidia's Blackwell GPUs have been shipped to several major customers with shipments expected to ramp up significantly.

- Blackwell shipments are expected to exceed supply for several quarters in fiscal 2026.

- The company recently announced the launch of a new and improved version of the H200 GPUs called the H200 NVL.

- Third Bridge analyst Lucas Keh expects Nvidia to be able to maintain sequential growth for some time to come.

Read Full Article

9 Likes

For uninterrupted reading, download the app