Coindoo

4w

311

Image Credit: Coindoo

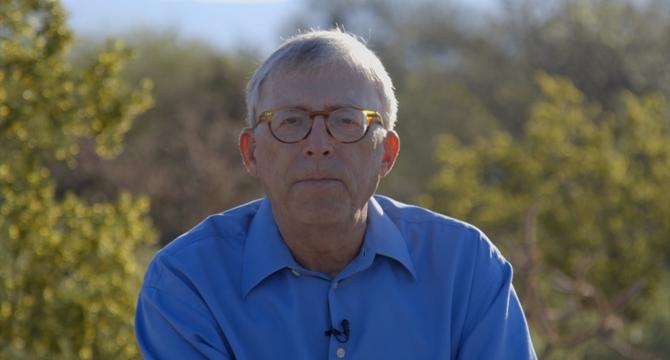

Peter Brandt Compares Current Bitcoin Structure to 2021 Top—Is History Repeating?

- Peter Brandt compares the current structure of Bitcoin to the 2021 top, highlighting similar price patterns near record levels.

- Both instances show price stalling after sharp rallies, forming sideways ranges indicating possible trend exhaustion.

- Brandt's comparison raises caution as the 2021 top led to a significant market correction and bear market.

- While not confirmed, the similarity in price structures suggests alertness for a potential trend reversal in Bitcoin.

- Bitcoin is currently trading near $105K, facing resistance around $108K with uncertainty reflected in weekly candles' indecision and large wicks.

- Open interest and on-chain flows remain steady, but macro and sentiment risks are growing in the market context.

- Brandt's chart acts as a warning rather than a crash confirmation, signaling that current conditions resemble a critical phase in Bitcoin's history.

- The upcoming weeks could define the next macro move for Bitcoin, whether it's consolidation, breakout, or breakdown, urging traders to stay vigilant.

Read Full Article

18 Likes

For uninterrupted reading, download the app