Medium

1M

149

Image Credit: Medium

Practical implementation on adding Alpha on a strategic allocation using Black-Litterman model…

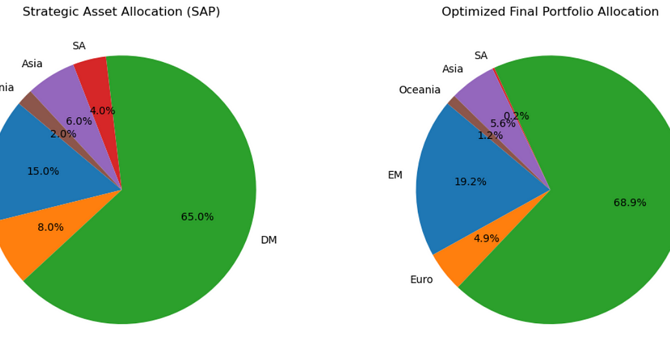

- The combination of Strategic Asset Portfolio (SAP) and Tactical Asset Portfolio (TAP) forms the final optimal portfolio according to the Black-Litterman model.

- Traditional Mean-Variance Optimization faces challenges like making precise forecasts, which are addressed by the Black-Litterman model.

- Black-Litterman model allows for classification-based approach to construct investor views and incorporates Sharpe Ratios for SAP and TAP to determine expected returns.

- The optimization problem in Black-Litterman model is formulated as a convex optimization framework with risk aversion coefficients and penalties for turnover and covariance shrinkage.

Read Full Article

9 Likes

For uninterrupted reading, download the app