Medium

1M

130

Image Credit: Medium

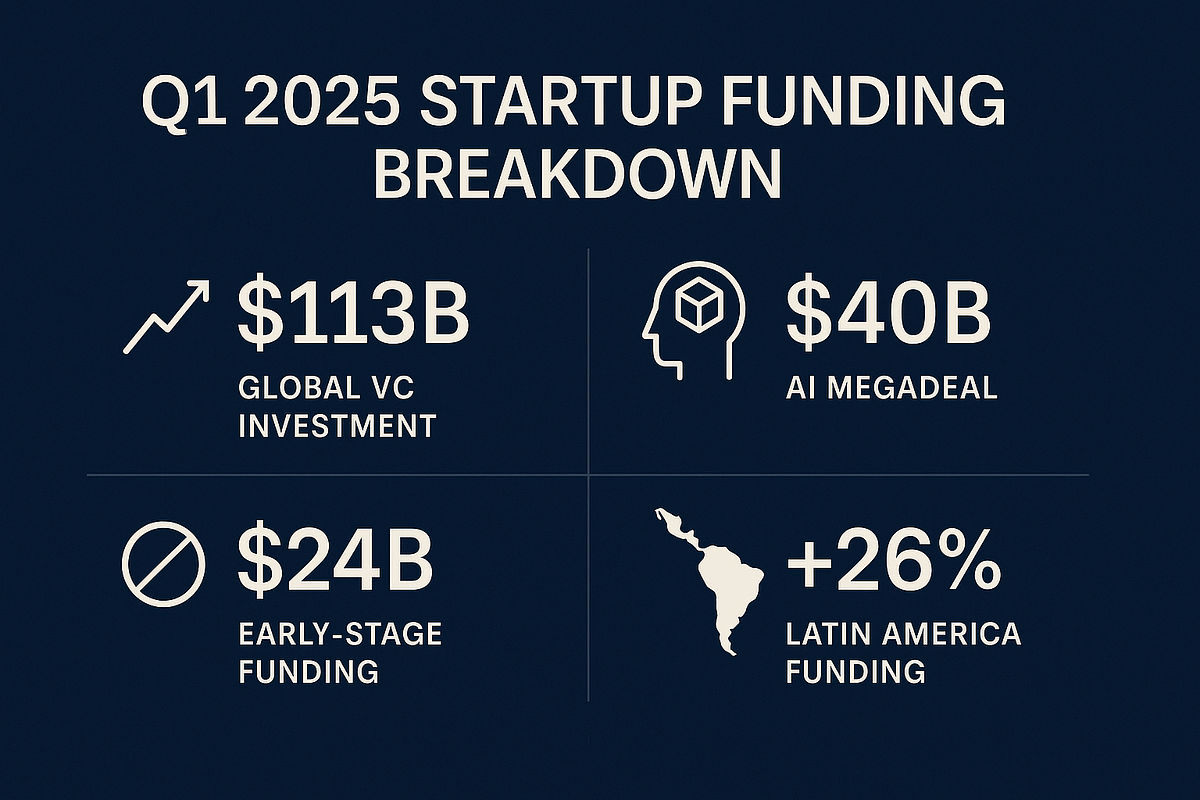

Q1 2025 Startup Funding Breakdown: What Founders Need to Know Before Raising Capital

- In Q1 2025, global venture capital investment reached $113 billion, showing a 17% increase from Q4 2024 and a 54% increase year-over-year.

- However, early-stage investment declined to $24 billion, the lowest in five quarters, emphasizing the challenges for early-stage founders.

- Investors are increasingly focusing on companies with revenue, users, and clear exits, making Series B+ investments popular again.

- Corporate Venture Capital saw a surge in Q1 2025, with over 1,215 corporate-backed startup rounds, emphasizing strategic value beyond capital.

- Founders addressing sustainability and impact issues are gaining traction, as LPs push for mission-aligned innovation in funding decisions.

- Alternative funding models are on the rise as early-stage founders explore options beyond traditional equity raises.

- Investors prioritize founder quality over market size, valuing traits like grit, storytelling, resilience, and founder-market fit in a competitive funding environment.

- Founders raising funds in 2025 are advised to understand their capital stack options and set specific traction milestones to justify future fundraising.

- Building relationships pre-raise is crucial, while utilizing founder-first tools like certain platforms can offer alternatives to conventional fundraising approaches.

- Amid the evolving funding landscape, the key lies in building with intention, layering capital intelligently, and focusing on creating solutions that address future needs.

- Success in the changed funding world will belong to founders who view capital as fuel, build with clarity and creativity, and adapt to the new rules of fundraising.

Read Full Article

7 Likes

For uninterrupted reading, download the app