Medium

1w

408

Image Credit: Medium

Raising a VC fund successfully in the current tough market: lessons learned and insights (part 3…

- Acuris PE’s Private Equity Fundraising and Investor Relations team has run an advice series on fundraising in these challenging times, with the last piece covering ways they successfully raised their latest vehicle, Acuris III, surpassing its €150m target despite the challenging conditions.

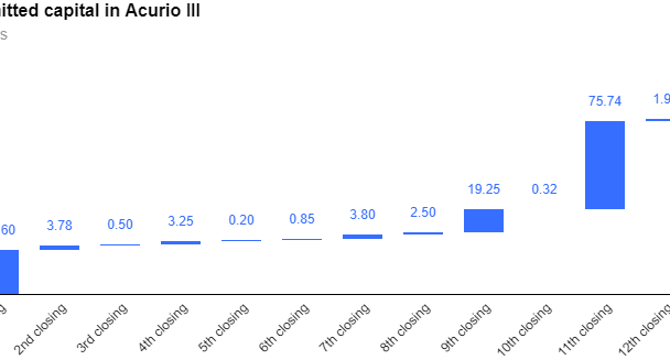

- With Acurio III not in a position to hold any single close, the fund opted for a rolling onboarding process with 13 closings i.e. each close taking place at the end of a calendar month.

- Acuris III’s legal documentation included a temporary moratorium on equalization payments for investors joining within two months from the first close to encourage early investment commitment.

- The second to last close was significant for Acuris III, as it attracted large institutional commitments.

- Returns aside, providing high quality service pays off as half of Acuris III investors are existing investors who have supported the company from both its direct and funds of funds strategy.

- The company was also able to attract high-quality new investors from Spain and abroad, exceeding expectations on institutionalization and internationalization of the investor base, ending up with more than half of Acuris III being contributed by institutional investors.

- Acuris III attracted one of the world’s most prominent endowments – a first for a Spain-based VC.

- The company brought in partnerships with more than 30 family offices, as well as relevant corporates and pension plans and insurance companies.

- The themes that sustained their fundraising effort were gaining momentum, building credibility and securing the necessary capital to actively invest from the outset.

- Acuris III includes 116 investors which set new foundations for future funds.

Read Full Article

24 Likes

For uninterrupted reading, download the app