Medium

3d

95

Image Credit: Medium

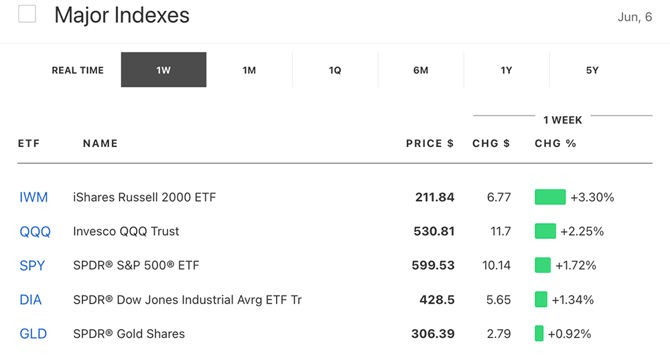

Review of the Week of June 2–6, 2025: Financial Leaders

- The week of June 2–6, 2025, saw strength in U.S. equities, with the S&P 500 and Nasdaq Composite posting gains despite initial trade concerns.

- Tech sector performance driven by companies like Nvidia and Microsoft, with notable movements in Meta Platforms, Spotify, Tesla, and Circle.

- Currency markets experienced volatility, reacting to ECB policy and U.S. data releases, with the euro and pound responding accordingly.

- Gold remained stable amidst U.S.-China tariff uncertainties, while Bitcoin consolidated following a historic May rally.

- The May NFP report, showing 139,000 new jobs, boosted optimism about the U.S. economy by the end of the week.

- Upcoming market focus on U.S.-China trade developments, corporate earnings, central bank decisions, and economic indicators for global economic health.

- SPY's positive momentum indicators suggest a potential upward move, with historical data showing favorable odds for a rise.

- Bullish trends indicated by SPY's three-day advance, Aroon Indicator uptrend, and potential continued price growth.

- Bearish signals from SPY's RSI moving out of overbought territory, Stochastic Oscillator, and MACD turning negative may suggest a downward trend.

- Notable companies in focus include NVIDIA Corp, Microsoft Corp, Apple, Amazon.com, Meta Platforms, and others within the S&P 500.

Read Full Article

5 Likes

For uninterrupted reading, download the app