TechJuice

1d

92

Image Credit: TechJuice

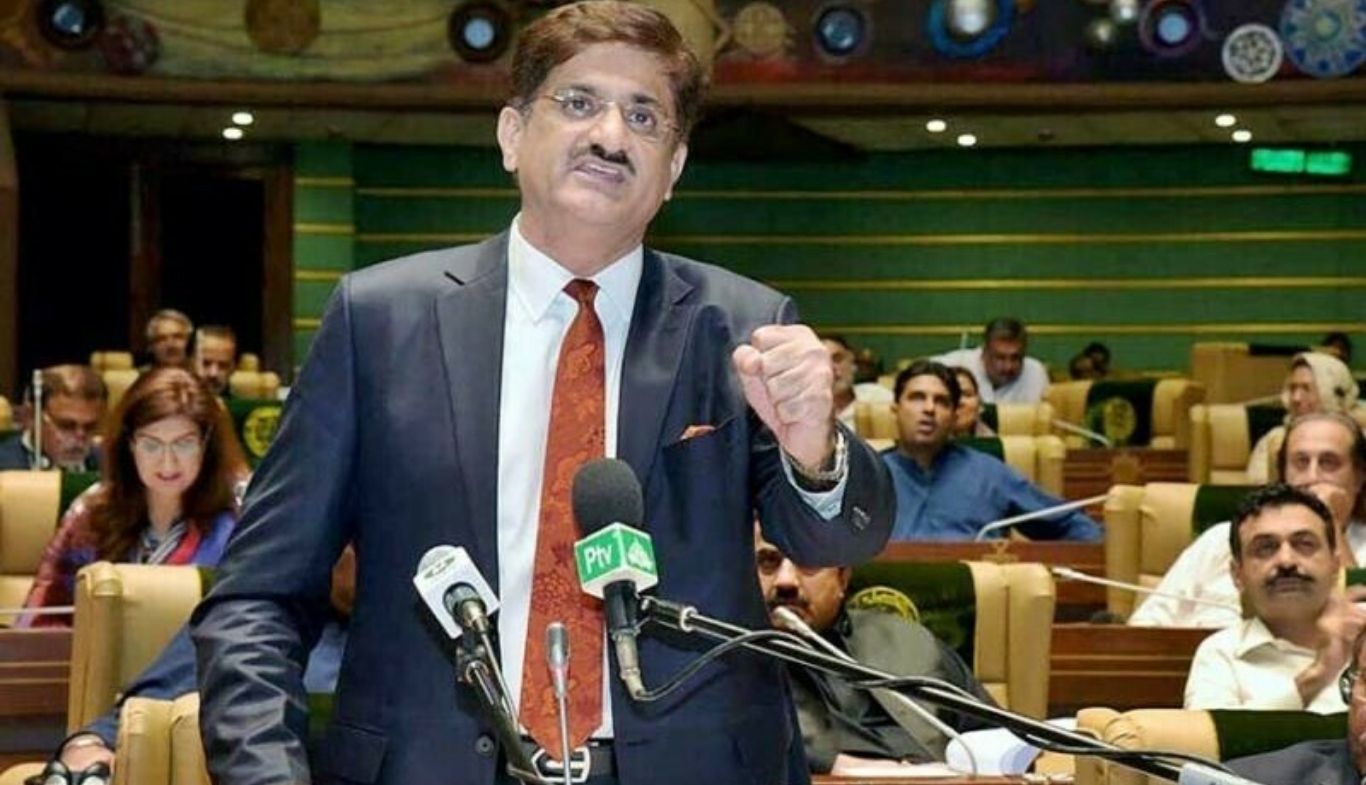

Sindh unveils Rs3.45 Trillion Tax-Relief Budget to Stimulate Growth

- The Sindh government announced a tax-relief budget of Rs3.45 trillion for FY 2025–26, focusing on growth, development, and public welfare.

- Chief Minister Syed Murad Ali Shah stated that no new taxes are introduced, with existing levies reduced or eliminated.

- Tax relaxations include exemptions for export processing zones, lower restaurant taxes, and reduced stamp duty on vehicle insurance.

- Sales tax exemptions expanded for various services such as health insurance, research at universities, and Hajj operators.

- New taxes include levies on digital services, security systems, vehicle transactions, and online payments.

- Over Rs1 trillion allocated for development, Rs2.15 trillion for current expenditures, including salary increments and job vacancies.

- Increased funding for education by 18%, health sector by 11%, and additional allocations for agriculture, irrigation, and local projects.

- Concerns raised over unpaid funds withheld by the federal government and exclusion of key projects from the development program.

- Sindh government opposes federal solar panel tax, allocates Rs25 billion for solar energy initiatives, and focuses on afforestation for climate change.

- Digitization efforts ongoing for land records, with infrastructure projects and sanitation initiatives progressing in the province.

Read Full Article

5 Likes

For uninterrupted reading, download the app