Cryptoticker

2w

336

Image Credit: Cryptoticker

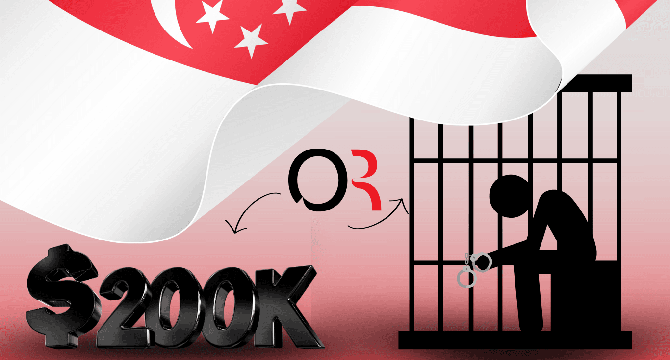

Singapore Tightens Crypto Rules: Jail Time or $200K Fine for Non-Compliant Firms

- Singapore has announced strict regulations for crypto firms, giving them the choice of obtaining a Digital Token Service Provider (DTSP) license by June 30, 2025, or facing fines of up to $200,000 or imprisonment.

- The crackdown aims to address regulatory arbitrage issues and eliminate grey areas for platforms offering services to clients outside Singapore.

- MAS has made it clear that DTSP licenses will be granted in very limited cases, leading many global-facing firms to consider relocating.

- Affected firms include crypto exchanges, OTC desks, custodial service providers, token project teams, prime brokerages, and liquidity providers.

- Several major players, such as Bitget, are already moving operations out of Singapore to comply with the new regulations.

- Alternative hubs for these firms include Dubai, Hong Kong, British Virgin Islands, Seychelles, and Mauritius, each offering different advantages.

- The MAS decision indicates a significant shift in Asia's crypto landscape, prompting crypto companies to reassess their operational bases.

- The deadline of June 30 poses a critical challenge to firms offering certain services, urging them to take quick action to avoid repercussions.

- This regulatory change in Singapore marks a shift from being a flexible fintech hub to a tightly regulated market, impacting how global crypto businesses operate.

- For global crypto firms serving international clients, Singapore no longer offers the same regulatory advantages, necessitating strategic decisions.

- Crypto firms must act promptly to either obtain licenses, cease offshore services, or relocate to jurisdictions with more favorable regulatory environments.

Read Full Article

20 Likes

For uninterrupted reading, download the app