Fintechnews

4w

375

Image Credit: Fintechnews

Stablecoins Gain Ground in Finance, Key Trends Include Yield Products, Cross-Border Payments

- Stablecoins are becoming integral to the global financial system, attracting traditional financial institutions due to their stability and blockchain advantages.

- Key trends in stablecoins include traditional banks issuing their own stablecoins and companies like Mastercard and Visa supporting stablecoin transactions.

- Stablecoins are expanding beyond safety features to include yield products like Paxos' Lift Dollar and payment capabilities for Stripe's USDB stablecoin.

- Stablecoins are increasingly used for cross-border payments, offering affordable alternatives in emerging markets and specialized options in developed nations.

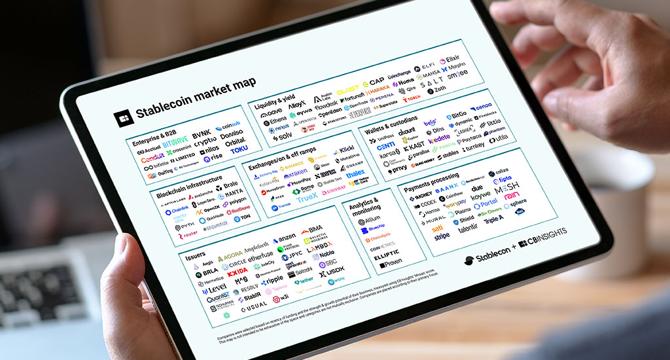

- The stablecoin market landscape includes 172 players categorized based on business focus, with stablecoin issuers leading in numbers and attracting potential consolidation.

- Liquidity and yield-focused firms have garnered the most funding over the last year, with StakeStone and Flowdesk prominent in this space.

- Wallets and custodians for stablecoins have shown significant headcount growth, with Kast from Hong Kong expanding its services.

- Payments processing companies, like Rain and Mesh, are expected to see substantial funding growth, with predictions of a tenfold increase in 2025.

- The stablecoin market, valued at approximately US$255 billion, could grow to US$2 trillion by 2028 with the anticipated regulatory framework through acts like the GENIUS Act.

- US legislation, such as the GENIUS Act, aims to provide regulatory clarity for stablecoins, potentially propelling the market's value to US$2 trillion by 2028.

Read Full Article

22 Likes

For uninterrupted reading, download the app