Siliconangle

1M

364

Image Credit: Siliconangle

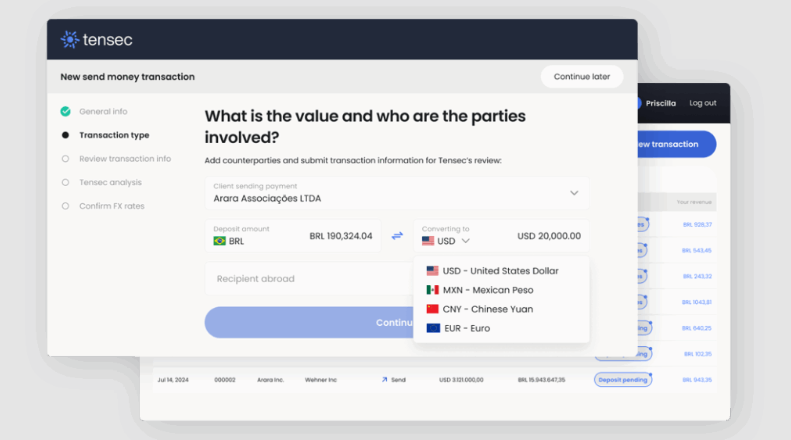

Tensec to deliver real-time, cross-border payments to smaller businesses after raising $10M in funding

- Tensec Holdings Ltd. secures $12 million in seed funding to revolutionize financial services for small and medium-sized businesses by offering real-time cross-border payments and banking services.

- The funding round was led by Costanoa Ventures with participation from Quiet Capital, WillowTree Investments, Cambrian VC, Ignia Partners, Montage Ventures, Renegade Partners, and Endeavor Scale Up Ventures.

- Tensec targets global trading companies, trade compliance consultants, investment firms, and foreign exchange brokers to enable seamless cross-border transactions and provide banking services to small and medium-sized businesses (SMBs).

- The startup has developed a global financial infrastructure platform to integrate international payments, FX services, treasury, loans, and other services at lower costs compared to traditional banks.

- Tensec aims to empower global trade companies to offer financial services directly to their partners, making global commerce faster, cheaper, and more accessible.

- The traditional SWIFT network for cross-border payments is deemed inefficient, prompting Tensec to provide modern financial tools for SMBs and global trade partners.

- Tensec simplifies global payments, hedging, and trade finance services into a single platform, enabling quick client onboarding and efficient transactions in over 150 countries and 70 currencies.

- The platform offers FX hedging services, treasury tools, customizable pricing models, and AI-powered compliance checks, enhancing efficiency for trading companies and their SMB clients.

- Tensec's services allow companies engaged in global trade to offer financial innovations, addressing the underserved needs of SMBs and aiding in their growth.

- Partnership with local banks, like Stearns Financial Services Inc., facilitates the delivery of payments and banking services through Tensec's platform.

- Tensec's platform integration is swift, requiring minimal setup time, and supports risk assessment and compliance checks to enhance security.

- Amy Cheetham from Costanoa Ventures praises Tensec for bridging the gap in financial services, providing new revenue opportunities for trading companies and modern tools to SMBs.

Read Full Article

21 Likes

For uninterrupted reading, download the app