VC Cafe

2w

218

Image Credit: VC Cafe

The Art of Non-Consensus Investing: Unlocking Venture Capital’s Hidden Gems

- Non-consensus investments challenge popular opinion and tend to yield the highest returns in venture capital investment.

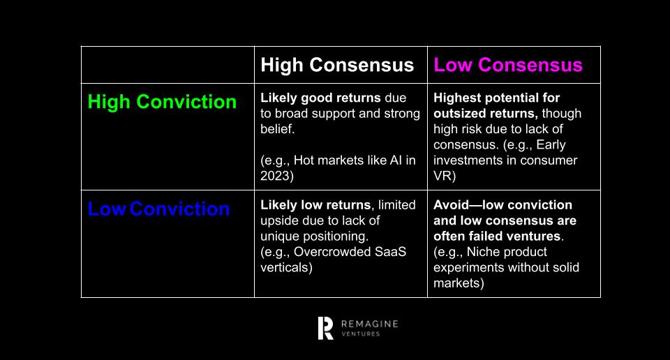

- The investment landscape maps consensus and conviction onto a quadrant.

- Consensus investments are aligned with majority opinion, while non-consensus investments may seem risky or unconventional.

- Non-consensus investments have radical differentiation, technological leap, and a counterintuitive approach.

- High-conviction, non-consensus investments can capture outsized returns if they succeed.

- Well-researched, high-conviction non-consensus investments provide steady returns.

- Deep domain expertise, rigorous due diligence and a framework for evaluating potential breakthrough technologies is required to mitigate risks.

- The data consistently shows that the most lucrative venture returns come from high-conviction bets that initially faced widespread skepticism.

- Top-quartile VC funds consistently feature a higher proportion of these contrarian bets in their portfolios.

- Successful non-consensus investments require patience, conviction, and a willingness to see value where others may see risk.

Read Full Article

13 Likes

For uninterrupted reading, download the app