Hackernoon

1M

182

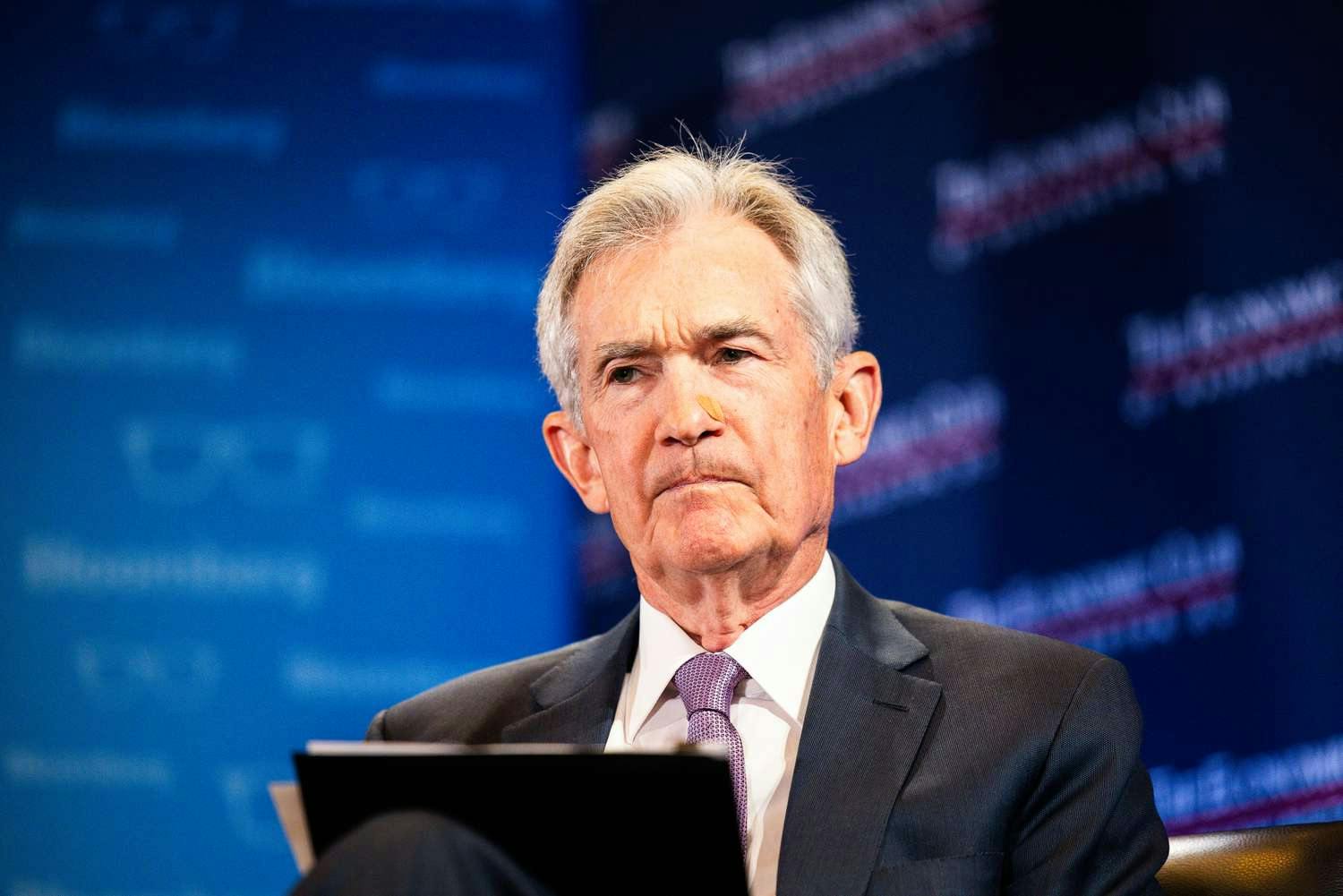

Image Credit: Hackernoon

The Fed Finally Cut Rates. What's Next?

- The US Federal Reserve lowered the rate by 0.5% in its first cut since March 2020 in response to inflation concerns and global recession fears.

- The rate cut is generally positive for cryptocurrencies as it can make capital more available for the stock market and risky assets.

- The cycle of the Fed interest rate reduction has started, which is confirmed by the positions of global central banks such as the European Central Bank, Bank of England, and Bank of Canada.

- Historical data indicates that the stock market and economy can continue to decline at the beginning of a rate cut cycle.

- Over the last 30 years, the Fed usually resorts to rate cuts during times of severe economic crisis.

- There are two potential scenarios for the cryptocurrency market - a bullish scenario if regulators increase liquidity injections, and a bearish scenario if the rate cut fails to prevent the markets from falling.

- The current uncertainty in macroeconomics is likely to continue, and the stock and cryptocurrency markets are waiting for certainty in politics.

- The measures already taken by the Fed, combined with the end of the period of political turbulence, may influence the market in a matter of months.

- The situation in the global economy is complex, and it is not clear what scenario will develop - perhaps a repeat of the great recession and even stagflation of the 80s.

- Individuals should be cautious when making decisions, especially when trading with leverage.

Read Full Article

10 Likes

For uninterrupted reading, download the app