Medium

1M

182

Image Credit: Medium

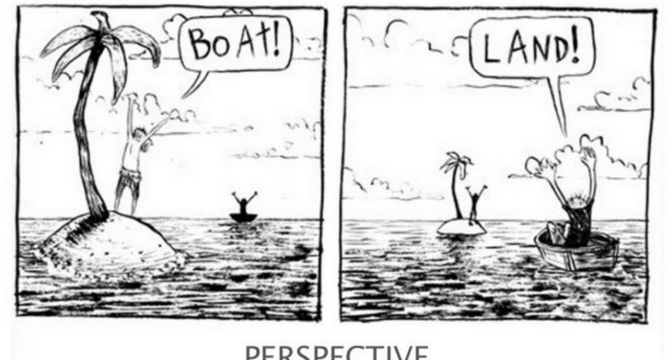

The Illusion of Venture Capital

- Venture capital returns have consistently underperformed public market indices on a risk-adjusted basis, revealing structural inefficiencies in the industry.

- The '2 and 20' compensation structure in venture capital incentivizes asset gathering over performance, leading to suboptimal investment outcomes.

- Pattern recognition in venture capital decision-making leads to cognitive bias and overlooks potentially superior investment opportunities.

- Approximately five percent of venture investments drive the majority of industry returns, contributing to extreme concentration in performance.

- Institutional dynamics favor established relationships and brands, creating barriers for emerging managers in the venture capital ecosystem.

- Venture capital's impact on innovation is overstated, with many breakthroughs originating from sources outside traditional venture funding.

- Alternative funding models like revenue-based financing offer more sustainable approaches than traditional venture capital.

- Structural advantages of top-performing venture firms highlight the significance of access and reputation in driving exceptional returns.

- Realigning incentives in venture capital towards sustained performance over capital accumulation is crucial for enhancing investor returns.

- Despite challenges, venture capital remains valuable for aggregating capital for high-risk opportunities, but requires more aligned incentive structures.

Read Full Article

10 Likes

For uninterrupted reading, download the app