Inc42

2w

51

Image Credit: Inc42

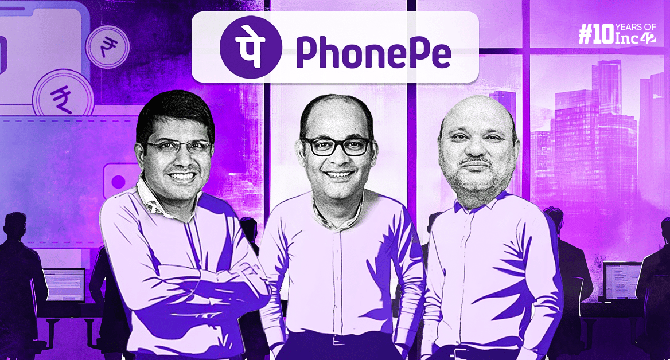

The People Taking PhonePe From UPI App To Super App

- PhonePe's annual report reveals over INR 5,000 Cr revenue in FY24 after becoming the second Indian startup to reach this milestone, the first being Paytm.

- PhonePe has diversified from its origins as a UPI app by harnessing its user base to sell insurance and lending services.

- It has also launched a stockbroking platform and an appstore to challenge Google's monopoly.

- Each of these services is run as a separate startup within PhonePe, with separate vertical function heads.

- Hypergrowth has necessitated centralised functions such as finance, HR, and administration, and the company boasts an institutional knowledge across the organisation.

- CEO Sameer Nigam has updated PhonePe's corporate governance processes to mimic those of a public company.

- PhonePe is the market leader for UPI payments, but its dependence on this service has kept it from going public until it can diversify.

- The company's emphasis on separate verticals, with different products for each, means it relies on each vertical to acquire new customers rather than relying on the PhonePe brand.

- Vertically-integrated superapp services are considered a challenge for public markets, so PhonePe's modular approach may do better with retail investors.

- PhonePe's high leadership retention and careful horizontal-vertical integration may enable it to position itself as the super app model that performs best in the public markets.

Read Full Article

3 Likes

For uninterrupted reading, download the app