Medium

2M

273

Image Credit: Medium

Watch Out As Venture Capital Goes Mainstream

- Retail investors are finding it challenging to navigate the venture capital landscape without proper preparation and understanding of the complexities involved.

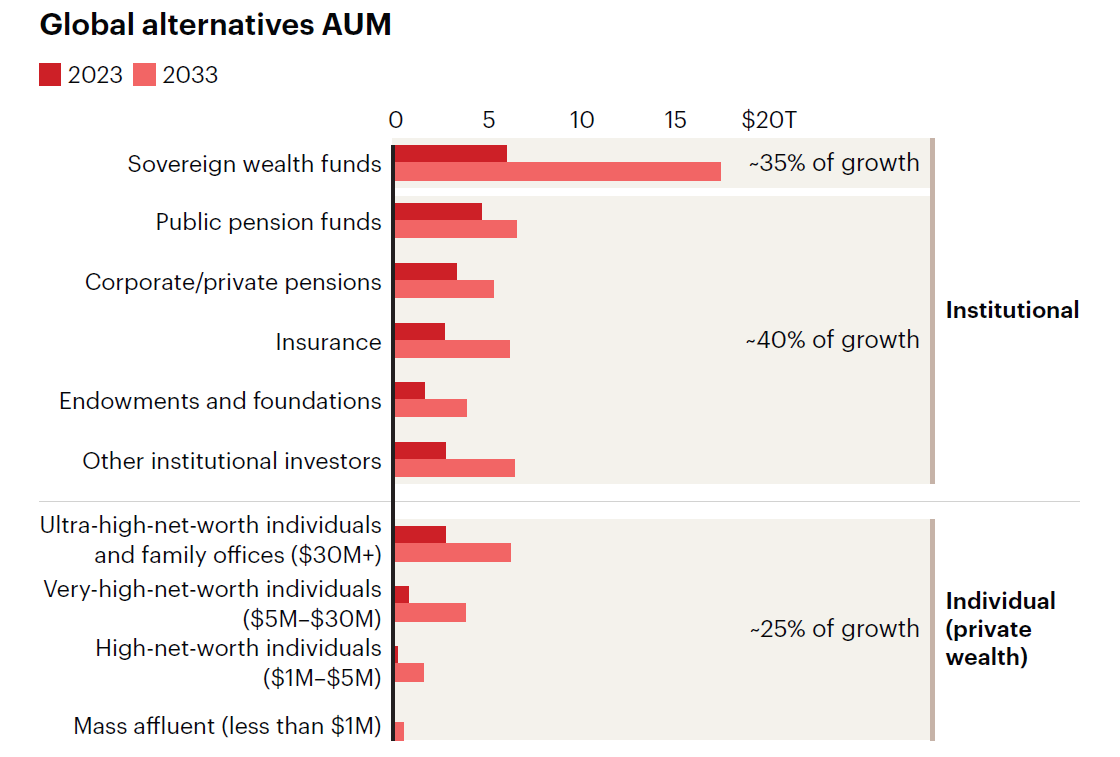

- The increasing interest from retail investors in VC deals is reshaping the traditional dynamics, with asset managers introducing new offerings to tap into this growing trend.

- Online platforms are reducing barriers to entry for retail investors, enabling them to access alternative investments like venture capital with lower minimum investments.

- Regulatory changes, such as the JOBS Act, are expanding eligibility for retail investors to participate in private markets, driving further growth in this sector.

- Millennials and Gen Z, who are poised to inherit significant wealth, are showing a keen interest in VC and alternative investments, fueling the shift towards retail capital in the industry.

- While retail investors can provide valuable capital and networks to startups, their short-term focus and liquidity expectations may clash with the long-term goals of institutional VCs.

- Venture capital offers the potential for significant wealth creation, especially with successful ventures like Stripe and Revolut outperforming other investment options over the years.

- Tax incentives and tech advancements are making VC more accessible to retail investors, although the long-term commitment and risks associated with startups remain key considerations.

- Implementing strategies like SPVs, utilizing tax-advantaged schemes, and keeping investors engaged can help startups effectively manage retail investor relationships and streamline operations.

- As retail investors increasingly participate in VC, founders need to vet these investors, communicate effectively, and align expectations to ensure a successful partnership and capitalize on the benefits of retail capital.

- While challenges exist, the evolving landscape of retail participation in VC presents opportunities for both startups and investors, emphasizing the need for a strategic approach to navigate this changing environment.

Read Full Article

16 Likes

For uninterrupted reading, download the app