Inc42

1w

242

Image Credit: Inc42

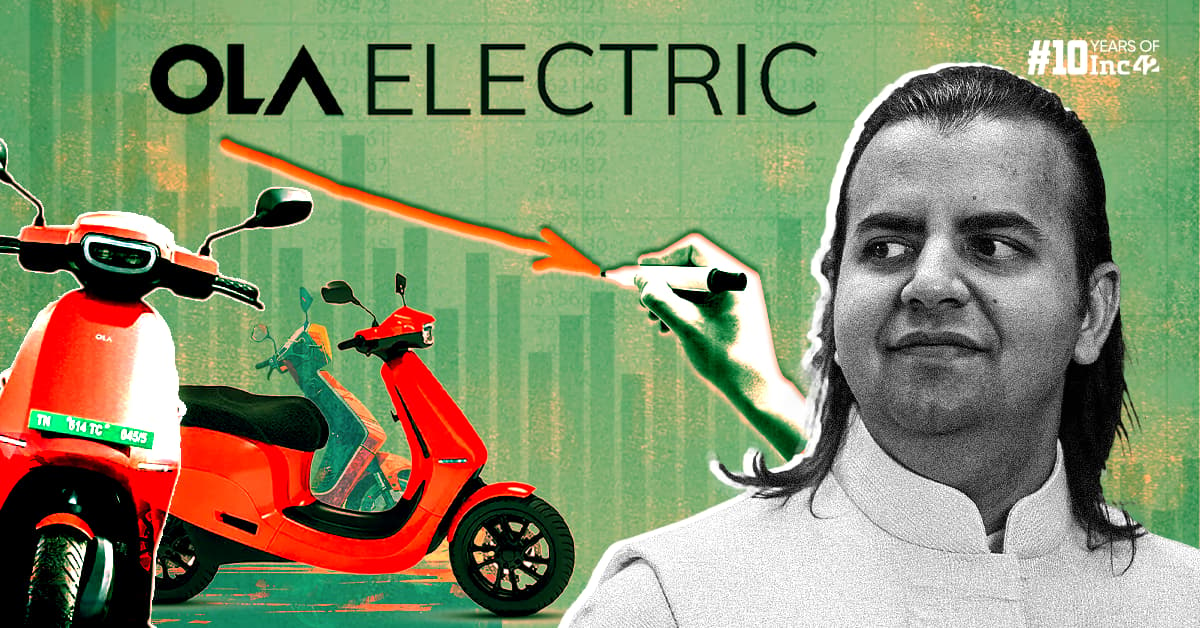

Why Ola Electric’s Road To Profits Is Long And Rocky

- Ola Electric has lost market share to rivals such as Ather Energy and legacy players amid concerns about poor servicing quality and customer complaints. Ola Electric has bled market share these past three months, and there are renewed apprehensions that its path to profitability might be stretched. As per analysts, Ola Electric would need to focus on growing sales volume by about 30%-40% from the current levels to reach the breakeven mark, which would take at least two to three years for the company. Ola Electric needs to focus on addressing its product quality issues. The after-sales servicing should be the top priority for the company right now.

- Even though the EBITDA margin is likely to improve from -25.3% in FY24 to -0.7% in FY27, Goldman Sachs’ projection is based on operating leverage arising from higher volumes, deflationary battery prices, and backward integration supporting the capital expenditure base.

- Despite the company’s plans to expand into the electric three-wheeler segment and diversify into electric motorcycles to improve its market share, the company should focus on improving its core competence in electric two-wheelers by addressing the issue with product quality and after-sales service.

- Globally, Tesla took five years after production commenced to reach profits, but Tesla’s focus on the US market sets it apart from Ola Electric. Furthermore, battery manufacturing might further delay Ola Electric’s profitability timeline, as it is highly capital expenditure-intensive and operationally complex, with technology rapidly evolving in terms of battery chemistry and the charging vs swapping debate.

- In general, the auto industry is highly cost-intensive due to the high capital expenditure required to set up manufacturing facilities. However, at the moment, the cost of building an EV is comparatively lower than petrol or diesel (ICE) vehicles, even despite the high battery costs. EVs require fewer components, so comparing Ola’s trajectory to that of Bajaj or TVS who started as ICE OEMs wouldn’t be fair.

- The EV market will likely grow every year, but capitalizing on this growth to build a profitable electric vehicle OEM is unprecedented in the Indian context. Ola Electric must focus on the basics in the automobile industry to improve its reputation, which has a direct impact on sales and fundamentals.

- Ola Electric has brought in audit giant EY India for a “service transformation” in response to the public outcry. However, the focus must be on addressing the fundamental issue with poor servicing quality and customer complaints, as any adverse word of mouth or lapses in service of the product could impact the company's demand in the mid- to long-term.

- Battery manufacturing is a risk for any company until execution is proven, given that procurement of raw material is still fraught with issues. The manufacturing process for new battery standards in the future could take a significant time to reach perfection.

- Ola Electric’s battery production ambitions remain another key variable in deciding its fate to improve fundamentals. However, given the product and servicing-related issues, diversification might not be the best idea till these critical issues are fixed.

- As a public company, Ola Electric faces the twin challenges of heavy losses and a drop in EV registrations amid customer complaints. The company's future hinges on two crucial factors — its ability to turn the narrative around in relation to poor servicing and lack of profitability, which is directly linked to sales volume.

Read Full Article

14 Likes

For uninterrupted reading, download the app