Siliconangle

1w

208

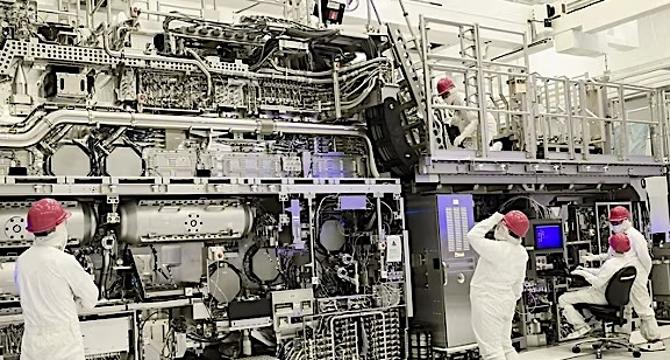

Image Credit: Siliconangle

A bold plan to spin out and revive Intel’s foundry business

- Intel's foundry business has negative value and is therefore unsustainable despite its strategic significance for the U.S. national interests and competitiveness.

- Intel's foundry is an asset showing negative worth with unsustainable losses that are dragging cash and lack the scale to compete in advanced manufacturing.

- A spinning-out Intel's foundry operation can be funded via multi-stakeholder investment and strategic partnerships with industry leaders like Taiwan Semiconductor Manufacturing Corp.

- A possible solution to save U.S. advanced semiconductor manufacturing is for Intel to spin out Intel Foundry Services (IFS) as a joint venture and partner with TSMC or Samsung to leverage advanced manufacturing expertise.

- The new entity will reduce Intel's financial burden and create a competitive and independent entity capable of safeguarding U.S. semiconductor leadership and aligns with broader industry and geopolitical imperatives.

- Intel's wafer volumes for its x86 business is in long-term decline compared to the wafer demand for Arm processors dominated by TSMC that is at least tenfold greater.

- Intel's lower wafer volumes result in manufacturing costs that are at best 30% to 35% higher than TSMC's due to Wright's Law and cost challenges.

- IFS produces $19 billion in revenue and posted a 31% revenue decline year-over-year with a $7 billion operating loss in April 2021.

- There are stakeholders needed for the long-term success of a spun-out foundry entity that will take at least more than 10 years to become a viable competitor.

- The venture will require contributions from diverse stakeholders, including major US tech companies such as Amazon, Google, Apple, Microsoft, NVIDIA, private equity firms, and public funds.

- The US government should divest its position over time and give the proceeds back to taxpayers in the form of debt reduction.

Read Full Article

12 Likes

For uninterrupted reading, download the app