Fintechnews

1d

213

Image Credit: Fintechnews

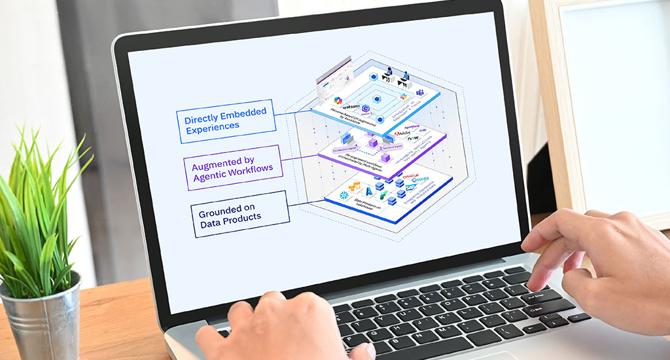

Agentic AI Poised to Transform Financial Services Through Automation and Personalization

- Agentic AI in financial services is set to revolutionize customer experiences and operational efficiency, as outlined in a report by IBM.

- It introduces challenges like goal misalignment, tool misuse, and privacy concerns, but holds promise in automation and personalization.

- Agentic AI acts autonomously, making decisions and executing tasks with minimal human intervention, streamlining processes such as customer onboarding and risk assessment.

- Applications include hyper-personalization, dynamic pricing, and robo-advice, improving customer engagement.

- In back-office operations, agentic AI enhances compliance, risk management, and efficiency, with organizations like PwC and Metzler leveraging this technology.

- The technology also aids in software development, showing significant improvements in code generation and infrastructure management.

- However, risks like goal misalignment, safety concerns, and data privacy vulnerabilities pose challenges that require careful oversight.

- Adoption of agentic AI is increasing, with finance leaders increasingly considering its implementation in the coming years.

- Current adoption rates are low, but projected to rise significantly, with momentum building in the financial industry.

- Overall, agentic AI presents both transformative opportunities and risks that necessitate strategic management and oversight.

Read Full Article

9 Likes

For uninterrupted reading, download the app