Medium

2w

156

Image Credit: Medium

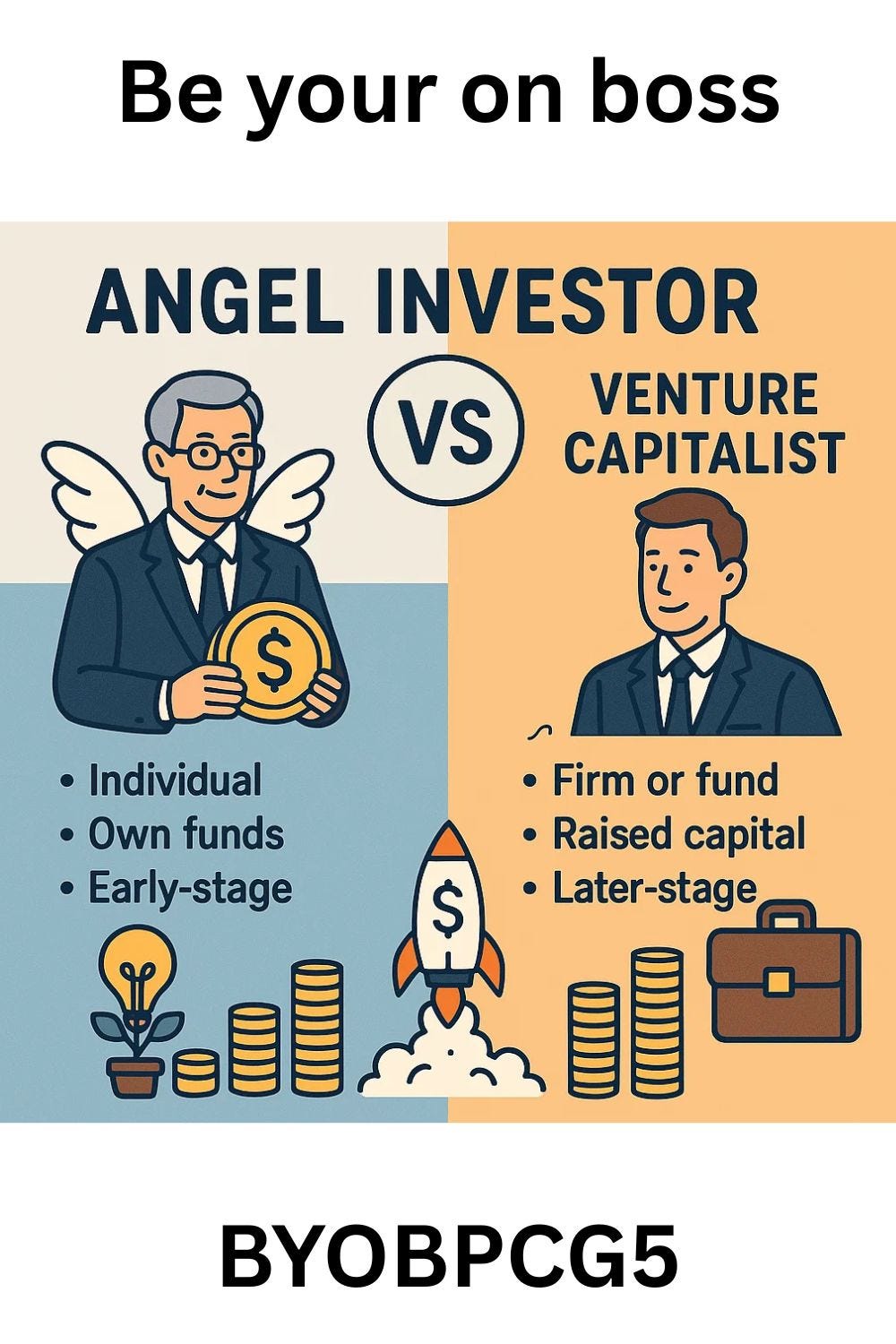

Angel Investor vs. Venture Capitalist: Which One Should Your Startup Choose?

- Angel investors are high-net-worth individuals who invest their own money into startups at the seed or pre-seed stage.

- Investment Range: $25,000 — $500,000. Stage: Early (pre-revenue or prototype phase).

- They focus on high-risk investments, offer hands-on mentorship, and networking opportunities.

- Successful startups like Google and Uber received initial funding from angel investors.

- Venture capitalists are professional investment firms that pool money from institutions.

- Investment Range: $2M — $10M+. Stage: Growth (usually Series A and beyond).

- VCs seek startups with proven traction, provide strategic guidance, connections, and expertise.

- Choosing between an angel investor and a VC depends on the startup's stage, funding needs, and goals.

- Many startups start with angels and later move on to raise VC funding as they grow.

- Angel investors bet on the founder's vision, while VCs focus on rapid scaling and exits.

- Angel investors offer quick funding with flexible terms, while VCs demand higher equity and stricter terms.

- Both angels and VCs play essential roles in the funding ecosystem for startups.

- Ultimately, the choice between an angel investor and a VC is influenced by the startup's specific circumstances.

- The decision involves considering factors like funding stage, risk appetite, and long-term objectives.

- For further comparison between angels and VCs, resources are available for an in-depth analysis of the options.

- While angels fuel early-stage dreams, VCs provide the resources needed for rapid growth.

- Startup founders are encouraged to weigh their options carefully and consider their funding journeys.

- Engagement is encouraged by inviting entrepreneurs to share their funding experiences in the comments.

Read Full Article

9 Likes

For uninterrupted reading, download the app