Venture Capital News

Medium

104

Image Credit: Medium

What I’ve Learned Watching 50+ Start-ups Pitch to VCs

- VCs prioritize clear and concise pitches that focus on the product and business model rather than market size.

- Having small traction is more impressive than aiming for hypothetical scale when pitching to investors.

- Founders should focus on demonstrating how their product solves a real problem rather than overwhelming with unnecessary details.

- A successful pitch is more about the founder's conviction and storytelling ability than just a well-designed pitch deck.

Read Full Article

5 Likes

Saastr

276

Image Credit: Saastr

SaaStr Sponsorships: Access the Elite 68% VP+ Executives Other Platforms Can’t Reach

- Direct access to 68% VP+ executives and 36% CEO/Founders with enterprise budgets.

- Benefits include faster sales cycles, higher deal values, and exclusive executive engagement opportunities.

- Elite ROI showcased through real case studies with significant returns and premium lead quality.

- Year-round executive visibility through podcasts, newsletters, events, and targeted campaigns for impact.

Read Full Article

15 Likes

Saastr

73

Image Credit: Saastr

Did Windsurf Sell Too Cheap? The Wild 72-Hour Saga and AI Coding Valuations

- Wild 72-hour saga in AI coding industry: Windsurf's cheap sale raises eyebrows.

- OpenAI's failed $3 billion acquisition, Google's $2.4 billion poach, Cognition's rescue.

- Comparing AI coding valuations: Windsurf's $82M ARR prompts industry valuation reevaluation.

- Market speculation evident with high multiples, Windsurf's unique circumstances influence acquisition dynamics.

Read Full Article

2 Likes

Medium

370

Image Credit: Medium

This Private Club Where VCs and Angels Secretly Bet together on Future next Unicorns

- H-MEDIA is a platform that connects founders with funding, resources, and global exposure, while allowing investors to discover high-potential deals.

- The platform aims to bring together the right investors, founders, and talents to create a powerful network and build successful ventures.

- Membership to H-MEDIA requires a paid subscription, emphasizing the value of committed players in the ecosystem.

- The platform encourages individuals to join the movement by sharing and spreading the word to help grow the ecosystem.

Read Full Article

21 Likes

Medium

33

Image Credit: Medium

The Product-Market Fit Trap: Why Most Start-ups Stall at ‘Good Enough’

- Start-ups often mistake early promising signs like user numbers, revenue, and partnerships for scalable and defensible businesses, leading to a high failure rate due to lack of market need.

- Product-market fit (PMF) is essential for a start-up's success, as shown by examples like Figma's explosive growth after nailing multi-user collaboration and Juicero's collapse despite early sales and funding due to a flawed product premise.

- To achieve PMF, founders should prioritize retention metrics, honest evaluation of value propositions, and be willing to pivot or kill off what's not working, as seen with Airbnb's shift from Craigslist arbitrage to redefining travel experiences.

- Resilient start-ups delay scaling until they establish real PMF, focusing on customer feedback, meaningful metrics, and avoiding premature scaling to ensure sustained growth and success.

Read Full Article

1 Like

Medium

338

Image Credit: Medium

Did you know McDonalds was started on a side hustle?

- McDonalds founder Ray Kroc started the company at age 52, well past middle age.

- Ray Kroc took a solitary hamburger stand in California and turned it into a billion-dollar company in 17 years.

- Today, McDonalds is a publicly traded company with a market cap of over $200 billion and annual revenues of $26 billion.

- The success of McDonalds proves that it all started from a side hustle for Ray Kroc.

Read Full Article

19 Likes

Medium

33

Image Credit: Medium

Bootstrapping vs. Fundraising: Which Path is Right for Your Startup?

- Friends may push for fundraising, but others advocate bootstrapping for control and independence.

- Both approaches have unique advantages and challenges; decision depends on specific circumstances.

- Bootstrapping relies on personal resources, promotes financial discipline, and advances in AI technology.

- Fundraising provides capital for rapid growth, strategic advice, but comes with ownership dilution and pressure.

Read Full Article

1 Like

Medium

222

If Zomato is profitable, why does that worry me?

- Zomato and Swiggy riders reveal that Zomato pays better despite fewer trips compared to Swiggy.

- Restaurants quietly raise prices to cope with the 30-40% commissions charged by delivery apps, leading to dissatisfaction among customers.

- Some middle-class users only order from these apps when necessary, like during bad weather or when transportation is unavailable.

- Despite Swiggy having a cheaper valuation than Zomato, Zomato is seen as the winner due to its ability to attract 'power users' who order frequently.

Read Full Article

13 Likes

Medium

223

Image Credit: Medium

Joyce Shen’s picks: musings and readings in AI/ML, July 14, 2025

- Meta plans to invest 'hundreds of billions of dollars' into AI compute infrastructure.

- Many Americans rely on AI for health information despite accuracy concerns.

- Google introduces curated AI 'notebooks' covering topics from parenting to Shakespeare.

- The European Commission releases the General-Purpose AI Code of Practice. Several companies secure significant financing rounds for AI/ML initiatives, ranging from $4.2 million to $50 million.

Read Full Article

13 Likes

Medium

347

Image Credit: Medium

GenX — The Reason For Renewed Interest in Womens Health

- GenX women are driving renewed interest in women's health due to various factors.

- Historically, women were excluded from drug trials, leading to ineffective treatments for them.

- GenX women, facing challenges like the gender pay gap, are demanding better healthcare.

- They control household decisions and the healthcare system's lack of support is concerning.

- GenX women, with their influence and resilience, are pushing for improved healthcare standards.

Read Full Article

20 Likes

Medium

313

Puppy’s VC Journal Entry #3 : Equity, Convertible notes and SAFE

- Equity, convertible notes, and SAFE notes are common in Series Seed, Series A, and beyond rounds.

- Founders like them because they're faster than negotiating a valuation upfront, while investors care to avoid dilution in later rounds.

- Convertible notes and SAFE notes can lead to messy math if multiple notes with different terms convert simultaneously, potentially complicating the cap table.

- Understanding these financing options is crucial for founders and investors as they navigate funding rounds and manage ownership stakes.

Read Full Article

18 Likes

Saastr

375

Image Credit: Saastr

Who Should Marketing Report To? What 3,000+ Companies Actually Do (And Why It Matters)

- New data reveals how marketing leaders report across company sizes and strategic priorities.

- CEO-centric reporting decreases as companies grow, showing distinct phases of marketing evolution.

- Data suggests a shift towards product-led growth, emergence of specialized leadership roles.

- Parallel marketing organizations with demand gen and brand-focused segments are emerging.

- CEO reporting for strategic alignment is favored over CRO reporting for marketing.

Read Full Article

22 Likes

Saastr

345

Image Credit: Saastr

The Real Work of AI: Why Human-in-the-Loop and Orchestration Are Bigger Jobs Than You Think

- Human-in-the-loop and AI orchestration are crucial but often misunderstood in the industry.

- Human involvement is essential for AI systems to perform at their best capabilities.

- Continuous human training and orchestration are key for successful AI adoption and performance.

- AI complexity demands specialized human oversight, deflection management, and strategic decision-making.

Read Full Article

19 Likes

Medium

209

Image Credit: Medium

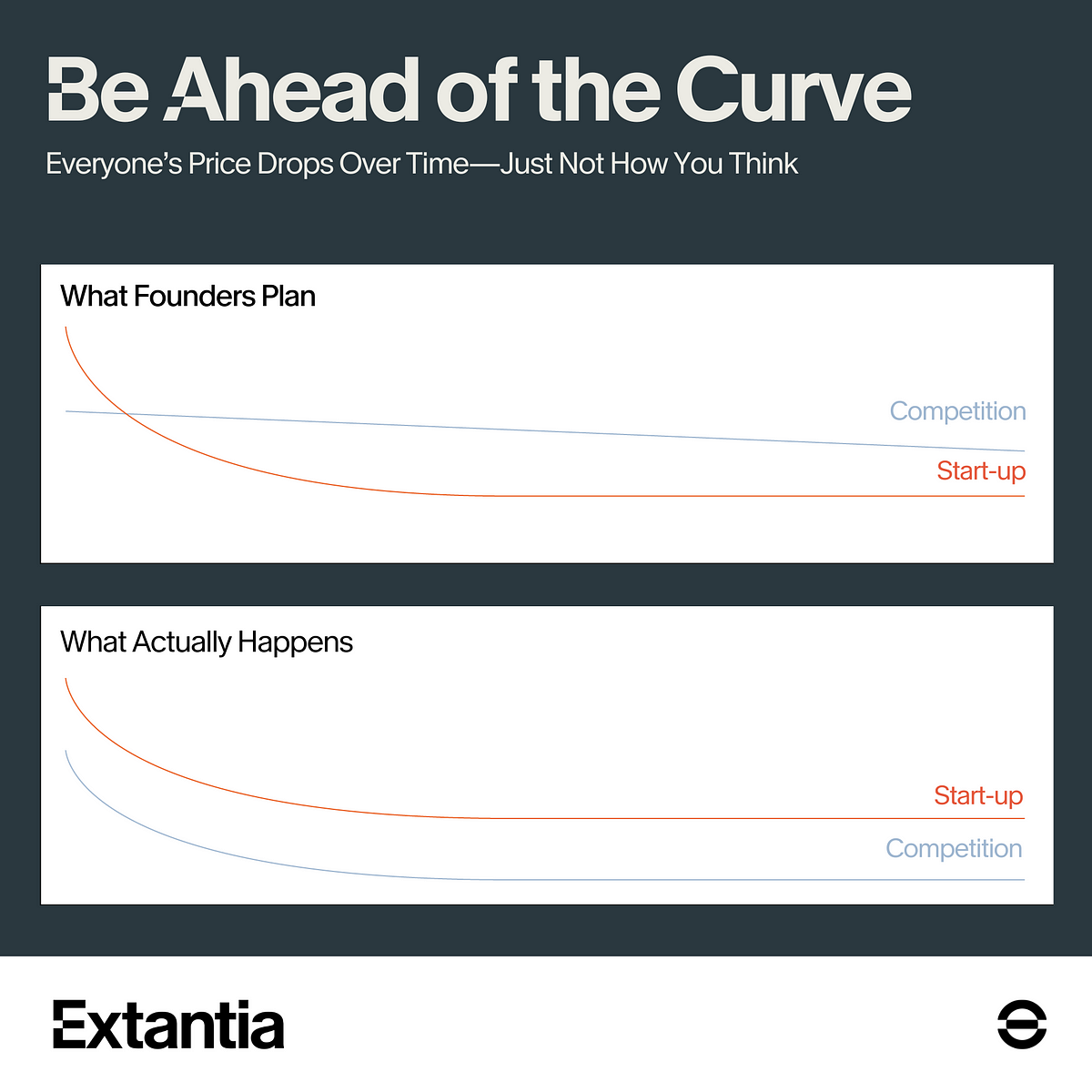

Be Ahead of the Curve: The Second Biggest Mistake Founders Make About Cost Curves

- Understanding learning curves is crucial in scaling a climate tech business.

- Founders should not only focus on their own cost curve but also on competitors'.

- The 'Better Mousetrap Fallacy' warns against assuming superiority guarantees market success.

- Start-ups need steeper learning curves than competitors to truly succeed in markets.

- Investing in innovations for significant cost reductions is key to staying competitive.

Read Full Article

12 Likes

Medium

74

Image Credit: Medium

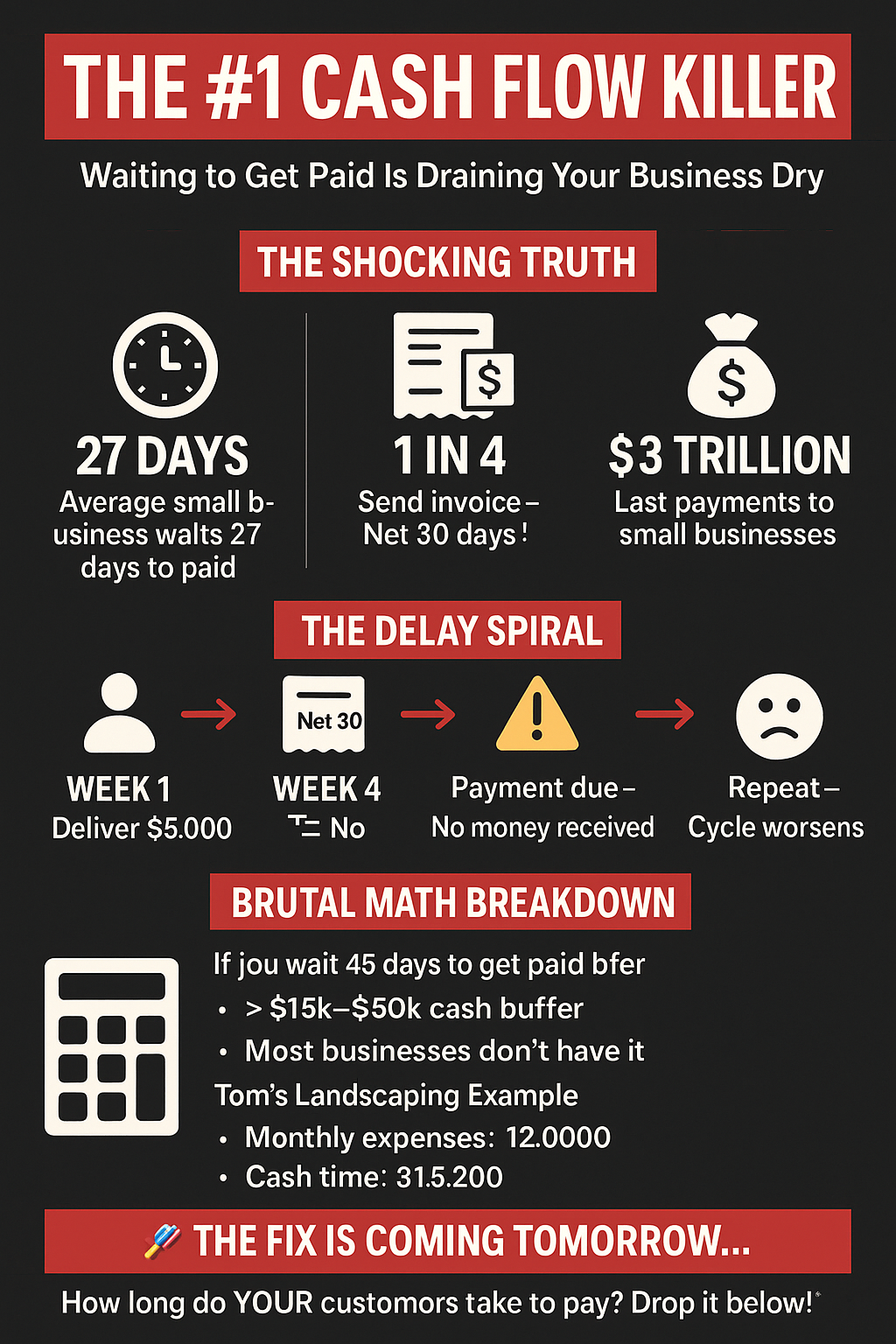

The #1 Cash Flow Killer - Accounts Receivable Delays

- The shocking truth reveals that the average small business waits 27 days to get paid, with 1 in 4 invoices being paid late (over 30 days), costing small businesses $3 trillion annually.

- Accounts receivable delays can severely impact a business's cash flow, causing a detrimental domino effect.

- Illustrative scenario: A business delivers $5,000 worth of work, waits 30 days for payment, struggles with late payments, falls behind on bills, and perpetuates a cycle of financial strain.

- The financial implications are significant, requiring businesses to have substantial funds saved up to bridge the gap between service delivery and receipt of payment, as exemplified by Tom's landscaping company's real-life cash flow struggle.

Read Full Article

4 Likes

For uninterrupted reading, download the app