Saastr

1M

228

Image Credit: Saastr

Are You Really On The IPO Track? If Not, Maybe Don’t Unicorn

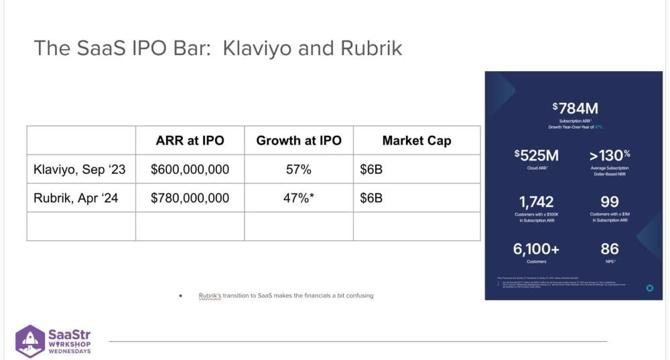

- Founders should be cautious about raising funds at valuations higher than $300 million unless they are certain about their path towards an IPO.

- SaaS IPOs with valuations above $500 million and annual recurring revenue (ARR) growing at 50% have the potential to achieve a $10 billion+ outcome.

- For earlier stage startups, growth rates of at least 80% at $100 million ARR, 125% at $50 million ARR, and 150% at $20 million ARR may be necessary to consider raising at higher valuations.

- Founders should be cautious of advice from existing VCs, as their valuation mark-ups may look good on paper but may not facilitate a smoother path to IPO or exit.

Read Full Article

13 Likes

For uninterrupted reading, download the app