Bitcoin News

Coin Telegraph

93

Image Credit: Coin Telegraph

IMF says El Salvador to make ‘efforts’ to stop Bitcoin buys with $120M payments deal

- The IMF has agreed to pay El Salvador $120 million after reviewing its $1.4 billion loan agreement.

- As part of the deal, El Salvador must limit government involvement in Bitcoin and cease its association with the Chivo wallet by the end of July.

- Efforts will continue to ensure that the total amount of Bitcoin held in government-owned wallets remains unchanged.

- Despite IMF's request to stop accumulating Bitcoin, El Salvador's president, Nayib Bukele, has mentioned that the government will persist in acquiring one BTC per day.

Read Full Article

5 Likes

Newsbtc

382

Ethereum May Be One Dip Away From Mass Losses—Data Warns

- A large portion of the Ethereum market cap was acquired near the current price, potentially making ETH susceptible to mass losses.

- Approximately $123 billion of the ETH market cap sits within 0 to 20% above its cost basis, indicating a fragile profit-loss balance.

- On-chain data reveals that even a minor pullback could result in a significant number of Ethereum tokens going underwater.

- Whales holding between 10,000 and 100,000 ETH have increased their holdings by around 1 million ETH in the past few weeks.

Read Full Article

23 Likes

Cryptopotato

288

Image Credit: Cryptopotato

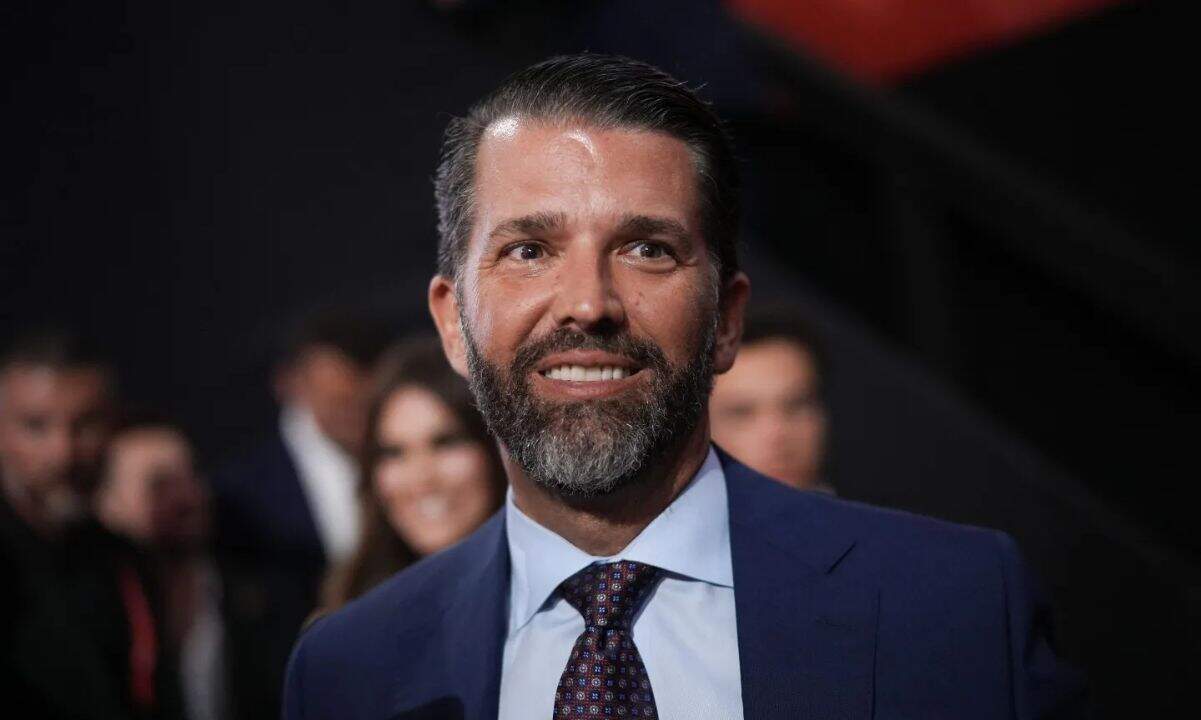

Donald Trump Jr. Unveils $2.5B Bitcoin Moon Shot at Vegas Conference

- Donald Trump Jr. expressed bullish sentiments on Bitcoin and crypto at the Bitcoin 2025 conference in Las Vegas.

- He announced the creation of a $2.5 billion Bitcoin treasury through the Trump media group, TMGT.

- Senator Cynthia Lummis mentioned Trump's support for the Bitcoin Act, which aims to acquire 1 million BTC over five years for a strategic reserve.

- David Sacks, the White House AI and crypto czar, emphasized Bitcoin as the 'financial system of the future' during the conference.

Read Full Article

17 Likes

Cryptopotato

1.3k

Image Credit: Cryptopotato

TRX’s Correlation to BTC Could Result in 4x Surge in 2025: Analyst

- TRX's correlation with BTC has analysts suggesting a potential 4x surge by 2025.

- Tokens like TRX, SUI, ADA, HBAR, and LTC with high correlation to BTC historically amplify gains during bull cycles.

- TRX's smaller market cap of $26 billion offers more explosive potential compared to Bitcoin's $2.17 trillion market cap.

- In addition to BTC correlation, TRX's resilience, network growth, and increased adoption across Asia signal strength and potential for further growth.

Read Full Article

24 Likes

Cryptopotato

229

Image Credit: Cryptopotato

Bitcoin (BTC) Nears Euphoria Zone With 99% UTXOs in Profit

- Bitcoin's price surged 50% from April lows to hit an all-time high of around $112,000 on May 23, driven by renewed market momentum.

- CryptoQuant's analysis reveals that 99% of Bitcoin's Unspent Transaction Outputs (UTXOs) are currently in profit, historically signaling market euphoria and potential turning points.

- Despite high UTXO profitability, macroeconomic uncertainty and cautious investor sentiment due to the potential policy direction of the Trump administration suggest true euphoria may not have arrived yet.

- Short-term buyer fatigue is observed as Glassnode reports a decline in 14-day RSI, net spot demand, and a cooling momentum alongside growing speculative activity in derivatives markets.

Read Full Article

13 Likes

Bitcoinist

237

Image Credit: Bitcoinist

Bank Of Korea Dives Into Crypto: Deposit Tokens Head To Public Chains

- The Bank of Korea plans to link its central-bank deposit tokens with public blockchain networks, aiming to reshape money movement in South Korea and beyond.

- Stablecoins accounted for 47% of South Korea's crypto outflows in Q1, leading to concerns about the reliance on foreign stablecoins impacting the won's global role.

- The global stablecoin market has exceeded $230 billion, with rapid growth in private issuers. South Korea aims to institutionalize stablecoins before foreign coins dominate local trading.

- Major exchanges and regulators in South Korea are involved in discussions about stablecoins. Political figures are proposing won-backed stablecoins to improve local trading and reduce crypto outflows.

Read Full Article

14 Likes

Coindoo

809

Image Credit: Coindoo

Altcoins Still Lag Behind as Bitcoin Dominates Market Momentum

- Bitcoin's dominance in the market has overshadowed the performance of alternative cryptocurrencies, according to analyst Daan Crypto Trades.

- Altcoins are struggling to break through a key horizontal resistance level, hindering their ability to catch up with Bitcoin's momentum.

- Despite a recent bounce in the altcoin market, it still lags behind Bitcoin's robust trend, with analysts cautioning investors to remain wary until altcoins show more strength.

- Until altcoins can convincingly surpass the resistance zone, Bitcoin's leadership in the market is expected to persist, prompting investors to stay cautious with altcoin investments.

Read Full Article

9 Likes

Coindoo

356

Image Credit: Coindoo

How Japanese Bond Market Turmoil Could Push Bitcoin Toward $200,000

- Head of European Research at Bitwise Asset Management, André Dragosch, believes Bitcoin's recent rally is driven by growing instability in Japan's sovereign bond market.

- The surge in Japan's 30-year government bond yield to a record 3.185% on May 20, 2025, indicates rising credit risk, prompting traditional financial institutions to reassess their portfolio strategies.

- As concerns about sovereign debt grow, Bitcoin is seen as a hedge due to its decentralized nature, immutability, and lack of counterparty risk, leading to increased adoption among traditional financial participants.

- Based on the potential for continued credit risks globally, especially in major economies like Japan, Bitwise's André Dragosch predicts Bitcoin could reach $200,000 in the long term as it gains traction as a macro hedge in institutional circles.

Read Full Article

21 Likes

Newsbtc

237

Image Credit: Newsbtc

TRON’s Correlation With Bitcoin Could Mean Massive Gains, Here’s Why

- TRON (TRX) has been performing well in the cryptocurrency market, gaining over 10% in the past month and showing a 0.7% increase in the last 24 hours, with the current price at $0.2748.

- TRX's growth aligns with the overall bullish trend of Bitcoin (BTC), hinting at potential gains driven by macro-level investor sentiment and Bitcoin's market movements.

- Assets like TRON, with a high correlation to Bitcoin, tend to reflect BTC's price actions, making them attractive to investors in terms of potential gains during bullish cycles.

- Analysts suggest that TRON's increasing network activity and correlation with Bitcoin could lead to significant value growth in the coming months, presenting opportunities for outperformance in strategic portfolio planning.

Read Full Article

14 Likes

Coin Telegraph

412

Image Credit: Coin Telegraph

Rep. Steil urges restraint on adding ‘non-germane items’ to crypto bills

- US Representative Bryan Steil urges lawmakers to avoid adding non-germane items to crypto bills to expedite the implementation of a regulatory framework.

- Democratic lawmakers previously withdrew support for the GENIUS Act citing concerns about potential conflicts of interest concerning former President Donald Trump's crypto ventures.

- Steil emphasizes the importance of focusing on the regulatory framework within the bills to benefit American consumers and promote innovation within the crypto market.

- Senator Mark Warner also stresses the significance of US lawmakers actively shaping blockchain technology to align with democratic values and prevent external influence on regulations.

Read Full Article

24 Likes

Bitcoinist

242

Image Credit: Bitcoinist

Bitcoin Miners Earning $50 Million Daily, How Does It Compare Historically?

- Bitcoin miners are currently making more than $50 million in daily revenue.

- Miners earn income through block subsidies and transaction fees, with transaction fees fluctuating based on network activity.

- The decline in Bitcoin miner revenue earlier in the year was due to a drop in the asset's price and transfer fees.

- With the recent bullish momentum in the cryptocurrency market, miner revenue has bounced back to around $51.6 million per day, still below the peaks of $80 million seen in previous years.

Read Full Article

14 Likes

Livebitcoinnews

84

Image Credit: Livebitcoinnews

Michael Saylor’s Security Stance Shakes Crypto Transparency Talks

- Michael Saylor, executive chairman of Strategy, rejects proof of reserves due to security risks at Bitcoin 2025 event in Las Vegas.

- Saylor believes that public wallet data exposure increases cyberattack vulnerability for firms, preferring traditional audits for safety.

- Strategy holds 576,230 BTC valued at $62.6 billion, making it the largest Bitcoin holder among companies.

- Crypto industry leans towards proof of reserves post-scandals, but Saylor argues large Bitcoin holders prefer privacy and security over transparency.

Read Full Article

5 Likes

Livebitcoinnews

259

Image Credit: Livebitcoinnews

Satoshi Nakamoto Now 11th Richest with $120B Bitcoin

- Satoshi Nakamoto, the creator of Bitcoin, is now the 11th richest person in the world with a fortune of $120 billion.

- Bitcoin's market cap of $2.16 trillion exceeds Amazon's $2.13 trillion, making it the fifth most valuable asset globally.

- The surge in Bitcoin's value is driven by institutional demand, with spot Bitcoin ETFs making it more accessible to traditional investors.

- The rise of Bitcoin signifies its growing influence in finance, with Nakamoto's wealth reflecting the shift towards cryptocurrencies in mainstream finance.

Read Full Article

15 Likes

Newsbtc

93

Bitcoin’s Calm Feels Dangerous—All Eyes On Vegas And June Reversal

- Bitcoin is currently trading between $107,000 and $111,000, with the options market indicating underlying tension despite the narrow price range.

- Traders are actively seeking short-term downside protection ahead of the Bitcoin Conference in Las Vegas, viewing it as a key near-term volatility catalyst.

- Recent data shows a defensive tilt in the market, with diminishing open interest in perpetual futures and decreasing funding rates, coupled with an increase in demand for short-dated puts.

- While some analysts predict a potential price increase until early June, the market remains cautious as headlines and market sentiment can lead to sudden shifts in Bitcoin's price.

Read Full Article

5 Likes

Livebitcoinnews

314

Image Credit: Livebitcoinnews

Paris Cracks Down on Crypto Kidnapping Ring, Arrests 12

- Paris police arrested 12 suspects in crypto-related kidnappings, targeting crypto entrepreneurs and demanding multi-million-euro ransoms. Several minors were among those charged with kidnapping and conspiracy.

- The arrests in Paris were made in connection to plans to kidnap owners and relatives of cryptocurrency businesses, following investigations into high-profile cases involving ransom demands in digital currencies.

- Recent incidents included a kidnapping attempt on the CEO's family member and the rescue of a cryptocurrency millionaire's father, with ransom demands in cryptocurrency. The rise in violent crime targeting those involved in the crypto industry has increased risks.

- To tackle rising risks, police have organized meetings with crypto industry leaders and implemented new security measures. Authorities suspect organized crime groups are behind these incidents and are using digital currencies to conceal their actions.

Read Full Article

18 Likes

For uninterrupted reading, download the app