Blockchain News

TheNewsCrypto

415

Worldcoin’s Bounce Ignites Excitement—Neo Pepe ($NEOP) Emerges as Investor Favorite

- Worldcoin is showing signs of rebounding, generating excitement among crypto traders, while Neo Pepe Protocol emerges as a favored meme coin.

- Neo Pepe Coin ($NEOP) at presale Stage 0 is priced attractively at $0.05, raising over $110,000, indicating early market confidence.

- Neo Pepe Protocol combines cultural resonance with a robust blockchain structure, offering investors a unique opportunity beyond speculation.

- Investors are drawn to Neo Pepe Coin due to its fixed token supply of 1 billion $NEOP, ensuring scarcity, and intrinsic value.

- The protocol's structured DAO governance model empowers the community through proposal creation, voting, quorum requirements, and transparent decision-making.

- Crypto analyst Bull Run Angel explores Neo Pepe's strengths, emphasizing its well-structured presale and community-driven governance.

- Worldcoin's recovery is boosting market optimism, potentially driving interest towards innovative projects like Neo Pepe Protocol.

- Investors are seeking tokens with compelling narratives and robust tokenomics amidst Worldcoin's stabilization and positive market sentiment.

Read Full Article

24 Likes

Medium

185

Image Credit: Medium

You’re Generating Billions in Data for the Tech Giants —Here’s Why You Should Be Getting Paid

- Your digital footprint is being used by tech giants without you being paid for it.

- WarpSynk Protocol aims to change this by enabling you to reclaim your data and power.

- WarpSynk is a Web3-powered data sync protocol that focuses on empowering individuals in the data ecosystem.

- You own and control your data through encryption and a personal Data Vault that only you can access.

- With on-chain smart contracts, you decide who can access your data and for what purposes.

- Users are compensated in $WSYNK tokens each time their data is utilized, avoiding middlemen and ensuring a fair exchange.

- WarpSynk advocates for a data economy where privacy is prioritized, consent is encoded in code, and value goes directly to the user.

- The goal is to eliminate data silos and exploitation, creating a system where users benefit from their digital lives.

- WarpSynk envisions a fair and user-owned internet where individuals are fairly compensated for their data.

- It's not just a protocol but a movement towards a more transparent and community-powered data ecosystem.

- WarpSynk focuses on action, replacing the fight against big tech with tangible solutions driven by code and community collaboration.

- To join the WarpSynk community and participate in this movement, visit x.com/WarpSynk or join their Telegram group at t.me/WarpSynk.

Read Full Article

11 Likes

Medium

401

Earn More with Roam App: Simple Ways to Maximize Your Roam Points

- Roam's core feature, the Roam Miner, allows users to passively earn Roam Points by running the app and scanning WiFi signals.

- Adding new WiFi networks through the app can increase earnings and contribute to improving location services for everyone.

- Consistent daily check-ins on the Roam App can earn users extra Roam Points with just one tap.

- Roam offers a referral program where users can earn bonus points for successful referrals, helping the network grow and getting rewarded.

- Participants in Roam's community events, challenges, and campaigns can earn extra Roam Points and token rewards.

- Joining the Roam community allows users to engage in events, meet fellow users, and boost their earnings.

- Roam App provides an opportunity to earn crypto rewards by mining, connecting WiFi, referring friends, and participating in community events.

Read Full Article

24 Likes

TheNewsCrypto

83

JPMorgan Poised to Expand Crypto Services with “JPMD” Trademark Filing

- JPMorgan has filed a trademark for “JPMD,” potentially indicating a move towards launching a stablecoin or crypto payment product.

- The trademark filing aligns with increasing clarity on U.S. stablecoin regulations.

- The trademark filing suggests JPMorgan is emphasizing its blockchain and crypto initiatives, possibly laying the groundwork for a future stablecoin release.

- The filing covers various digital asset functions such as trading, transfers, payments, and clearing, hinting at a fiat-backed token like USDC.

- The U.S. Senate's advancement of the GENIUS Act aims to establish a national framework for issuing stablecoins, enabling banks to play a larger role in issuing digital tokens and handling crypto payments.

- JPMorgan's move is part of a trend, with other major banks considering joint bank-issued stablecoins, following in the footsteps of Tether and Circle.

- Regulatory developments, like the GENIUS Act and potential future bills, are seen as positive signals for stablecoin progress and institutional digital dollar adoption.

- JPMorgan is no stranger to blockchain technology with its existing network and JPM Coin for interbank transfers, handling significant daily transaction volumes.

- JPMD could potentially enable JPMorgan to extend its blockchain offerings to a wider client base beyond institutional clients.

- The trademark filing is viewed as a strategic move to secure intellectual property rights amidst the evolving stablecoin regulatory landscape.

- JPMorgan's JPMD trademark filing could indicate a step towards making its blockchain solutions accessible beyond internal use.

- The competitive stablecoin landscape, regulatory advancements, and major players exploring digital dollar initiatives are influencing JPMorgan's strategic direction towards regulated crypto payment infrastructures.

Read Full Article

5 Likes

Fintechnews

264

Image Credit: Fintechnews

Can Crypto Firms Catch Up on Compliance Gaps as Regulations Evolve?

- Regulators are enforcing the FATF Travel Rule compliance in APAC as crypto adoption rises.

- Many governments have passed legislation to implement the Travel Rule for VASPs.

- 75% of jurisdictions in APAC are non-compliant or partially compliant, leaving room for fraud.

- Identity fraud is a significant concern in crypto, requiring ongoing user monitoring.

- Weak risk assessments, delayed Travel Rule rollout, and lack of interoperability are key compliance issues.

- More countries like India and Indonesia are expected to enforce the Travel Rule more strictly.

- Poor compliance exposes firms to regulatory risks and undermines industry trust.

- VASPs need robust risk mitigation strategies to close compliance gaps.

- Compliance is crucial for accelerating crypto adoption while the industry remains cautious about overregulation.

- Sumsub's guide offers insights on Travel Rule implementation, fraud prevention, and regulatory best practices.

Read Full Article

15 Likes

Coindoo

220

Image Credit: Coindoo

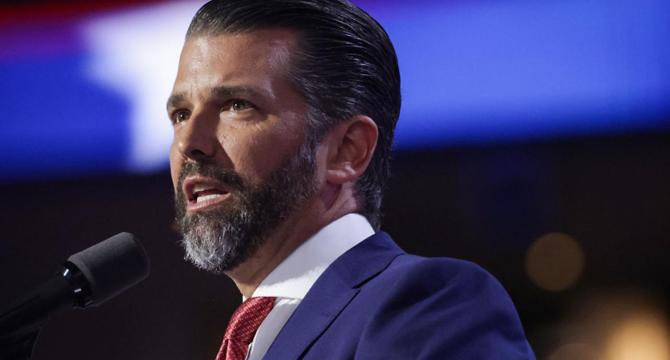

Eric Trump Denies Involvement in Tron Public Listing Deal

- Eric Trump denied any involvement in Tron's rumored plan to go public, calling the claims inaccurate.

- Despite distancing himself, Eric Trump acknowledged Justin Sun's contributions to the digital asset industry and praised his support for Trump-aligned crypto initiatives.

- Justin Sun has aligned his efforts with Trump-led financial and blockchain ventures, boosting visibility and adoption in pro-crypto circles.

- Tron has seen renewed U.S. momentum as the SEC and Sun agreed to pause the ongoing lawsuit, hinting at a shift in the government's stance.

- Eric Trump's denial of ties to Tron-related listings contrasts with the close relationship between Sun and Trump-affiliated initiatives.

- The denied involvement comes as Eric Trump respects Sun's efforts in the crypto space.

- Eric Trump's post on social media emphasized the inaccurate nature of the circulating claims.

- Sun's alignment with Trump-led ventures has contributed to increased visibility and adoption for Tron in pro-crypto circles.

- Tron's resurgence in the U.S. market is partly attributed to the legal pause in the SEC lawsuit in partnership with Sun.

- The joint motion filed by the SEC and Justin Sun to pause the lawsuit suggests a potential regulatory shift in Tron's favor.

- The relationship between Sun and Trump-related initiatives continues to influence Tron's U.S. market momentum.

- Eric Trump, in his denial, acknowledged the value of Sun's contributions to the digital asset industry.

- Sun's support for Trump-aligned crypto projects has contributed to visibility and acceptance within pro-crypto communities.

- Tron's recent resurgence in the U.S. market is accompanied by a legal pause in the ongoing SEC lawsuit, indicating a possible change in regulatory dynamics.

- The association between Sun and Trump-linked ventures plays a role in shaping Tron's growing momentum in the U.S. financial space.

Read Full Article

13 Likes

TechBullion

273

Image Credit: TechBullion

Watch Closely: These 5 Altcoins Are Poised to Dominate—Best Altcoins to Buy This Week

- The cryptocurrency market is abuzz with the search for the best altcoins to buy this week, as newer blockchain projects promise innovation and potential market reshaping.

- Qubetics ($TICS) is gaining traction for its decentralized finance solutions and multi-chain ecosystem, attracting attention as one of the top contenders.

- EOS maintains its position as a reliable platform for scalable dApps, with recent updates enhancing its appeal to developers seeking cost-efficient solutions.

- Astra's DeFi platform offers financial services with lower costs and faster processing, making it a strong candidate for those interested in decentralized finance.

- Theta aims to decentralize the video streaming industry, forging partnerships and expanding its ecosystem to enhance the streaming experience.

- Helium's blockchain-powered IoT network incentivizes users with $HNT tokens, establishing a decentralized wireless infrastructure for connected IoT devices.

- Qubetics, EOS, Astra, Theta, and Helium (HNT) are identified as the best altcoins to buy this week, each showcasing unique value propositions and growth potential.

- These projects stand out for driving innovation and real-world use cases in a maturing cryptocurrency market.

- Qubetics offers a non-custodial multi-chain wallet, EOS excels in scalable dApps, Astra focuses on user-friendly DeFi, Theta aims at decentralized video streaming, and Helium combines blockchain with IoT technology.

- With a focus on innovation, strong community support, and potential for future growth, these altcoins present investment opportunities aligned with the evolving crypto landscape.

- Qubetics, EOS, Astra, Theta, and Helium (HNT) are recommended altcoins for investors looking to participate in the next phase of blockchain adoption and growth.

Read Full Article

16 Likes

TronWeekly

22

Image Credit: TronWeekly

Ethereum’s Lubin Sparks Wall Street Interest in DeFi with Bold Treasury Strategy Vision

- Ethereum co-founder Joseph Lubin emphasizes profit-driven DeFi access and treasury exposure for Wall Street adoption.

- IBM's Tom Lee highlights companies using Bitcoin and Ethereum in treasury strategies as models bridging traditional finance with cryptocurrencies.

- Regulatory concerns are decreasing, paving the way for increased enterprise interest in decentralized finance and token issuance.

- Lubin promotes Ethereum and Bitcoin treasury strategies as key for bringing traditional finance into DeFi.

- Lubin points to SBET as a promising treasury tool centered around staking Ether, similar to successful Bitcoin-forward strategies.

- Tom Lee from Fundstrat sees GRNY ETF and SBET as connecting points between DeFi and conventional capital markets.

- Steady profit streams like those associated with Ethereum are expected to attract more Wall Street investment into the DeFi ecosystem.

- Improved scalability and affordability post-upgrades position Ethereum for global-scale applications, making DeFi more appealing to enterprises.

- With clearer regulations and reduced fear of SEC crackdowns, companies are increasingly exploring DeFi concepts and tokenization.

- Web3 features are now being integrated by traditional Web2 developers and corporations into products, viewing Ethereum as a comprehensive tech stack.

- Friendly regulatory conditions encourage innovation, allowing developers to experiment with Web3 without excessive concern over bans or legal actions.

- Ethereum's community-focused governance and ownership model are becoming attractive to teams beyond financial profits.

- Joseph Lubin anticipates mainstream adoption of DeFi tools through Wall Street participation, leading to a new era of financial evolution.

Read Full Article

1 Like

Zebpay

331

Image Credit: Zebpay

Dogecoin (DOGE) Price Prediction

- Dogecoin is gaining attention as a memecoin and has garnered popularity in the crypto landscape.

- It was introduced in 2013, featuring the 'Doge' meme dog as its mascot.

- Dogecoin has grown significantly with support from figures like Elon Musk and Vitalik Buterin.

- Transactions with Dogecoin are verified through mining, and its supply is uncapped.

- Dogecoin's current price is $0.1743, with a circulating supply of 149.71 billion DOGE.

- By 2025, Dogecoin is predicted to reach a high of $1.05 reflecting the ongoing crypto cycle.

- The memecoin's value is tied to community interest and social media presence, making it a volatile investment.

- Investing in Dogecoin relies on belief in its community and enduring appeal.

- The future of Dogecoin is dependent on supply, demand, and community activities.

- India's crypto market and regulations impact Dogecoin's pricing in the region.

Read Full Article

19 Likes

TronWeekly

123

Image Credit: TronWeekly

SRM Entertainment to Rebrand as Tron Inc. After $100M TRX Treasury Investment

- SRM Entertainment, a Nasdaq-listed company, will rebrand as Tron Inc. following a $100M equity investment for a TRX treasury strategy.

- Justin Sun, founder of TRON, becomes an advisor for Tron Inc. and supports TRX staking and dividend programs.

- TRX price surged by nearly 7% after SRM announced a $210M warrant-backed treasury deal.

- The agreement includes issuing 100,000 shares of Series B convertible preferred stock and 220 million warrants to be exercised at $0.50 per share.

- Dominari Securities LLC is the exclusive placement agent for the $100M investment in TRX treasury strategy.

- Tron Inc. plans to use the investment to establish a substantial TRON treasury and implement a staking program.

- By implementing staking, Tron Inc. aims to generate returns for the company and shareholders, followed by implementing a dividend policy.

- Justin Sun emphasizes the increased use of stablecoins and blockchain technology in global payments, aiming for TRON to become the primary protocol for on-chain settlement globally.

- TRON, founded in 2017, boasts low fees, rapid transactions, smart contracts, and decentralized applications, challenging major blockchains like Bitcoin and Ethereum.

- TRON hosts around $78.7 billion in US dollar stablecoins, showcasing a strong position in the market.

- The positive news of the collaboration between SRM and TRON resulted in a 7% increase in TRX price, trading at about $0.28.

Read Full Article

7 Likes

Cryptonews

1.1k

Cautionary Tale: $7M Lost by Crypto Investor Who Bought Discounted Cold Wallet

- A Chinese crypto investor lost almost US$7 million in crypto assets after buying a discounted cold wallet through Douyin, the Chinese version of TikTok.

- Blockchain security firm SlowMist believes the wallet's private key was compromised at creation, leading to the loss of US$6.5 million in digital assets within hours.

- SlowMist warned against buying discounted cold wallets through unofficial channels, stating that 99% of them are tampered.

- The victim's close friend, a Chinese Twitter user named Hella, reported the theft and traced the stolen assets to Huiwang, a company associated with cybercriminal activities.

- Huiwang is known for services like payment processing and has been linked to money laundering by cybercriminals.

- SlowMist emphasized the risks of purchasing cold wallets through unofficial channels and advised using official sources for such transactions.

- The incident serves as a cautionary tale for crypto investors, highlighting the importance of verifying the authenticity of the products they purchase.

- Australian investors are also warned about the prevalence of crypto scams, as ASIC continues its efforts to shut down fraudulent companies engaging in scams.

- ASIC's Deputy Chair, Sarah Court, emphasized the persistent threat of scams and urged consumers to remain vigilant.

- Crypto investors are reminded to prioritize security and legitimacy when dealing with digital assets to avoid falling victim to similar scams.

- The case underscores the ongoing challenges in ensuring the safety and security of crypto investments in the face of evolving threats in the digital space.

Read Full Article

14 Likes

Dev

340

Image Credit: Dev

Ethereum 101: The Complete Beginner’s Guide to Ethereum and How It Works

- Ethereum is a blockchain platform allowing developers to create decentralized applications and smart contracts, distinct from Bitcoin.

- Vitalik Buterin proposed Ethereum in 2013, with a successful launch in 2015, aiming for a programmable blockchain.

- Ethereum's technology includes the Ethereum Virtual Machine (EVM) for executing smart contracts and gas for transactions.

- Key differences between Ethereum and Bitcoin include purpose, block time, consensus model, supply cap, and programmability.

- Ethereum's Merge transitioned to Proof of Stake, reducing energy consumption and laying the groundwork for scalability.

- Real-world applications of Ethereum include DeFi, NFTs, gaming, virtual worlds, and enterprise solutions.

- Challenges for Ethereum include smart contract risks, network congestion, and regulatory uncertainties.

- Investing in ETH can be done through exchanges, staking, DeFi, or NFT platforms, with consideration for regulations.

- The future outlook for Ethereum includes growing Layer 2 adoption, institutional use, NFT expansion, DeFi evolution, and cross-chain interoperability.

- Ethereum remains at the forefront of blockchain innovation, evolving as a global decentralized infrastructure.

Read Full Article

20 Likes

Bitcoinsensus

397

Image Credit: Bitcoinsensus

Is Zkasino Behind WhiteRock? ZachXBT Links the Teams in New Report

- ZachXBT's recent investigation suggests potential ties between WhiteRock and Zkasino, indicating overlaps in on-chain activities, email addresses, aliases, funding sources, and launch patterns.

- Community alert was raised due to a team member from the $30M Zkasino exit scam possibly being involved with WhiteRock, with evidence of on-chain transactions and a shared email address.

- Zkasino faced issues in the past, including raising $30 million in a presale, failing to deliver on commitments, and resulting in arrests for fraud and money laundering.

- The investigation links WhiteRock to Zkasino through email addresses, aliases like IldarTheGrandMaster on Chess.com, and suspicious wallet activity.

- Funds withdrawn from Zkasino moved through various cross-chain transactions and may have been integrated into WhiteRock, possibly to obscure their origin.

- WhiteRock also exhibited risky behavior with questionable partnerships, lack of transparency in payment infrastructure, and side wallets funded through instant conversion services.

- Despite unconfirmed allegations, the findings raise concerns about WhiteRock's legitimacy, prompting a need for closer monitoring.

- ZachXBT's credibility is highlighted by past investigations, like exposing vulnerabilities and potential North Korean hacker involvement in the Bybit incident.

- Vigilance is advised to follow developments regarding WhiteRock's response to these allegations and to verify information in the crypto, blockchain, and DeFi space.

Read Full Article

23 Likes

TechBullion

397

Image Credit: TechBullion

Could Ruvi AI (RUVI) Mimic Binance Coin’s (BNB) Rise? $1.8M Raised and Over 1,600 Holders Signal Huge Potential

- Ruvi AI (RUVI) is gaining traction and being compared to Binance Coin’s (BNB) success in the crypto market.

- Ruvi AI raised $1.8 million in its presale and has over 1,600 holders, indicating significant potential.

- BNB is renowned for its utility in the Binance exchange ecosystem, DeFi protocols, and NFT transactions with its deflationary mechanism.

- Newer projects like Ruvi AI are attracting attention for innovative technologies and competitive token structures.

- Ruvi AI combines blockchain and artificial intelligence to offer a decentralized superapp with real-world applications.

- The $RUVI token plays a crucial role in facilitating transactions, staking rewards, governance decisions, and accessing premium features.

- Ruvi AI’s presale success, with over 1,600 holders and $1.8 million raised, reflects strong investor confidence.

- The project has undergone an audit by Cyberscope for trust and security, distinguishing it from riskier projects.

- Ruvi AI's structured VIP presale tiers offer significant return opportunities, positioning it as a high-growth investment.

- With its focus on utility, transparency, and AI integration, Ruvi AI is seen as a serious competitor to established projects like Binance Coin.

- Investors interested in high-growth opportunities are encouraged to consider Ruvi AI for its potential and community support.

Read Full Article

23 Likes

Coindoo

335

Image Credit: Coindoo

XRP Search Interest Surges Globally as ETF Speculation Grows

- XRP, the fourth-largest cryptocurrency, is garnering increased global attention amidst speculation over a potential ETF approval.

- European countries, notably the Netherlands and Germany, exhibit the highest surge in search interest for XRP, underscoring widespread international curiosity.

- Analysts attribute this spike to a growing demand for XRP-related investment products and a focus on the asset's regulatory landscape.

- Searches related to XRP ETF approval timelines have jumped by 150%, indicating heightened interest from both retail and institutional investors.

- XRP's price near $2, combined with $11 million in recent fund inflows and escalating search activity, suggests mounting confidence and potential significant developments ahead.

Read Full Article

20 Likes

For uninterrupted reading, download the app