Medium

1M

208

Image Credit: Medium

Building the modern credit network for B2B payments: why we invested in OatFi

- White Star Capital led OatFi’s $24m Series A round to enhance B2B payments' credit network.

- Despite B2B transactions' large volume in the US, only less than 20% are digital, unlike B2C.

- While platforms like Bill.com have digitalized B2B transactions, lack of flexible lending products persists.

- SMBs, key players in the US economy, face challenges accessing lending products.

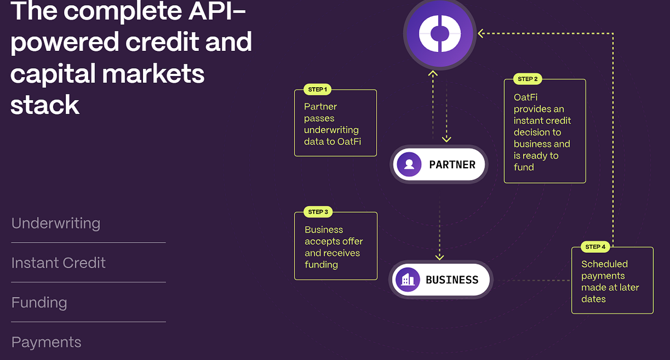

- OatFi aims to revolutionize B2B payments by embedding financing into payment platforms.

- OatFi enables SMBs to access instant credit, addressing cash flow challenges.

- Through OatFi's APIs, businesses like Order.co have streamlined procurement and managed spending efficiently.

- OatFi's efficient go-to-market strategy and API-first approach have driven significant growth.

- OatFi's leadership team, with diverse expertise, positions the company for success in the competitive market.

- White Star Capital, alongside QED and Portage, supports OatFi in enhancing the modern credit network for B2B payments.

Read Full Article

12 Likes

For uninterrupted reading, download the app