Cryptocurrency News

Insider

75

Image Credit: Insider

Why a famed financial advisor thinks crypto should be up to 40% of your portfolio

- Financial advisor Ric Edelman suggests allocating up to 40% of portfolios to cryptocurrencies, a significant increase from his previous recommendation of 1% a few years ago.

- Edelman believes in allocating at least 10% of a portfolio to crypto assets and as much as 40% in some cases, citing the outperformance and growth potential of digital assets.

- He argues that portfolios with bitcoin have historically generated higher returns with lower risk and emphasizes the importance of including crypto in investment strategies.

- Edelman criticizes the traditional 40/60 mix of stocks and bonds, advocating for portfolios that can generate revenue for 50 years or more with increased exposure to cryptocurrencies, especially amid blockchain technology advancements.

Read Full Article

4 Likes

Coindoo

327

Image Credit: Coindoo

MicroStrategy Buys $531M in Bitcoin — Cardano Leads as Crypto Catalysts Strengthen

- MicroStrategy has purchased an additional 4,980 BTC, investing around $531 million at an average price of $106,000, bolstering its position as the largest corporate Bitcoin holder.

- The purchase by MicroStrategy has boosted bullish sentiment in the market, with Bitcoin's price hovering between $106,000 - $107,000, reinforcing confidence in Bitcoin's long-term viability.

- Cardano (ADA) maintains focus on long-term infrastructure growth, emphasizing progress on scaling solutions and secure client infrastructure, positioning itself for sustainable growth in the Web3 landscape.

- The current market divide is evident, with Bitcoin and Cardano representing long-term conviction plays, while retail investors are increasingly drawn to emerging tokens for faster upside potential amidst the growing trend of altcoin capital rotation.

Read Full Article

19 Likes

Coinpedia

344

Image Credit: Coinpedia

Pepeto vs PEPE Price Prediction: Which Moonshot Wins in July?

- Pepe token has seen significant trading activities and holds an RSI value of 41.76, suggesting stability in a volatile market.

- Pepeto, an underdog cryptocurrency, is gaining attention with its presale funding of $5.5 million and plans for further fundraising.

- Pepeto's value lies in its exchange, PEPETO Bridge, aiming to enhance financial operations and liquidity through cross-chain transactions.

- Investors are eyeing Pepeto's potential with staking rewards, tokenomics benefits, and upcoming listings on Tier 1 exchanges for possible exponential growth.

Read Full Article

20 Likes

Zycrypto

97

Image Credit: Zycrypto

US Treasury Sanctions $350k TRON Wallet Linked to BPH Service Provider Aeza Group

- The US Treasury has sanctioned a TRON wallet address linked to the Russian-based Aeza Group for enabling ransomware attacks and providing Bulletproof Hosting services.

- The TRON wallet contained $350,000 in funds and was used for criminal activities like hosting ransomware servers and phishing attacks targeting crypto holders.

- The US Treasury also sanctioned other entities and individuals related to Aeza Group, including Russian and UK firms, in efforts to combat cybercrime and disrupt criminal networks.

- OFAC's sanctions targeted key personnel and businesses affiliated with Aeza Group, aiming to prevent illicit activities that undermine economic health and national security.

Read Full Article

5 Likes

Cryptoninjas

362

Image Credit: Cryptoninjas

Germany Approves EURAU: First MiCA-Compliant Euro Stablecoin Gets Green Light from BaFin

- Germany's BaFin approves EURAU, the first MiCA-compliant euro stablecoin by AllUnity.

- EURAU is 100% collateralized and targets cross-border settlements for financial institutions.

- Collaboration of DWS, Flow Traders, and Galaxy ensures compliance and institutional-grade transparency.

- Regulators see EURAU as a pivotal step towards a regulated digital financial system.

Read Full Article

21 Likes

TronWeekly

216

Image Credit: TronWeekly

Limited capacity: Join the ranks of the 1% of the “rich” and earn $550,000, while most investors are still struggling with the volatility of ETFs

- The monthly net inflow of Bitcoin spot ETF has surpassed 9.8 billion US dollars, showing traditional capital's full acceptance of crypto assets.

- Top investors opt for Bow Miner over ETFs due to the challenges of traditional ETF investments such as market dependency, high entry thresholds, professional dependence, and hidden costs.

- Bow Miner cloud mining offers anti-volatility income, starting from $15 with multi-currency payment options, full AI custody, and 100% clean energy operation.

- Investors can choose from various contracts on Bow Miner for different investment amounts and contract periods to earn profits, making it an attractive option for both novices and institutions.

Read Full Article

13 Likes

TechBullion

433

Image Credit: TechBullion

Top Cryptos to Buy Now: BlockDAG’s Airdrop Is Outshining TRX, HBAR & CRO

- Invest in top cryptos focusing on real user engagement and long-term value.

- BlockDAG leads with a hands-on airdrop approach, mobilizing millions via action-first participation.

- TRON, Hedera, and Cronos also offer practical use cases and community-driven growth models.

- BlockDAG shows the power of rewarding participation, with 2 million users shaping its ecosystem.

- Investors looking for user engagement-driven growth should keep an eye on BlockDAG.

Read Full Article

26 Likes

Newsbtc

38

Image Credit: Newsbtc

The ‘MicroStrategy’ Of Ethereum Emerges: Tom Lee And Joe Lubin Raise $675M To Stack ETH

- Tom Lee and Joe Lubin are advancing their Ethereum treasuries, aiming to create the 'MicroStrategy' of Ethereum.

- BitMine announced a $250 million private placement to raise capital for acquiring ETH, with Tom Lee as Chairman of the Board.

- SharpLink Gaming, chaired by Joe Lubin, has increased its ETH holdings to $475 million, becoming a major Ethereum holder.

- Both companies plan to mirror Michael Saylor's strategy, with BitMine focusing on 'ETH per share' through staking, and SharpLink exploring DeFi strategies and potential leverage.

Read Full Article

2 Likes

TronWeekly

329

Image Credit: TronWeekly

Binance Coin (BNB) Fails to Break $660 Despite $157 Billion BNB Chain Volume Surge

- Binance Coin struggles to maintain price above $660 despite a 0.69% increase to $656.66 in the last 24 hours.

- Technical indicators like RSI and MACD suggest weakening momentum, with failure to surpass $660 potentially leading to a pullback to $640.

- BNB Chain sees a surge in DEX volume to $157 billion in June, indicating strong network growth, but Binance Coin’s price lags behind.

- The discrepancy between BNB Chain’s performance and Binance Coin’s valuation raises concerns within the crypto community, with a need for a strong surge above $660 for a bullish trend.

Read Full Article

19 Likes

TheCryptoBasic

176

Image Credit: TheCryptoBasic

BlackRock Bitcoin ETF Now Holds 696,874 BTC with All-Time High Value of $75B+

- BlackRock's iShares Bitcoin Trust now holds 696,874 BTC, valued at over $75.1 billion, marking an all-time high for the ETF.

- BlackRock is the largest holder of Bitcoin among ETFs, accounting for 3.318% of the total 21 million BTC supply.

- Comparatively, BlackRock holds over three times more Bitcoin than its closest rival, Fidelity, which holds 201,346 BTC.

- U.S. Bitcoin ETFs collectively hold 1.247 million BTC valued over $135 billion, with global ETFs increasing the total to 1.426 million BTC worth $153.86 billion.

Read Full Article

10 Likes

Bitcoinist

252

Image Credit: Bitcoinist

Corporate Bitcoin Holdings Surge Past 3 Million BTC As Treasury Firms Multiply–Report

- Corporate Bitcoin holdings have surged past 3 million BTC, worth about $315 billion, with 199 entities now involved in holding Bitcoin.

- Major companies view crypto not just as a trading asset but as a long-term treasury play, as the total BTC holdings have more than doubled since the start of 2024.

- Strategy leads with 580,250 BTC worth about $60 billion, pioneering the concept of a pure-play treasury firm, setting a higher premium for its shares.

- Debt risks are a concern for companies heavily invested in Bitcoin, with potential challenges in refinancing during market downturns, despite the broader industry influence and entry of new players into the market.

Read Full Article

15 Likes

TronWeekly

216

Image Credit: TronWeekly

PENGU Token Rockets 47% Amid NFT Market Surge and Growing Institutional Backing

- PENGU Token, associated with Pudgy Penguins, surged by 47% in the past week, adding $300 million to its market capitalization, despite crypto market fluctuations.

- Whale investors acquired nearly 240 million PENGU tokens, demonstrating growing optimism among experienced market players.

- Pudgy Penguins NFT volume rose by 191% amidst a 33.8% increase in the overall NFT market, driven by the upcoming mobile game 'Pudgy Party' to broaden the project's ecosystem.

- Analysts anticipate a breakout for PENGU above $0.017, with bullish upside targets reaching as high as $0.1774, drawing parallels to past meme coin success.

Read Full Article

13 Likes

TheNewsCrypto

185

The Role of Stablecoins in Illicit Activities

- Stablecoins facilitate illicit transactions due to price stability, speed, and blockchain acceptance.

- Regulators worldwide are enforcing rules to increase transparency and monitor stablecoin use.

- Originating in 2014, stablecoins combine fiat value with blockchain technology for various uses.

- Illicit activities involving stablecoins include money laundering, sanctions evasion, and ransomware payments.

- Mitigating misuse requires regulatory oversight, issuer control, international cooperation, and CBDCs support.

Read Full Article

11 Likes

Medium

141

Image Credit: Medium

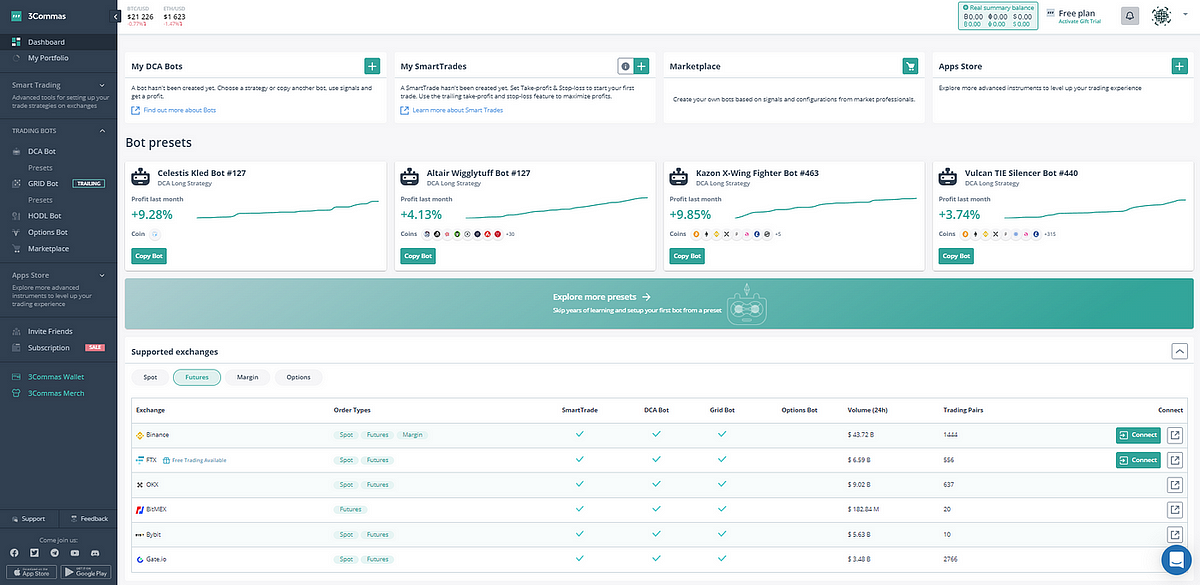

How I Automated My Crypto Profits with 3Commas Bots — and You Can Too!

- 3Commas offers automation tools like smart DCA bots and grid bots to automate crypto trades on major exchanges.

- Users can monitor trades 24/7 through desktop and mobile dashboards, with affordable PRO plans available.

- The platform also provides an affiliate program with commissions and bonuses for referrals, making it lucrative for users.

- Steps to automate crypto trading with 3Commas include creating an affiliate link, connecting exchange APIs, choosing bot type, adjusting settings, and launching bots for automated trading.

Read Full Article

8 Likes

Livebitcoinnews

150

Image Credit: Livebitcoinnews

Here’s Why You Might Be Wrong To Predict A $3 Rally For XRP, Despite 89% ETF Approval Odds

- XRP is currently range-bound between $2.00 and $2.35, with $2.35 acting as strong technical resistance.

- Despite high odds of an XRP ETF approval, a rally towards $3 could be challenging.

- A clear break above $2.35 is crucial for XRP to target $2.65, while a drop below $2.00 could lead to a decline towards $1.61.

- The XRP ETF speculation is causing optimism, but technical resistance at $2.35 remains a key hurdle for any potential rally.

Read Full Article

9 Likes

For uninterrupted reading, download the app