Cryptography News

Cryptopotato

135

Image Credit: Cryptopotato

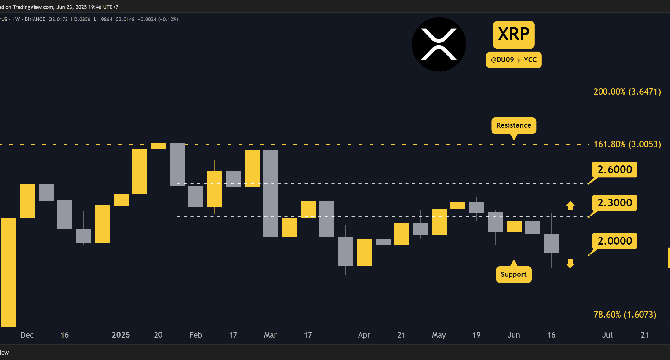

Ripple (XRP) Price Predictions for This Week

- XRP touched $2 and holds steady despite recent market turbulence.

- Key support levels include $2, while key resistance levels stand at $2.3, $2.6, and $3.

- Buyers defended the $2 support level following a market crash triggered by US actions in Iran, with XRP bouncing back from $1.9.

- Overall momentum in higher timeframes remains bearish, indicated by falling MACD on daily and weekly charts.

- On lower timeframes like the 4H, the RSI shows XRP is oversold, leading to a temporary bounce to $2.

- However, a potential retest of $2 support by sellers may lead to a further decline to $1.6.

Read Full Article

8 Likes

Coindoo

196

Image Credit: Coindoo

Top Trending Cryptocurrencies Today, According to Coingecko

- The list of top trending cryptocurrencies includes Toncoin (TON), Notcoin (NOT), and LAMBO based on searches.

- Toncoin (TON) is leading the trend at rank #22, trading at $2.81 with a 4.1% gain in the last 24 hours despite a 5.5% dip in the past week.

- Notcoin (NOT), ranked #293, is valued at $0.001695, showing a 2.6% increase in the last 24 hours but down by 20.6% over the week.

- LAMBO (LAMBO) is also notable at rank #799, priced at $0.003551, experiencing a 7.2% rise in the last 24 hours but a 28.7% drop in the past 7 days.

- Other trending cryptocurrencies include Cross The Ages (CTA), Hyperliquid (HYPE), Spark (SPK), and Virtuals Protocol (VIRTUAL).

- Solana (SOL), a major player at rank #6, is trending at $133.97 with a 5.0% gain in the last 24 hours.

- The CoinGecko trending list showcases current market interest in various cryptocurrencies, reflecting investor and enthusiast activities.

- While some tokens display short-term gains, the weekly performance indicates ongoing volatility in the cryptocurrency market.

Read Full Article

11 Likes

Bitcoinmagazine

30

Genesis Digital Assets Limited Acquires 1000 Air-Cooled Miners to Mine Bitcoin

- Genesis Digital Assets Limited (GDA) has acquired 1000 Teraflux AT2880-277 air-cooled miners from Auradine for mining Bitcoin.

- The mining machines will be installed at GDA's 40 MW data center in Glasscock County, Texas.

- GDA aims to combine operational excellence with sustainability in its mining operations.

- The air-cooled miners offer up to 260 TH/s hash rate with energy efficiency as low as 16 J/TH.

- The machines will participate in Texas's ERCOT demand response program to enhance grid stability.

- GDA's partnership with Auradine emphasizes the importance of energy-efficient mining infrastructure.

- The deployment aligns with GDA's US expansion strategy, focusing on Texas's renewable energy assets.

- Auradine recently introduced high-performance ASIC chips and cooling systems for mining operations.

- The collaboration aims to democratize access to Bitcoin mining and support innovation in the sector.

- The article was written by Oscar Zarraga Perez and was first published on Bitcoin Magazine.

Read Full Article

1 Like

Coinjournal

253

Image Credit: Coinjournal

Movement (MOVE) price outlook as it bounces back from recent correction

- Movement (MOVE) price has rebounded 22.4% from a recent low of $0.1107 driven by buybacks and tightening supply.

- Niza Exchange listing has enhanced MOVE's visibility and demand.

- The cryptocurrency has surged, reclaiming key levels and sparking optimism among traders.

- MOVE is trading at $0.1467, up 22.4% in 24 hours, showing a strong recovery from the bottom.

- The rally follows an all-time low on June 22, 2025, with increased market participation and confidence.

- Trading volume surged to $206.5 million, indicating growing momentum and interest.

- Technical indicators suggest a bullish structure forming, with potential for upward momentum.

- Whale accumulation and staking lock-up support a bullish setup for MOVE.

- The recent Niza Exchange listing and Movement Network Foundation buybacks contribute to positive sentiment.

- Analysts expect a retest of $0.1780 if MOVE holds above the 100-day MA.

- The overall sentiment for Movement (MOVE) remains bullish due to positive developments.

Read Full Article

15 Likes

Bitcoinmagazine

192

Strategy Buys $26 Million Worth Of Bitcoin

- Strategy continues its steady Bitcoin accumulation strategy by purchasing an additional 245 Bitcoin for $26 million.

- The company now holds a total of 592,345 BTC with an average price of $70,681 per coin.

- The purchase was made through an at-the-market equity offering program, selling preferred stock to fund the acquisition.

- Despite recent market volatility due to geopolitical tensions, Strategy maintains its consistent Bitcoin accumulation approach.

- Bitcoin recovered from weekend lows following U.S. airstrikes on Iranian nuclear facilities.

- Strategy reports a Bitcoin yield of 19.2% year-to-date, nearing its 25% target for 2025.

- This marks Strategy's tenth consecutive week of Bitcoin purchases, demonstrating its long-term commitment to digital asset accumulation.

- Strategy's shares were down 1.55% in premarket trading, with Bitcoin trading at $101,654.

Read Full Article

11 Likes

Coindoo

205

Image Credit: Coindoo

Anthony Pompliano Launches ProCap Financial in $1 Billion Merger, Secures Record Bitcoin Treasury Fundraise

- Anthony Pompliano launched ProCap Financial in a $1 billion merger to create a new entity focusing on holding Bitcoin.

- The merger has raised over $750 million, the largest initial fundraise in history for a public Bitcoin treasury company.

- Funds raised include $516.5 million in equity and $235 million in convertible notes, with a strategic objective to acquire Bitcoin for revenue generation.

- Equity investors will gain immediate exposure to Bitcoin through the financing transactions.

- Columbus Circle Capital Corp. I, a SPAC sponsored by Cohen & Company Inc., will aid in making ProCap Financial public.

- Leading institutional and Bitcoin-native investors participated in the financing, including Magnetar Capital, Woodline Partners LP, and others.

- Notable industry figures like Mark Yusko and Jason Williams were part of the venture, demonstrating a growing institutional interest in Bitcoin.

Read Full Article

12 Likes

Coinjournal

65

Image Credit: Coinjournal

Why is the price of FUNToken (FUN) rising so fast?

- FUNToken's price surge is attributed to its deflationary supply model and CertiK audit, confirming security and eliminating inflation risk.

- Its on-chain gaming model and ecosystem expansion contribute to growing adoption and utility, with over 40 games and gasless gaming features.

- Investor optimism is high as FUNToken shows strong technical momentum and increasing wallet activity, with a surge over 62% in the past 24 hours.

- The token's narrative shift from speculative to utility-driven has garnered trust and credibility among traders, backed by real value creation.

Read Full Article

3 Likes

Coindoo

236

Image Credit: Coindoo

Strategy Boosts Bitcoin Holdings, Buying 245 BTC

- Strategy has recently purchased an additional 245 BTC, totaling their Bitcoin holdings to 592,345 BTC as of June 22, 2025.

- The total acquisition cost for Strategy's holdings is approximately $41.87 billion, with an average purchase price of $70,681 per BTC.

- Strategy's BTC Yield for Year-To-Date (YTD) 2025 stands at an impressive 19.2%, showcasing the success of their Bitcoin strategy.

- The constant acquisitions highlight Strategy's confidence in Bitcoin as a long-term store of value and strategic corporate asset.

- These moves reinforce Strategy's position as a major corporate holder of Bitcoin.

- The news showcases the firm belief in Bitcoin's potential amidst market fluctuations.

- Strategy's CEO, Michael Saylor, has played a key role in leading these Bitcoin acquisitions.

- The story emphasizes the ongoing bullish sentiment towards Bitcoin within corporate entities.

- Strategy's accumulation strategy has proven successful with significant BTC holdings.

- The increasing BTC holdings reflect Strategy's commitment to Bitcoin as a valuable asset.

- Strategy's Bitcoin holdings demonstrate substantial growth and investment in the cryptocurrency.

- The article highlights the positive performance trend of Strategy's Bitcoin strategy.

- Strategy's actions underscore a long-term investment approach towards Bitcoin.

- The notable BTC purchases by Strategy affirm their dedication to holding Bitcoin.

- The impressive BTC Yield achieved by Strategy further emphasizes the benefits of their Bitcoin strategy.

Read Full Article

14 Likes

Coindoo

345

Image Credit: Coindoo

Bitcoin Dominance Soars, But Key Indicators Flash Bearish Signals

- Ethereum (ETH) facing challenges due to overleveraged futures positions and dwindling market liquidity.

- 10x Research report questions the true nature of ETH ETF inflows and highlights broader systemic concerns in the crypto market.

- Market liquidity reduction may hinder future price increases, while stablecoin flows suggest some major buyers are withdrawing as summer approaches.

- Both Bitcoin (BTC) and Ethereum experiencing significant corrections, transitioning from a bullish trend to a bearish one.

- 10x Research warns of potential bearish indicators for Bitcoin and Ethereum, with a focus on critical support levels being tested.

- Ethereum vulnerable to breaking below $2,420, as highlighted in the report, with Bitcoin also at risk of a bearish shift.

- Investors advised to exercise caution as bearish signals emerge in the cryptocurrency market.

Read Full Article

20 Likes

Zycrypto

161

Image Credit: Zycrypto

SenturoPay Debuts New App Experience: Simpler Crypto, Smarter Spending

- SenturoPay has launched a major app upgrade to provide a simpler and more intuitive digifi experience for crypto spenders.

- The redesign focuses on enhancing control, personalization, and usability for users.

- The new platform update aims to make crypto tools more approachable and practical.

- The app offers streamlined user interface, multi-card control, and a referral rewards system.

- It emphasizes user-centric design and ease of use for both experienced and new crypto users.

- SenturoPay's app enables users to manage multiple virtual crypto cards with individual configurations.

- Built-in incentives allow users to earn rewards by inviting friends and expanding the community.

- The platform provides faster access to spending tools with reduced login steps.

- Features like card controls and instant transaction history ensure transparency and security.

- SenturoPay is designed for everyday use, prioritizing practicality over trading or speculation.

- The app offers a clean UI, multi-card control, and referral rewards.

- SenturoPay aims to make digifi personal, intuitive, and instant for users.

- The platform helps users manage digital assets confidently and conveniently.

- SenturoPay's focus is on simplifying crypto use for everyday spending.

- The new app upgrade reflects the commitment to providing a user-friendly crypto experience.

- Users can explore the new features by visiting SenturoPay's official website.

Read Full Article

9 Likes

Cryptopotato

363

Image Credit: Cryptopotato

Metaplanet Buys 1,111 BTC, Total Holdings Now Top $1.1 Billion

- Metaplanet Inc. has purchased 1,111 BTC, increasing their total holdings to 11,111 BTC valued at over $1.12 billion.

- The acquisition was made at an average price of around $106,408 per Bitcoin.

- This move solidifies Metaplanet's position among the top ten largest corporate holders of Bitcoin globally.

- Chairman Simon Gerovich revealed plans to target 30,000 BTC by the end of 2025 and aims for 210,000 BTC by 2027.

- Metaplanet's rapid growth is driven by capital market activities involving stock acquisition rights and bonds.

- Metaplanet uses the "BTC Yield" metric to measure success, showing a 306.7% increase year-to-date.

- The company's stock was down 5.39% following geopolitical tensions in the Middle East and a recent decrease in the price of Bitcoin.

- Metaplanet's BTC purchases are part of a trend in which more companies are embracing Bitcoin as a treasury reserve asset.

- By June 16, 24 companies had collectively increased their Bitcoin holdings by 11,902 units.

- Institutions like Genius Group and H100 are also actively acquiring Bitcoin for their treasuries.

Read Full Article

21 Likes

Coinjournal

411

Image Credit: Coinjournal

Sonic, Four, SPX6900 surge amid market volatility

- Sonic, Four, and SPX6900 led crypto gains despite market turbulence.

- Top cryptocurrencies bounce back as equities stabilize, indicating renewed investor confidence.

- SPX6900's volatile market presence highlights its meme coin momentum.

- Crypto market experienced selling pressure after Bitcoin dropped due to US bombing of Iran's nuclear sites.

- Despite the weekend turmoil, Sonic, Four, and SPX6900 are among the top gainers showcasing double-digit gains.

- Sonic is trading at $0.28, Four at $2.57, and SPX at $1.07.

- Bitcoin and other major cryptocurrencies see upward movement, instilling cautious optimism among investors.

- Equities markets are recovering from losses, aligning with the crypto market's rebound.

- Fear & Greed Index shows a shift towards fear from neutral sentiment in the crypto market.

- Four records a 10% increase at $2.57 with a high 24-hour trading volume.

- Sonic surges by 9% trading at around $0.27, showing potential for further upside.

- SPX6900, a Solana-based meme coin, boasts a 10x rally but experienced profit-taking, currently trading at $1.06.

- SPX6900's market cap is around $985 million, ranking it in the top 100 cryptocurrencies.

- Despite recent declines, SPX6900 is up by 6% in the last 24 hours, aiming to break $2 but could drop to $0.90.

- Sonic, Four, and SPX6900 exemplify the crypto market's high-risk, high-reward nature amidst ongoing market uncertainty.

Read Full Article

24 Likes

Coinjournal

179

Image Credit: Coinjournal

Bitcoin price forecast: BTC holds above $105k ahead of FOMC

- Bitcoin's price remains above $105k amidst the ongoing Middle East crisis.

- Traders are closely monitoring the outcome of today's FOMC meeting, expecting potential market movements.

- Despite the bearish trend in the cryptocurrency market due to the Israel-Iran crisis, Bitcoin has shown resilience with only a 1.4% loss in 24 hours and a 4% loss over the past week.

- Investors' bullish sentiment is reflected in BTC holding steady at around $105k.

- Securing Bitcoin in a reliable digital wallet is essential for asset protection.

- The focus shifts to the FOMC meeting where interest rate decisions and their impact on the economy will be discussed.

- Analysts anticipate the Fed to maintain interest rates, but any unexpected signals could influence Bitcoin's price.

- Bank of America economist highlights the Fed's stance amidst evolving economic conditions.

- Bitcoin's resilience is supported by institutional interest, with companies like Metaplanet and Strategy increasing their Bitcoin holdings.

- US spot Bitcoin ETFs have seen significant inflows, indicating robust demand from financial institutions.

- Technical analysis suggests Bitcoin could rally towards $108k with the 50-day EMA providing support.

- Indicators like RSI and MACD show mixed signals but hint at potential price movements based on trader sentiment.

- A potential BTC recovery above $108,064 could pave the way for retesting the all-time high of $111k.

- The article was originally published on CoinJournal.

Read Full Article

10 Likes

Coindoo

74

Image Credit: Coindoo

Crypto Wallet Trezor Warns Users of Scam Emails Posing as Support

- Trezor warns users of scam emails posing as support to trick users into sharing private wallet backup information.

- Attackers abused Trezor's contact form to send fraudulent emails appearing as legitimate support replies.

- Trezor emphasizes the security rule of never sharing wallet backups, which must remain private and offline.

- The company confirms containment of the issue related to scam emails and has resolved the vulnerability in the contact form.

- Trezor stresses the importance of continuous security measures and advises users to remain vigilant against phishing attempts.

- Users are urged to exercise caution with all communications and prioritize the security of their private keys and recovery phrases.

Read Full Article

4 Likes

Coindoo

428

Image Credit: Coindoo

23 Billion Coins Sold Before Listing: Why BlockDAG Has the Best Bullish Signals

- BlockDAG has sold over 23 billion BDAG coins with none in circulation yet, signaling a bullish setup in Layer 1 history.

- The intentional delay in token circulation by BlockDAG indicates supply discipline and strategic planning.

- The project's unique approach includes no pre-dumps, early exit liquidity, and a structured token unlocking event.

- Avoiding early token unlocks aims to prevent sell pressure surpassing demand upon listing, unlike past crypto launches.

- BlockDAG's phased rollout plan prioritizes infrastructure readiness and decentralization before trading starts.

- The project's model involves building value into the network through mining and participation before liquidity, creating demand without selling pressure.

- By combining scalability, security, and innovative tools, BlockDAG is modernizing early Bitcoin ethos and building conviction among users.

- Buying BDAG at the limited-time price could lead to a projected ROI of 2,677%, offering early-stage participation before mainstream hype enters the market.

- The unique opportunity lies in entering the market before the hype cycle, influencers' involvement, and trading bots activity, with demand already present.

Read Full Article

25 Likes

For uninterrupted reading, download the app