Cryptography News

Coindoo

159

Image Credit: Coindoo

First Global Custody Support Rolled Out for Ripple’s RLUSD

- AMINA Bank has launched the first global custody support for Ripple's RLUSD, a dollar-pegged stablecoin backed by U.S. Treasuries and regulated by the New York Department of Financial Services.

- RLUSD has gained early demand with a circulating supply of $430 million, indicating the interest in compliant digital dollar alternatives.

- AMINA Bank, licensed by FINMA and under regulatory supervision in Abu Dhabi and Hong Kong, aims to bridge traditional banking with crypto finance, supporting RLUSD to meet global compliance standards.

- This move not only strengthens Ripple's position in the stablecoin market but also signals potential for future product expansions such as interest-bearing accounts, payment integrations, and more institutional trading solutions.

Read Full Article

9 Likes

Coinjournal

210

Image Credit: Coinjournal

Pi Network price faces an imminent crash as $10M Pi Coin is unlocked

- Pi Coin price nears all-time low ahead of $10 million token unlock, set to flood market with over 19 million coins.

- Bearish patterns suggest potential drop to $0.351, with Pi Coin trading around $0.498, down over 10% in the past week.

- Pi Network anticipates a 30-day unlock schedule releasing 304.7 million tokens into circulation, raising fears of selloff by early holders.

- Pi Coin decouples from Bitcoin rally, faces technical breakdown with bearish flag pattern and weakening sentiment among traders.

Read Full Article

12 Likes

Cryptoticker

416

Image Credit: Cryptoticker

Is PEPE Ready For A 50% Pump?

- PEPE price is showing signs of a possible shift in momentum after weeks of sideways movement and selling pressure in the meme coin market.

- The daily chart indicates early reversal signals with Heikin Ashi candles turning green, RSI nearing the neutral 50 level, and a recent breakout attempt from a tight range.

- Technical analysis suggests that if PEPE sustains above a key resistance level of 0.00001050, the next target could be around 0.00001150–0.00001200, representing a potential 45.2% upside.

- Traders are advised to watch for a daily close above 0.00001050, RSI crossing 50, and a volume spike to confirm real buyer interest for a possible rally towards 0.00001200–0.00001500.

Read Full Article

25 Likes

Coinjournal

84

Image Credit: Coinjournal

Dogwifhat up 20% in 7 days as Solana meme coin regains momentum

- Dogwifhat (WIF), a meme coin running on the Solana blockchain, has surged over 20% in the last seven days, reaching $0.92322.

- WIF now has a market capitalization of $931.21 million and ranks 75th among all cryptocurrencies by market cap.

- The recent increase in WIF's price follows a period of quiet after hitting an all-time high of $4.85 in March 2024. Price forecasts for 2025 range from $1.17 to $3.65.

- The surge in WIF's price aligns with a broader uptrend in Solana-based assets, reflecting growing interest in the Solana ecosystem as an alternative to Ethereum.

Read Full Article

5 Likes

Coindoo

182

Image Credit: Coindoo

DeepSeek AI Price Predictions: Where Next For PEPE, SOL, and APORK?

- Angry Pepe Fork introduces 'CommunityFi' enhancing community engagement and increasing token value.

- Early predictions suggest a price increase for APORK due to presale completion.

- SOL is rising with heightened activity in NFT marketplaces, potentially testing year highs.

- PEPE's potential burn event could reduce supply, leading to higher prices in the future.

Read Full Article

10 Likes

Medium

130

Image Credit: Medium

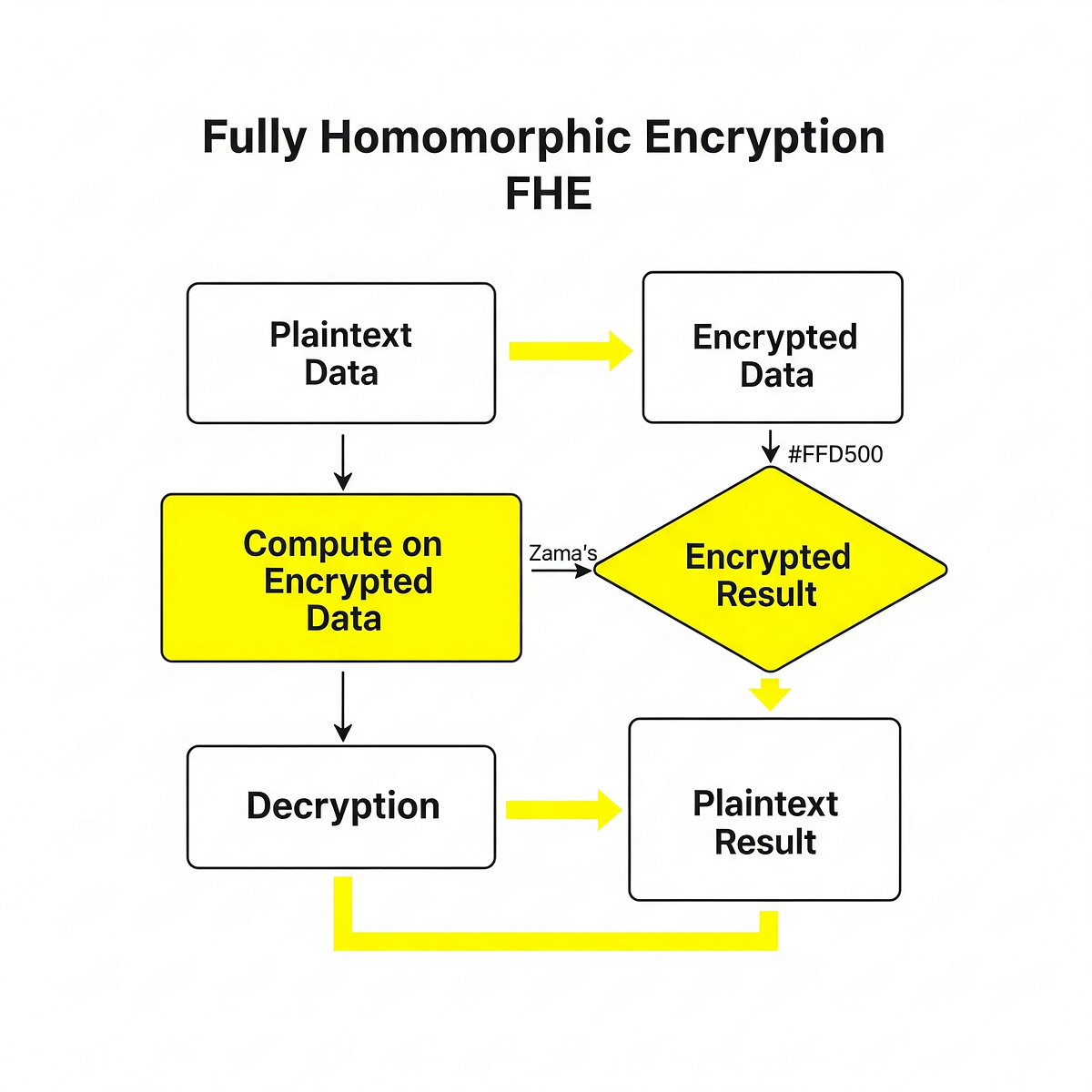

Zama and Fully Homomorphic Encryption: Unlocking Private Smart Contracts for the Future of…

- Blockchains provide transparency but lack confidentiality, hindering applications requiring privacy.

- Fully Homomorphic Encryption (FHE) allows computations on encrypted data without decryption, enabling private smart contracts.

- Zama is at the forefront of implementing FHE in blockchain technology, allowing for confidential execution of smart contracts.

- By using FHE, Zama aims to revolutionize industries like healthcare, finance, and AI by enabling encrypted data processing on-chain.

Read Full Article

7 Likes

Cryptopotato

387

Image Credit: Cryptopotato

Bitcoin Price Analysis: Will BTC Hit $120K in the Next Few Days?

- Bitcoin is approaching its all-time high of $111K with renewed buying interest and strong technical momentum.

- Expectations are growing for a potential breakout that could propel BTC to the $120K range soon.

- Technical analysis indicates a Golden Cross forming on the 100-day and 200-day moving averages, signaling a bullish trend.

- There is significant focus on the $111K resistance level as a key determinant for a potential rally towards $120K.

Read Full Article

23 Likes

Coindoo

248

Image Credit: Coindoo

Is Bitcoin About to Surprise Everyone Again?

- Trader Peter Brandt shared an inverted chart of Bitcoin, suggesting consolidation and a potential move higher rather than a bearish pattern.

- Bitcoin is currently around $109,000, consolidating in a support zone since mid-June, hinting at a base for a potential upward move.

- Technical projections indicate Bitcoin could target $115,000 to $118,000 in the short term if the current support holds.

- Brandt's message highlights the importance of perspective in trading and the impact of visual bias in technical analysis.

Read Full Article

14 Likes

Financemagnates

168

Image Credit: Financemagnates

CFDs Traders Are Trading in a "Closed Box": Can Crypto Perpetuals Challenge This?

- CFDs emerged in the 1990s as trading tools for institutions and later became a retail product, offering access to global markets with leverage but lack transparency.

- Perpetual futures, introduced by BitMEX in 2016, have revolutionized trading by offering a product that tracks spot markets without the need for brokers to set prices.

- CFDs have drawbacks like trading against the broker, spread manipulation, and price discrepancies. In contrast, perpetual futures offer transparency with public order books and real-time market dynamics.

- Perpetual futures provide a transparent, competitive market structure, attracting significant trading volumes, and offering simplicity, efficiency, and limited risk for traders.

Read Full Article

10 Likes

Coindoo

58

Image Credit: Coindoo

Chinese Tech Giants Urge Approval for Offshore Yuan Stablecoin

- Chinese tech giants like JD.com and Ant Group are pushing for approval to launch an offshore yuan stablecoin to enhance the currency's global presence.

- They aim to issue Hong Kong dollar stablecoins to address the dominance of US dollar stablecoins in global transactions.

- China's efforts to internationalize the yuan face challenges due to capital restrictions and the 2021 crypto ban, with the yuan's global payment share dropping.

- The firms see an opportunity in Hong Kong's evolving crypto regulations to launch digital yuan products internationally and compete in the digital trade landscape.

Read Full Article

3 Likes

Cryptoticker

109

Image Credit: Cryptoticker

Bitcoin Price Prediction: Will BTC Hit $120K in July? Can ETH Finally Catch Up?

- Bitcoin surged above $110K amid significant short liquidations in early July, with potential targets set at $112K-$116K, driven by a mix of geopolitical factors.

- The 'One Big Beautiful Bill' in the U.S., Elon Musk's opposition, U.S.-China relations, Jerome Powell's possible resignation, and a dual Bitcoin-Ether ETF filing are influencing the crypto market.

- Potential impacts include bullish sentiments if the bill is signed, positive ramifications of U.S.-China tech collaboration, and speculation on crypto market reactions to Powell's tenure.

- Ethereum struggles around $2,600 but could see an upswing with the progress of a proposed dual Bitcoin-Ethereum ETF and potential changes in the U.S. monetary policy.

Read Full Article

6 Likes

Zycrypto

416

Image Credit: Zycrypto

The Open Platform Becomes First Web3 Ecosystem in Telegram to Hit $1 Billion Valuation

- The Open Platform has reached a $1 billion valuation after completing a series A funding round, becoming the first unicorn in the TON-based ecosystem in Telegram to reach this milestone.

- The funding round, led by Ribbit Capital and supported by key players like Pantera Capital, has raised $28.5 million, with a total of $70 million secured in this and the previous round.

- The Open Platform, built on the TON Blockchain, aims to expand geographically with a focus on the U.S., EU, and other regions. The funding will support initiatives like go-to-market strategies, regulatory compliance, and security enhancements.

- The project, led by CEO Andrew Rogozov, plans to leverage Telegram's global reach to scale blockchain product adoption. Its consumer-facing apps like Wallet in Telegram and Tonkeeper aim to bring blockchain technology to everyday digital experiences.

Read Full Article

25 Likes

Coindoo

46

Image Credit: Coindoo

Crypto-Fueled Corporate Treasuries Raise Growth Potential — and Collapse Risks

- Over 130 publicly traded companies are holding Bitcoin, Ethereum, and Solana in their corporate treasuries through capital raises to invest in crypto assets directly.

- The strategy of companies raising funds in bull markets, issuing stocks above net asset value, and investing in crypto can lead to increased market caps, attracting investors and enabling further fundraising.

- However, Franklin Templeton warns of risks associated with this strategy, such as a potential reversal in token prices leading to NAV discounts, cutting off access to capital, and forcing liquidation of crypto holdings.

- Analysts highlight the high-risk nature of heavily investing in crypto for corporate treasuries, with concerns about the impact of market downturns and excessive leverage in the next bear cycle.

Read Full Article

2 Likes

Coindoo

3.9k

Image Credit: Coindoo

Why These 3 Projects Are the Best Crypto Coins to Invest in Now for Long Term Growth

- Qubetics, Cardano, and Tron are highlighted for long-term crypto investment potential.

- Qubetics stands out for its dVPN and rapid market performance post-launch.

- Cardano focuses on governance and security, while Tron excels in high-throughput transactions.

Read Full Article

8 Likes

Coindoo

67

Image Credit: Coindoo

U.S. Jobs Report Lower Than Expectations, Bitcoin Surges on Optimism

- The U.S. jobs report for June showed a lower unemployment rate of 4.1% and an increase in nonfarm payrolls by 147,000, surpassing analyst expectations.

- The positive job data indicates resilience in the U.S. labor market despite concerns about an economic slowdown.

- Markets reacted positively to the news, with Bitcoin surging above $110,000 as traders saw the employment figures as a sign of economic stability.

- The strong job creation eases fears of an economic downturn, potentially giving the Federal Reserve more flexibility regarding rate cuts.

Read Full Article

4 Likes

For uninterrupted reading, download the app