DeFi News

Hackernoon

0

Image Credit: Hackernoon

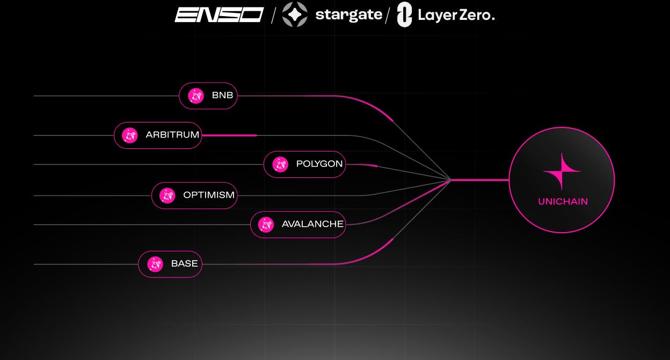

How Enso Is Migrating $3.5B in DeFi Liquidity to Unichain with a Single Click

- Enso, Stargate, and LayerZero have collaborated to create a tool allowing Uniswap liquidity providers to migrate to Unichain with just one click, potentially moving $3.5 billion in liquidity.

- The tool simplifies a previously complex process involving multiple manual steps in cross-chain liquidity migration.

- Enso's tool automates tasks such as withdrawing LP tokens, bridging assets, and depositing assets into Uniswap v4 pools on Unichain with a single transaction.

- Stargate serves as a liquidity transport layer, while LayerZero functions as a communication protocol in this collaboration.

- This partnership streamlines operational complexity, concentrates liquidity on Unichain, and demonstrates the concept of composability in DeFi applications.

- The partnership highlights the importance of making blockchain transactions accessible and reducing friction for users to drive mass adoption.

- This innovation raises questions regarding trust and abstraction, as users must rely on smart contracts and middleware providers.

- The collaboration sets a standard for liquidity migration, showcasing a practical implementation of composability in the DeFi space.

- The tool's success could signify a milestone in reducing DeFi friction while emphasizing decentralization and control.

- Developers in Web3 may view this partnership as a model for future liquidity migrations across various blockchain architectures.

Read Full Article

Like

Medium

413

Image Credit: Medium

Drosera Network: Building the Future of Decentralized Application Security

- Drosera Network introduces a proactive approach to decentralized application security by combining smart contract 'Traps,' real-time monitoring, and a decentralized marketplace for security services.

- The network aims to create a security economy, where applications define security needs via smart contracts and operators provide security services in exchange for rewards.

- Traps are programmable security agents that collect data, analyze behavior, and trigger actions, while operators are decentralized node runners who execute detection logic in real time.

- Drosera stands out for its decentralized nature, economic efficiency, programmability, and scalability by building on Ethereum's validator ecosystem and EigenLayer's restaking model.

Read Full Article

24 Likes

Dev

50

Image Credit: Dev

Evaluating the Legitimacy of Drip Network: A Comprehensive Analysis of DeFi Innovation

- The article provides a thorough analysis of the Drip Network, a decentralized finance protocol on Binance Smart Chain, covering its background, features, community engagement, challenges, and future trends.

- Key points discussed include transparency, technology, security, and sustainable strategies, with practical use cases, tables, and community insights provided.

- Drip Network leverages deflationary smart contracts, the Binance Smart Chain, and a community-driven governance model for daily return distribution.

- Concerns on sustainability, regulatory risks, security vulnerabilities, and market volatility are highlighted as challenges for Drip Network.

- Future predictions include enhanced transparency through audits, improved financial models, regulatory adaptation, multi-chain interoperability, and community-driven governance.

- The article emphasizes the need for continued monitoring, due diligence, and engagement to navigate the evolving DeFi landscape effectively.

- Areas for future innovation in Drip Network include third-party audits, multi-chain interoperability, decentralized governance, and dynamic reward mechanisms.

- Investors are advised to critically evaluate both the strengths and challenges of projects like Drip Network for informed decision-making in the DeFi space.

- Continuous monitoring of regulatory developments, technical advancements, and community growth is essential for the sustainable growth of decentralized financial ecosystems.

- The article suggests exploring resources like CoinDesk and CoinTelegraph for more insights on DeFi innovations and related topics.

- It also recommends further reading on open source and blockchain intersections for a deeper understanding of the evolving financial landscape.

Read Full Article

3 Likes

Dev

0

Image Credit: Dev

Unlocking Passive Income: Exploring Drip Network's Daily Rewards in the DeFi Universe

- The article delves into the Drip Network's daily rewards system in decentralized finance (DeFi).

- Key concepts explored include staking, compounding yields, smart contract security, and referrals.

- Drip Network offers a 1% daily return on staked $DRIP tokens with compounding gains and a maximum payout cap.

- The platform's staking process on Binance Smart Chain is secure and user-friendly.

- Its referral system drives community growth and offers bonus incentives for users.

- Challenges like market volatility, smart contract risks, liquidity constraints, and regulatory changes are addressed.

- Future trends include enhanced security, blockchain interoperability, and community governance evolution.

- Innovations could involve advanced yield farming techniques and expanded referral programs.

- Drip Network's approach to passive income through staking and community engagement is highlighted.

- Understanding risks and embracing opportunities in DeFi can lead to a rewarding crypto journey.

Read Full Article

Like

Bitcoinsensus

36

Image Credit: Bitcoinsensus

Crypto Projects Lost $92M in April: 2.2x Increase Compared to March

- Crypto projects lost $92 million in April, marking a 2.2x increase compared to March. Ethereum, BNB Chain, and Base were the most affected networks.

- 100% of the incidents affected DeFi, with no losses in CeFi. The largest attacks targeted UPCX, KiloEx, and Loopscale.

- Cumulatively, DeFi crypto losses in 2025 have already surpassed the entire 2024 total, reaching $1.74 billion. All incidents in April were hacks, not fraud.

- Despite blockchain security, external vulnerabilities contribute to direct attacks. The trend suggests a rise in attacks due to growing interest in blockchain amid geopolitical and economic uncertainty.

Read Full Article

2 Likes

Sdtimes

369

Image Credit: Sdtimes

The new frontier of API governance: Ensuring alignment, security, and efficiency through decentralization

- Decentralized architectural landscapes pose challenges for traditional, centralized API governance models as applications rely on APIs developed by distributed teams.

- Modern organizations need to focus on proactive API management during planning, design, and development stages for compliance, security, and autonomy.

- Optimized API governance in decentralized environments involves collaboration, flexibility, shared responsibility, and clear guidelines.

- Using code-based governance policies, tools, and automation ensures consistent standards across decentralized teams, reducing errors.

- AI plays a crucial role in enhancing API governance by automating tasks, improving efficiency, and aiding decision-making processes.

- Design-time API governance focuses on standards, contract testing, security, documentation, compliance, and incorporating AI for efficiency.

- Runtime API governance involves monitoring, access control, traffic management, observability, versioning, and using AI for real-time insights and threat detection.

- Collaborative culture and AI integration are key for successful decentralized API governance, enabling innovation while ensuring security and compliance.

- Effective API governance is crucial for organizational agility and innovation in a rapidly evolving API-driven landscape.

- Decentralized API governance is not just about compliance but a strategic enabler of innovation and agility in the API-centric world.

Read Full Article

22 Likes

Medium

18

Image Credit: Medium

Mitosis: Where Liquidity Grows Up

- Mitosis is a next-gen protocol in the DeFi space that aims to provide programmable, transparent, and democratized liquidity for users.

- Mitosis allows users to unlock their capital, automate its productivity, and engage in liquidity governance through features like Ecosystem-Owned Liquidity (EOL) and the Matrix DeFi marketplace.

- Users can transform their assets into position tokens, trade positions, use them as collateral, separate yield from principal, and create new financial instruments through Mitosis.

- Mitosis offers fair access, real transparency, and community governance in DeFi, providing users with opportunities to participate in curated campaigns, maximize control, and explore new strategies in a user-friendly manner.

Read Full Article

1 Like

Dev

386

Image Credit: Dev

Exploring Blockchain Governance: Navigating Decentralization and Beyond

- Blockchain governance merges on-chain and off-chain systems for decentralized networks, facilitating transparency and scalability.

- Evolving from Bitcoin's model, platforms like Ethereum and Tezos embrace sophisticated governance models.

- Key aspects include cross-chain interoperability, AI integration, and regulatory compliance in governance frameworks.

- Governance models encompass on-chain, off-chain, and hybrid systems to ensure transparent decision-making.

- Features like decentralization, transparency, incentive alignment, and scalability characterize blockchain governance.

- Integration with AI, DeFi, NFTs, and regulatory compliance showcases the versatility of blockchain governance.

- Practical applications span DeFi, NFT marketplaces, and even government sectors for voting enhancements.

- Challenges include scalability, centralization risks, security vulnerabilities, regulatory uncertainties, and user engagement.

- Future innovations revolve around AI integration, cross-chain governance, dynamic tokenomics, and regulatory frameworks.

- Blockchain governance ensures a secure, transparent, and equitable digital ecosystem, evolving with advanced technologies.

Read Full Article

23 Likes

Cryptonews

105

Ledger Warns of New Scam Involving Fake Letters Asking for Recovery Phrases

- Scammers are targeting Ledger users with fake letters urging them to scan a QR code and provide their 24-word recovery phrase under the guise of a “security update”.

- The phishing scheme exploits data from Ledger's 2020 breach, exposing personal details of over 270,000 users, including home addresses.

- Ledger reiterated that it never asks for seed phrases and warned users to ignore such requests, regardless of how legitimate they may appear.

- Despite closely mimicking Ledger's branding, the fake letters aim to steal recovery phrases, prompting Ledger to caution users against engaging with any such solicitations.

Read Full Article

6 Likes

Pymnts

56

Image Credit: Pymnts

Report: Circle Rejects Ripple’s $4 Billion to $5 Billion Takeover Bid

- Circle Internet Group rejected a $4 billion to $5 billion takeover bid from Ripple, citing the amount as too low.

- Ripple is still interested in a deal with Circle but has not decided whether to make another offer. Circle is focusing on its initial public offering (IPO).

- Ripple acquired prime brokerage Hidden Road for $1.25 billion, becoming the first cryptocurrency company to own and operate a multi-asset prime broker.

- An $8.2 billion wave of crypto deals, including Ripple's acquisition of Hidden Road, was initiated by the cryptocurrency-friendly White House.

Read Full Article

3 Likes

Bitcoinist

289

Image Credit: Bitcoinist

UK Sets The Stage For New Crypto Regulation With Draft Rules On Exchanges And Stablecoins

- The UK has introduced draft legislation to regulate the cryptocurrency industry, focusing on exchanges, dealers, and agents.

- The regulations aim to ensure transparency, consumer protection, and operational resilience for firms dealing with UK customers.

- UK Finance Minister Rachel Reeves emphasized the importance of international cooperation to make the UK a global leader in digital assets.

- Industry concerns have been raised over the Financial Conduct Authority's restrictive approval process, hoping for a more balanced approach to encourage growth.

Read Full Article

17 Likes

Medium

386

Image Credit: Medium

Web3PvZ & Telgather: Reflections Around TOKEN2049 Season

- TOKEN2049 season in Dubai was a hub for the Web3 world, with meaningful conversations happening in lounges and side events.

- Web3PvZ and Telgather focused on deepening alignment with those shaping the future of on-chain social, gaming, and coordination tools.

- Convergence of degen energy with structured innovation was a key theme, emphasizing rewarding true believers and maintaining fun in systems.

- Presence and signal mattered more than badges, with upcoming plans for Telgather including rollouts on Kaia and new integrations in the on-chain gaming sphere.

Read Full Article

23 Likes

TronWeekly

303

Image Credit: TronWeekly

Ledger Warns Users of Scam Letters Demanding Seed Phrases

- Ledger users are being targeted by scammers sending fake physical letters that mimic official communications, asking for their seed phrases.

- The scam letters appear legitimate, using Ledger’s logo, business address, and threats of account deactivation to pressure recipients.

- This phishing attempt may be connected to the 2020 Ledger data breach that exposed over 270,000 customers’ personal details, including home addresses.

- A recent crypto scam involves sending physical letters to Ledger hardware wallet owners, requesting confirmation of private seed phrases to steal funds.

Read Full Article

18 Likes

TheNewsCrypto

13

Ledger Scammers Turned to Physical Phishing To Steal Seed Phrases

- Scammers have abandoned traditional phishing methods to use physical mail as their new tactic in attacks.

- The security of Ledger hardware wallet users is at risk as scammers are sending deceptive mail letters demanding vital seed phrases.

- The scam exploits a 2020 data breach where over 270,000 users' personal information was exposed.

- Legitimate hardware wallet providers, like Ledger, never ask for seed phrases, so users need to stay vigilant against such scams.

Read Full Article

Like

Cryptonews

308

1inch Expands to Solana, Unlocking Over 1 Million New Tokens for DeFi Traders

- 1inch has expanded to Solana, offering MEV-protected swaps and Fusion mode for DeFi traders.

- This integration unlocks over 1 million Solana-based tokens for trading on 1inch with wallet support for Phantom and TrustWallet.

- 1inch's launch on Solana brings Fusion mode, on-chain swaps, and developer APIs to the DeFi ecosystem.

- Solana has been outpacing Ethereum in DEX volume, transaction counts, and active wallets, making it an attractive platform for DeFi activities.

Read Full Article

18 Likes

For uninterrupted reading, download the app