DeFi News

Pymnts

412

Image Credit: Pymnts

Visa: Stablecoins Represent Opportunities in Emerging Markets, Cross-Border Money Movement

- Visa's Chief Product and Strategy Officer, Jack Forestell, sees stablecoins as an important opportunity for use cases in emerging markets and specific cross-border money movements.

- Stablecoins can address problems such as the unavailability of U.S. dollars, high volatility of local fiat currency, and needs for remittances and B2B payments.

- Visa plans to leverage partnerships with stablecoin native partners and financial institutions to enhance its business growth.

- Forestell mentioned that the Senate's passage of the GENIUS Act stablecoin legislation is a crucial step towards regulatory clarity for stablecoins in the U.S.

- Visa is already active in the stablecoin space by connecting stablecoin and crypto platforms with its global network, enabling cross-border money movement solutions, and offering programmable money solutions.

- While stablecoins hold potential in emerging markets, Forestell noted that in developed markets like the U.S., consumers and businesses may prefer traditional fiat currency and Visa credentials for payments.

- Visa partnered with Yellow Card to explore stablecoin use cases across African markets and collaborated with Rain, a card-issuing platform for stablecoins, to enhance real-time global payments.

- The partnership with Rain allows FinTechs and wallets to issue on-chain cards and settle transactions in stablecoins.

- Visa is actively involved in exploring stablecoin opportunities and enhancing payment solutions in various market segments.

- The use of stablecoins is positioned to grow in specific scenarios where traditional banking systems may not adequately meet the needs of users.

- Stablecoins provide a unique value proposition in facilitating cross-border money movement and addressing currency volatility concerns in certain regions.

- Partnerships with stablecoin providers like Yellow Card and Rain demonstrate Visa's commitment to innovating in the digital payment landscape.

- However, the adoption of stablecoins in developed markets might be slower due to the availability of established payment options.

- Visa's engagement in stablecoin initiatives reflects the company's strategic focus on leveraging emerging technologies to enhance its global payment network.

- Overall, Visa recognizes the potential of stablecoins to revolutionize financial services and is actively exploring ways to integrate these digital assets into its existing payment ecosystem.

Read Full Article

24 Likes

Pymnts

83

Image Credit: Pymnts

Kraken Launches Blockchain Partnership With DeFi Development

- Decentralized finance company DeFi Development has partnered with Kraken.

- The collaboration involves listing tokenized stock of DeFi Development's publicly traded equity on the Solana blockchain as part of Kraken's xStocks platform.

- The tokenized representation of DeFi Dev Corp. will trade under the symbol DFDVx.

- This partnership merges traditional capital markets with the Solana ecosystem, allowing for onchain access to the Company's equity.

- DFDVx being live onchain enables developers, institutions, and DeFi protocols to create new financial products.

- DeFi Dev Corp CEO views tokenizing stock as a DeFi building block for innovation.

- Kraken's xStocks general manager highlighted the demand for onchain access to US equities like DFDV.

- The tokenization of DFDV's shares occurs amidst increasing demand for real-world assets on Solana.

- Real-world assets offer CFOs opportunities in liquidity management, yield generation, and collateralization strategies.

- Kraken aims to offer DFDVx on its exchange.

- The partnership signifies a milestone in merging traditional finance with blockchain.

- The integration of DFDV's equity into the Solana ecosystem enables new financial possibilities.

- RWAs are based on real-world value and can enhance liquidity management for CFOs and treasurers.

- Demand for onchain access to tokenized equity like DFDVx is growing within the crypto community.

- The partnership marks a significant step in tokenizing equity for onchain finance innovations.

Read Full Article

5 Likes

Bitcoinsensus

363

Image Credit: Bitcoinsensus

ICOs & Top Coins to Watch UOMI, XO, ETM, PIPE, AIPAY & KAIA, SEI, FORM

- UOMI IDO on KingdomStarter from June 24 to 25, TGE on June 26.

- XO Megadrop on Bybit from June 20 to 25, TGE on June 26.

- ETM IDO and TGE on TrustFi from June 26 to 27.

- PIPE dual public sale on Coinlist from June 26 to July 3.

- AIPAY TGE scheduled for September 30.

- Kaia (KAIA) +17.59%, $0.1893, volume $112.66M.

- Sei (SEI) +10.91%, $0.2043, volume $230.03M.

- FORM +3.44%, $2.62, volume $26.80M.

- AI blockchains, metaverses, and decentralized CDNs in the IDO spotlight.

- Rising tokens related to high-throughput L1s, applied DeFi interfaces, and infrastructure ecosystems.

Read Full Article

21 Likes

Coin Telegraph

376

Image Credit: Coin Telegraph

The crypto trap that won’t let you sell — and how to avoid it

- Honeypot crypto scams lure investors with fake liquidity, price movement, and hype, trapping funds permanently by rigged contracts.

- Modern variations of honeypots involve tampered cold wallets sold via platforms like TikTok with preloaded private keys for instant fund theft.

- Scammers now utilize high sell tax honeypots and 'honeypot-as-a-service' kits, making it easier to target both new and experienced users.

- To avoid falling into these scams, it's recommended to test-sell before committing funds, analyze smart contracts, avoid sudden hype, and purchase wallets from official sources.

- Honeypot crypto scams operate by deceiving users into buying tokens that cannot be sold, with the scammer's wallet being the only one capable of withdrawals.

- Honeypots utilize tactics like overriding transfer functions, high sell taxes, hidden blacklists, and fake liquidity pools to trap unsuspecting investors.

- One of the dangers of honeypots is that they can even deceive tech-savvy individuals due to their sophisticated construction and appearance of normal trading activity.

- These scams work by setting traps with fake liquidity, blocking sell functions for victims, and ultimately allowing scammers to drain profits by withdrawing funds.

- Types of honeypot scams include smart contract honeypots, high sell tax schemes, fake or pulled liquidity traps, hardware wallet scams, and 'honeypot-as-a-service' kits.

- Honeypots differ from rug pulls in the way they trap investors, with honeypots blocking selling while rug pulls involve draining liquidity, leaving holders with worthless assets.

Read Full Article

22 Likes

TronWeekly

75

Image Credit: TronWeekly

Chainlink Unlocks $149M LINK on Binance, Will Price Rally?

- Chainlink unlocks $149 million worth of LINK tokens on Binance, leading to price speculation.

- After the influx of tokens to exchanges, LINK price decreases by 7.4%, triggering analysis of historical patterns.

- Chainlink's position in DeFi and oracle technology instill confidence in long-term investors.

- The quarterly token unlock process starts in 2022, releasing 17.875 million LINK coins.

- Majority of unlocked tokens were transferred to Binance, a significant cryptocurrency exchange.

- Trading platforms witness a movement of approximately $225 million worth of LINK this week.

- Despite a 29% 30-day price decline, Chainlink experiences an increase in trading volume by 185%.

- The price of LINK fell by 7.4% in the last 24 hours, hitting $11.4, the lowest since April.

- Historical data suggests that LINK's price typically rises after previous token unlocks, leading to predictions of a potential price surge.

- Chainlink's technology, crucial for DeFi, offers solutions like proof-of-reserves to enhance transparency with stablecoins.

- The cross-chain feature of Chainlink aids blockchain interoperability, positioning it as a key player in Oracle solutions bridging real-world data with blockchains.

Read Full Article

4 Likes

Global Fintech Series

405

Image Credit: Global Fintech Series

Blueprint Finance Raises Additional $9.5 Million to Build the Next Generation of DeFi Infrastructure Solutions

- Blueprint Finance raises $9.5 million in funding led by Polychain Capital and including strategic investment from Yzi Labs.

- The company, known for Ethereum-based Concrete and Solana-based Glow Finance, has raised over $17 million to date.

- The funding round also saw participation from other industry investors like VanEck, Selini Capital, and BitGo.

- Blueprint Finance emerged from stealth last year with the launch of Concrete, a protocol for DeFi-native asset management.

- Concrete has introduced products like liquidity bootstrapping campaigns and yield strategy vaults with $650 million TVL.

- The new funds will support growth of Concrete and Glow protocols, new products, and institutional adoption.

- Blueprint expanded into the Solana ecosystem with Glow Finance in April, introducing innovative features and products.

- CEO Nic Roberts-Huntley highlights the team's progress and ability to serve both retail and institutional users.

- Polychain Capital's Josh Rosenthal emphasizes Blueprint's focus on security and liquidity in the evolving DeFi landscape.

- The Blueprint Finance team comprises professionals from traditional finance and Web3, with key strategic hires to drive growth.

Read Full Article

24 Likes

Global Fintech Series

104

Image Credit: Global Fintech Series

Veda Raises $18 Million Led by CoinFund to Bring Institutional-Grade DeFi Yield to Consumer Apps Through $3.7 Billion+ Vault Platform

- Veda, a DeFi vault platform, raised $18 million in funding led by CoinFund with participation from various other investors and angel investors.

- The platform aims to bring DeFi to consumer and institutional audiences by simplifying its complexity and managing risk on behalf of users while preserving self-custody, transparency, and security.

- Veda provides a universal vault infrastructure platform that abstracts away DeFi complexities, allowing for a seamless user experience for transacting through vaults.

- The platform has a BoringVault framework, the most used vault standard in DeFi, which has garnered over 100,000 users since its launch.

- Veda's vault standard powers yield strategies across various segments, including yield vaults, liquid restaking tokens, native yield for chains, pre-deposit campaigns, and wallets.

- The platform has over $3.7 billion in Total-Value Locked (TVL) and plans to partner with a top five global centralized exchange in the near future.

- Veda was founded in early 2024 and is led by CEO Sun Raghupathi, CTO Joe Terrigno, and COO Stephanie Vaughan, with a focus on providing essential infrastructure for the future of financial markets.

- David Pakman from CoinFund expressed confidence in Veda's potential to meet the growing need for on-chain wealth management and the foundational infrastructure it provides for the future of financial markets.

Read Full Article

6 Likes

Medium

29

Image Credit: Medium

ColdStack x Copute.ai: Powering the Next Generation of Decentralized AI and Cloud Gaming

- The demand for compute power is growing exponentially, challenging traditional infrastructure providers like AWS, Azure, and OpenAI.

- Centralization in cloud services leads to high costs and limited innovation, speed, and flexibility.

- ColdStack and Copute are addressing these challenges by offering decentralized cloud storage and compute solutions, respectively.

- ColdStack aggregates multiple Web3 storage networks like Filecoin, Arweave, and Storj to simplify access for developers.

- Copute transforms idle GPUs into community-powered infrastructure for AI, LLMs, and cloud gaming.

- The partnership between ColdStack and Copute aims to create a unified Web3-native backend for decentralized storage and compute.

- This collaboration democratizes access to high-performance compute globally and challenges centralized providers.

- Copute is actively engaging in enterprise pilots with tech and gaming brands like TikTok, Razer, and Mihoyo.

- ColdStack continues to attract developers and enterprises seeking transparent and resilient storage solutions.

- The partnership sets a new standard for decentralized infrastructure: community-powered, modular, and scalable.

Read Full Article

1 Like

Global Fintech Series

243

Image Credit: Global Fintech Series

DeFi Technologies Engages ShareIntel and Urvin to Enhance Market Transparency and Shareholder Intelligence

- DeFi Technologies engaged ShareIntel and Urvin to enhance market transparency and shareholder intelligence.

- The initiative aims to deepen market intelligence and strengthen transparency for DeFi Technologies' shareholders.

- DeFi Technologies implements tools and analytics to gain greater visibility into trading activity surrounding its common shares.

- ShareIntel uses its DRIL-Down technology to track and analyze stock trading activity from various entities.

- Urvin specializes in analyzing cross-border trading behavior and pattern recognition related to trading activities across markets.

- Olivier Roussy Newton, CEO of DeFi Technologies, emphasizes the importance of transparency and informed decision-making.

- DeFi Technologies aims to understand its shareholder base better and maintain market integrity through these partnerships.

Read Full Article

14 Likes

Global Fintech Series

92

Image Credit: Global Fintech Series

NetXD Unveils End-to-End TradFi-DeFi Infrastructure Platform

- NetXD announces the launch of a full-stack infrastructure bridging traditional (TradFi) and decentralized finance (DeFi), combining programmable ledger, real-time payments, and stablecoin support.

- The platform offers a programmable ledger, global payments hub, bank-grade HD wallet, Large Action Model (LAM), and AI engine for institutions to manage tokenized products, money movement, and back-office workflows.

- This release follows the U.S. Senate's passing of the GENIUS Act, emphasizing the need for compliant digital-asset infrastructure.

- Key benefits include XD Ledger for tokenizing assets, XD Payments for unified payment processing, XD AI for automation of contracts and operations, and an Enterprise HD Wallet Suite for self-custody.

- NetXD aims to streamline operations and drive innovation for financial institutions without the burden of complex integrations, according to Chairman Suresh Ramamurthi.

- The platform allows institutions to execute transactions across various blockchains and dApps, offering cost savings, speed, and compliance at scale.

- The infrastructure supports real-time payments through different rails and blockchain networks, including stablecoins, for enhanced efficiency.

- NetXD's AI engine automates middle- and back-office tasks, turning contracts and policies into executable workflows with audit trails.

- The Enterprise HD Wallet Suite ensures secure access to multiple chains and tokens, including stablecoins, with advanced security measures.

- Financial institutions can tokenize deposits, settle transactions, enforce governance, and automate processes using NetXD's infrastructure.

- The integration of traditional and decentralized finance allows for seamless money movement and product management.

- NetXD promotes innovation and customer-centric services by simplifying processes and reducing operational costs.

- The platform's release aligns with regulatory efforts to establish compliant frameworks for digital assets, endorsing the significance of fully collateralized infrastructures.

- Financial institutions can leverage NetXD's solution to enhance their digital offerings and streamline operations in the evolving finance landscape.

- The announcement marks a significant step towards bridging the gap between traditional and decentralized finance systems, catering to the evolving needs of the financial industry.

Read Full Article

5 Likes

Medium

243

Exploring AgentXYZ’s Innovative Ambassador Program: A Deep Dive into AI-Powered Crypto Trading…

- AgentXYZ has launched an ambassador program with a $30,000 reward pool and a unique drafting system to incentivize community engagement.

- This initiative aligns with the trend of blockchain companies adopting gamified marketing strategies to boost engagement.

- Ambassadors can earn rewards, 0% trading fees, and exclusive perks, with top performers winning significant prizes based on leaderboard rankings.

- The program combines skill and luck through a drafting system that offers better odds to higher-ranked participants in a probabilistic draw.

- AgentXYZ's ecosystem is AI-driven, providing real-time insights through 28 AI agents in its trading terminal.

- Joining the program involves signing up via a provided link, tracking leaderboard ranks, and following @AgentXYZ_ai for updates.

- The program reflects trends in AI finance and gamification strategies, aiming to build brand loyalty and engage users in a merit-based system.

- AgentXYZ's Ambassador Program stands out in the crypto market with its rewards, AI insights, and gamified elements, offering opportunities for traders and enthusiasts.

- The focus on technology, community, and rewarding top performers showcases the evolving landscape of crypto trading with AI-powered solutions.

- The program emphasizes the intersection of technology and community, signaling a shift in how crypto platforms operate with a focus on brand loyalty and user advocacy.

Read Full Article

14 Likes

Medium

88

7 Ways Mira Network is Making AI Trustworthy Again

- Mira Network is a decentralized protocol verifying AI output for trustworthiness.

- Seven projects are already using Mira Network for various applications:

- 1. Gigabrain for improved AI insights in crypto trading.

- 2. Astro247 for trustworthy AI astrology.

- 3. Learnrite for more accurate AI-generated test prep.

- 4. Kernel for fault-tolerance enhancement in AI on BNB Chain.

- 5. FereAI for real-time verification of crypto analytics.

- 6. Storacha for creating a decentralized memory bank for AI actions.

- 7. SendAI & ZerePy for dependable AI agents across blockchain and social media.

- Mira aims to establish verifiable, reliable, and decentralized AI.

- Trustworthiness in AI output is becoming crucial in the next era of technology.

- To know more, visit @Mira_Network and explore the world of decentralized AI.

- Key hashtags: #AI #DecentralizedAI #Crypto #Blockchain #DePIN #Web3

Read Full Article

5 Likes

Bitcoinist

160

Image Credit: Bitcoinist

French Crypto User Assaulted Over Ledger Wallet In Shocking Attack

- A 23-year-old man in a Paris suburb was kidnapped and forced to reveal his digital keys related to cryptocurrencies, highlighting the dangers associated with holding digital assets.

- The victim was seized in Maisons-Alfort, held for several hours, and then released in nearby Créteil after being subjected to violence to divulge information.

- The attackers demanded 5,000 euros in cash and the key to his Ledger hardware wallet, emphasizing the trend of physical attacks targeting cryptocurrency holders.

- Similar incidents, including 'wrench attacks,' have been reported worldwide, with cases in India, Hong Kong, the Philippines, Spain, and the United States.

- Experts caution that hardware wallets may not provide foolproof protection in violent situations, prompting the need for enhanced security measures like decoy accounts or multi-signature setups.

- Despite an increasing number of attacks on crypto users, arrests in such cases remain infrequent, and victims often choose not to report the incidents due to concerns about further threats.

- The incident in France underscores the importance of safeguarding private keys and personal safety in a world where cryptocurrency transactions occur.

- Calls have been made for improved security features by crypto companies to protect users facing coercion or attacks.

- The rise in physical attacks targeting individuals holding cryptocurrencies has led to heightened scrutiny on the vulnerabilities faced by users in the digital asset space.

- Law enforcement agencies are under pressure to address these crimes, but challenges persist in apprehending suspects and ensuring the safety of crypto users.

- The incident serves as a stark reminder that the intersection of digital assets and physical security poses real dangers for individuals involved in cryptocurrency transactions.

Read Full Article

9 Likes

Medium

400

Image Credit: Medium

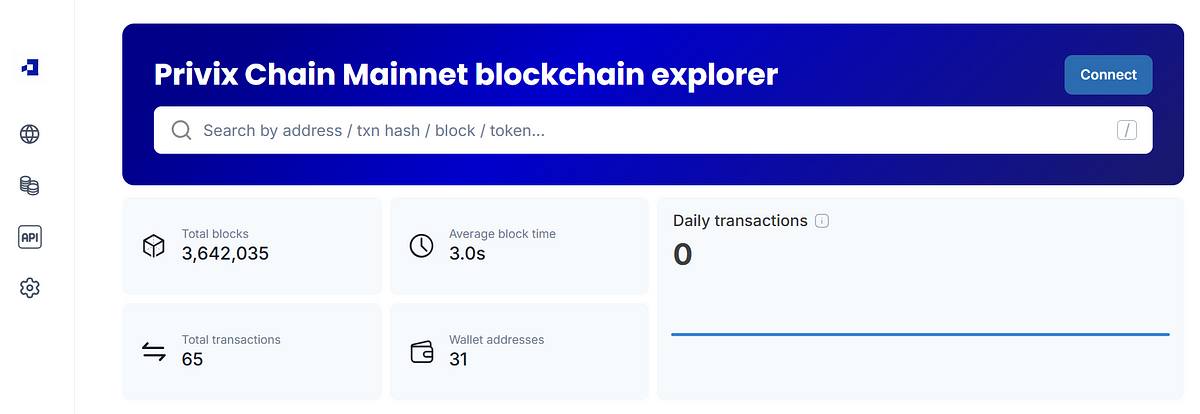

Exposing the Truth Behind Privix Chain. A Fake EVM compatible blockchain Built on Hollow Blocks

- Privix Chain is exposed as a fake EVM compatible blockchain built on hollow blocks with zero real usage and fake validators.

- The current 'live mainnet' and associated dApps offer no custom logic, privacy layers, or decentralization, just a rebranding of open-source work.

- Forking from existing projects is common in web3, but Privix's contributions seem limited to hardcoded configurations with no real substance.

- Privix's claims of being a PoS blockchain are debunked, as it operates on a Proof of Authority model with hardcoded validators and no true decentralization.

- Their chain lacks real usage, relying on time-based block creation and auto-mining without actual validation.

- Their dApps like Nexar and Pulsar are critiqued for being custodial services disguised as privacy-preserving DEXes, with centralized control over user assets.

- Privix markets various dApps as built on a privacy-first Layer 1, but in reality, they lack real smart contract enforcement, on-chain storage, or cryptography.

- Analysis reveals lack of decentralization, realistic staking mechanisms, or true privacy solutions in Privix's ecosystem, with many aspects being centralized or mimicked.

- The 'Spot DEX' and other offerings by Privix are criticized for lacking real substance, utilizing fake tokens, and relying on manual interactions rather than decentralized protocols.

- The article questions the authenticity of Privix's partnerships, documentation, and technology claims, urging readers to think critically and stay vigilant.

- The author invites scientific challenges to the analysis presented, emphasizing the need for transparency and factual discussions in the blockchain space.

Read Full Article

24 Likes

For uninterrupted reading, download the app