Medium

2M

59

Image Credit: Medium

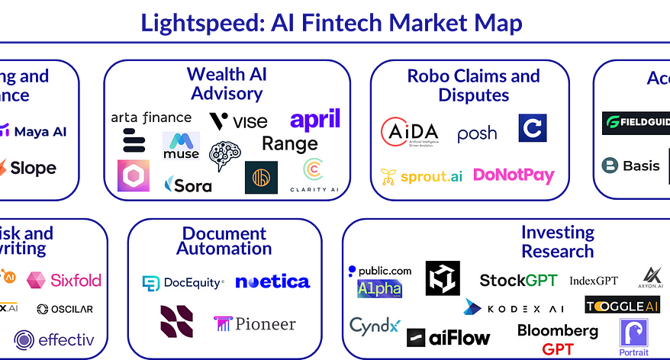

Fintech AI: How AI is Reshaping Financial Services, Why We’re Excited, and What’s Next

- Traditional predictive AI techniques like machine learning have long been used in fintech for fraud detection, credit underwriting, and investment management.

- Generative AI (GenAI) is revolutionizing fintech by creating new outputs like human-like conversations and financial narratives.

- GenAI is enhancing automation in complex operations, compliance, credit scoring, and personalized services in financial services.

- AI in fintech excels in real-time data analysis, enhancing decision-making, fraud detection, credit decisions, and algorithmic trading.

- AI enables rapid data processing, fraud detection, credit decisions, and algorithmic trading in fintech through platforms like Quantexa and Taktile.

- Automated financial reporting tools like Datarails and FloQast improve accuracy and responsiveness in financial workflows.

- AI-powered customer support systems like Clerkie and Klarna use chatbots to provide real-time financial advice and resolve inquiries efficiently.

- Personalized recommendations in fintech by AI platforms like Personetics and Zest AI tailor financial products and marketing campaigns based on customer data.

- AI automates back-office functions, data entry, compliance checks, financial modeling, and forecasting, improving efficiency in tasks like customer service and financial planning.

- The fintech AI market is growing rapidly, with expectations to reach over $50B by 2029, driven by demand for AI solutions enhancing decision-making and customer engagement.

Read Full Article

3 Likes

For uninterrupted reading, download the app