Medium

1w

250

Image Credit: Medium

From Fundamentals to Factor Buckets : A K-Means Clustering Approach to Stock Styles

- Investors often face information overload, leading to analysis paralysis and sub-optimal decisions.

- The mismatch between individual investors' thinking and how data is presented by screeners is a significant issue.

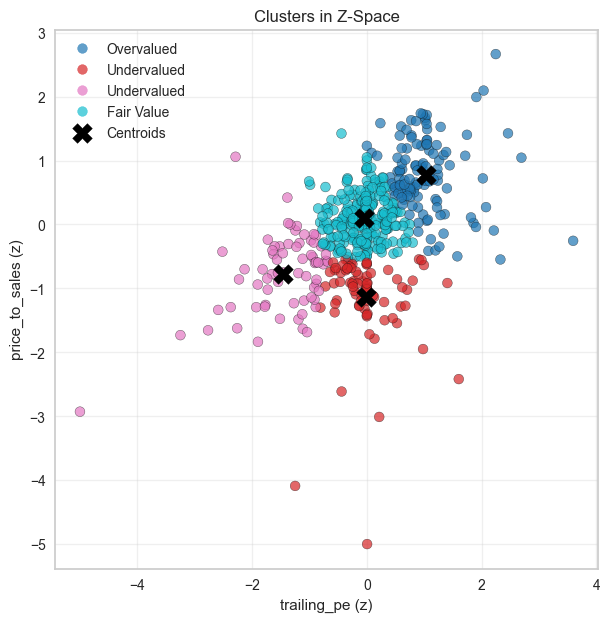

- A K-Means clustering approach was used to categorize S&P 500 companies into intuitive 'styles' like Undervalued, High Growth, etc.

- The project focuses on capturing five core factor themes: Value, Growth, Quality, Defensive, and Momentum & Risk.

- Data cleaning steps involved imputing sector medians, transforming skewed distributions, sector-neutral robust scaling, and winsorizing outliers.

- Feature selection was based on Spread Ratio, and metrics with spread ratio > 4% were kept for clustering.

- The number of clusters for each factor bucket was determined using elbow analysis, Silhouette score, and Davies–Bouldin index.

- Clusters were labeled based on their characteristics, making the model output actionable and easy to interpret for investors.

- The model's performance was tested using hypothetical investor personas and equal-weighted mini-portfolios.

- The results suggested that the factor buckets captured distinct investment styles with varying performance.

Read Full Article

15 Likes

For uninterrupted reading, download the app